数个月以来,BP一直在策划把今年的年度股东大会办的时髦一些。公司的新任首席执行官将登上伦敦ExCeL会展中心,向数千名股东宣传其绿色革命理念。但在2020年,鲜有事情能够按照计划进行。当会议最终于5月底召开时,现场没有观众,也没有掌声。

实际情况是,全球最大石油公司的掌门人伯纳德•鲁尼坐在BP空空如也的总部大楼的一个没有家具的房间中,对着摄像头讲话,身旁坐着一名董事和公司高管。截至当时,英国已经有3.8万多人因为疫情而丧生。与此同时,ExCeL中心也并没有用来举行BP的大型活动,而是被改造为一座新冠病患的分诊医院。在家隔离了数个月而刚出来不久的鲁尼看起来并不像是一位有着111年历史的知名石油巨头负责人,而是像一名落魄的船长,驾驶着一艘向地球传播坏消息的太空船。他对那些看不到的与会投资者说:“当前的挑战的规模可谓是前所未有。”他将其称之为“残酷的环境”。

就在三个月前,鲁尼开始了其BP的首席执行官职业生涯,并通过推出一个激进的公司改造方案让人们大吃一惊。他承诺在2050年之前实现“净零”碳排放,该策略旨在对公司进行大刀阔斧的调整,随后多个竞争对手也开始匆忙效仿这一举措。

然而鲁尼还没来得及庆祝,新冠疫情便给全球经济带来了重创。飞机和汽车数个月以来都处于闲置的状态,因为封锁令而迫使数十亿人口居家隔离,包括鲁尼自己及其团队。在家中,BP高管亲眼看到了全球原油需求的崩塌,创下了二战以来的最高跌幅。由于没有地方来储存数千万桶无法出售的油品,原油期货价格在4月一度跌至负值,这在历史上还是首次。

现实确实够残酷。BP第一季度财报显示,公司的债务超过了60亿美元,亏损达到了44亿美元,而去年同期则是近30亿美元的盈利。6月,该公司宣布裁员一万人,相当于全球总员工数的七分之一,并将这一坏消息归咎于公司的净零目标重组。同月,公司警告称即将对其资产价值进行高达175亿美元的减记。(实际减记额为174亿美元。)8月初则传来了一个更不幸的消息:BP财报称第二季度亏损168亿美元,并将派息减半。

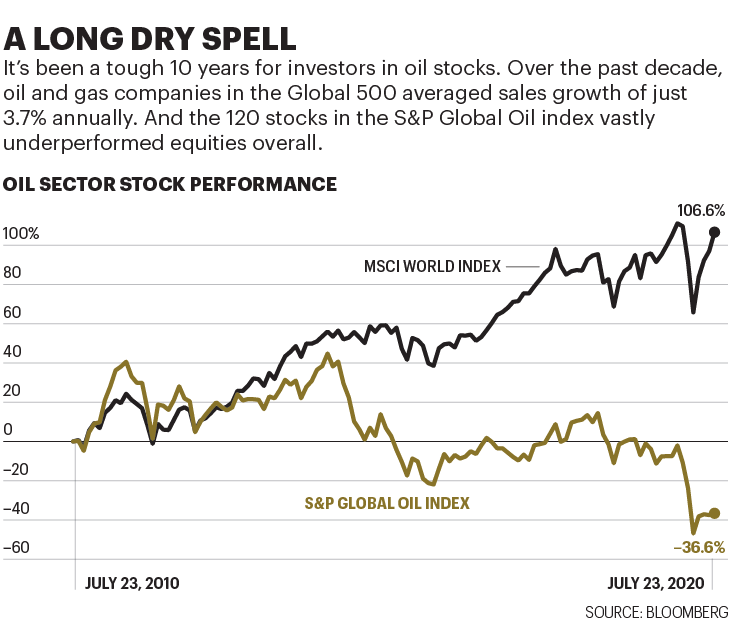

不过,原油行业的危机并非源于新冠疫情。即便在新冠病毒开始在全球肆虐之前,全球主要股市指数的各大石油公司股价都已经严重落后其他股票,原因在于运营成本的上升和原油价格的低位徘徊。然而,类似于BP这样的超级石油巨头远没有到破产的边缘。至于证据,不妨看看今年的《财富》世界500强排名,其中排名前十的都是油气公司,BP位列第八,2019年营收达到了2830亿美元,利润40亿美元。

尽管这些公司斩获了数万亿美元的销售业绩,但它们内部逐渐出现了一种不安感,因为整个世界逐渐变得越来越注重环保,而身处其中的它们也在评估自身的前景。在一系列综合因素的作用下,引发变革的外部压力越来越大,这包括加快恶化的气候危机;愤怒、目标明确的年轻一代;以及可能最为关键的是,越来越多的股东正威胁抛售其油气股票,除非他们能看到这些公司做出重大改变。

在去年的气候游行中,数千万青年在各大原油公司门前游行,指责其引发了全球变暖现象;科学家预计,大气中三分之一的温室气体都与油气行业有关。去年10月,示威者向参加伦敦“石油与货币大会”的代表扔甜菜根汁。在2月鲁尼担任首席执行官的第一日,Greenspace激进人士在BP伦敦总部周围设置了路障,迫使办公室临时关闭。明智的是,鲁尼选择在当日去拜会了BP德国炼油厂。

扔甜菜根汁和设置路障倒不是什么大事。然而,各大原油公司已经无法对这些更深层次的问题视而不见。为了避免其核心业务在未来数十年内突然崩塌,这些原油公司需要执行其悠久历史中最为激进的转型举措。至少,这是众多外界人士得出的结论。1月,就在鲁尼担任首席执行官不久,全球最大的资产管理基金贝莱德集团创始人兼首席执行官拉里•芬克通过其年度信件让投资者震惊了一把,他在信中写道,“气候变化应对计划已经成为公司长期前景的决定性因素。”他说,随着新一代人成长为投资者和首席执行官,这一点将越来越明确。简而言之,公司要么加入气候变化应对大军,要么逐渐消亡。

对于能源巨头来说,这个选择确实非常痛苦。从逻辑上来讲,此举可能意味着放任数亿桶原油和数万亿公吨的天然气躺在地底下,不去钻探和勘探。这一点与其与生俱来的业务特征格格不入。非营利性组织“环境捍卫基金”(Environmental Defense Fund)的总裁弗雷德克•拉普说:“原油行业面临的挑战就在眼前。这件事情实施起来将困难重重。”

这个理念在BP内部并未彻底消失。在贝莱德集团的芬克发布其信件之前,鲁尼已经得出了同样的结论。2月12日,也就是上任一周后,他通过沉重的标题“重构能源,重建BP”,宣布了其对公司的巨大调整。该理念的核心宗旨是在2050年或之前将碳排放降为零,也印证了气候科学家所宣扬的规避环境灾难应采取的必要措施。

石油行业分析师和环保主义者对此的反应可谓是希望与无奈并存。在采访中,多位人士提到了BP在上个世纪90年代末的品牌重新定位运动,以及随之而来的口号“超越原油”,它也成为了业界探索清洁能源未果的典型案例。如今,BP再次成为了这场运动名义上的先锋,而且鲁尼坚持认为,这一次BP将全身心地投入其中。鲁尼在2月说:“方向已经确定。我们将朝净零排放进发,而且没有回头路可走。”

如果真是这样,鲁尼的计划对于BP来说可谓是颠覆性的转变,因为该公司自1909年以来的发展动力一直都源于从地下和海底开采石油和天然气,然后提炼,卖给全球加油站。如今,BP需要在不超过30年的时间内,来抵消公司每年向大气排放的4.25吨碳,方法包括使用风力发电或太阳能电厂等非碳可再生能源、削减原油设施释放的甲烷、捕捉碳并将其储存在地底、保护森林,以及最困难的一点——首先停止生产部分含碳产品。

鲁尼在8月初对投资者说,BP将在10年内将其油气产能削减40%,并停止在新国家开采化石燃料。他说,在从事这一行业一个多世纪之后,BP如今将成为一家“综合性能源公司”。确保这一转型的实施有可能成为一个史诗级的挑战。但BP的这位新老板坚持认为,这是不可逆的。鲁尼在一个长篇采访中向《财富》杂志透露:“我真的认为这个趋势是无可阻挡的。我真是这么认为的。”

事后看来,有鉴于投资者不断施加的压力,各大公司争相调整公司发展方向的现象似乎是必然的。伦敦Sanford C. Bernstein公司的分析师奥斯瓦尔德•克林特说,“毫无疑问”,这一举措的影响是“非常巨大的”。他认为原油公司的高管们自身已经变得对气候问题非常在意,并非是被迫采取行动。克林特说:“也许各大公司在过去是被迫的,但如今不是,而是完全接受,其文化发生了变化。”

BP成为这一历史性转变的先驱似乎出乎很多人的预料。早些时候,BP通过利用现如今的伊朗、伊拉克、利比亚以及其他地区的政治动荡,而得以发展壮大。最近,BP成为了过街老鼠,因为公司对不安全作业环境视而不见,并造成了灾难性的后果。美国民众应该非常清楚地记得BP的两个重大事故,均源于操作的粗心大意,分别是2005年得州得克萨斯城的BP炼油厂爆炸,造成了15名工人死亡;以及2010年路易斯安那州近Deepwater Horizon的爆炸,造成11名员工死亡,并给墨西哥湾造成了巨大损失。此次事故是美国历史上最严重的原油泄漏事件。到目前为止,BP依然在向当地社区支付数十亿美元的资金。

鲁尼升任公司首席执行官最终也为公司提供了一个向全新角色转变的机会。在其净零决策发布数周之后,BP在欧洲的竞争对手争相效仿,可能是觉得如果自己没有这么做便会被视为环境罪人。在鲁尼演讲数周后,荷兰皇家壳牌、意大利原油巨头ENI以及法国的道达尔均宣布到2050年实现净零碳排放的目标。西班牙石油公司雷普索尔和挪威国家石油公司也在早些时候做出了类似的声明,承诺加大对可再生能源的投资,并提升原油生产的能源效率。

鲁尼在8月推出的计划将大幅改变BP的面貌。按照该计划,公司在2030年前对低碳能源资源的投资将增加10倍,并最终以峰值水平为基准,将其油气业务削减75%。他说:“我们知道这件事并不容易,但我们坚信它对于公司的所有利益相关方来说都是件好事。”该计划将逐渐影响BP的所有决策。BP策略与可持续发展部门新执行副总裁的吉尤里亚•奇尔琪娅说:“人们会看到低碳业务的增长,化石燃料在今后很长一段时间内将呈现下降趋势。我们会做出选择,而这些选择将是低碳的。”奇尔琪娅于4月加入BP担任这一职务,帮助管理净零转型。

对于49岁的鲁尼来说,这是他在深思熟虑之后做出的决定。在6月底一个长达一小时的视频采访中,他表示自己意识到,公司每天生产3800万桶油气的事实无法让其去应对日益严峻的气候变化。必须有所付出。鲁尼在伦敦家中周边跑完3英里之后,穿着黑色的T恤衫坐在家中的办公室说:“过去几年很明显的一个现象在于,公司在很多方面都在逆势而为。”我问他,如果BP和其他石油巨头不采取碳印迹清零举措会有什么样的结果。他说:“如果不采取行动,全球的未来将会黯淡无光。”

鲁尼称,他在思考BP未来时对两个人群进行了重点权衡:雇员以及投资者。很明显,这两个人群会因此而深感不安。他说:“我们可以感觉到,投资者真的开始敦促我们,并质疑我们的目标,而这一现象也开始影响整个行业的财务业绩。公司的雇员则会感到焦虑,焦虑的原因也就是我所说的个人目标与公司目标出现了偏差。”

乔•亚历山大便是这样一位焦虑的雇员。她是一名地质科学家,留着一头红色长发,自2003年毕业于牛津大学后便加入了BP,然后在十年间一直从事一些主要的原油项目,包括利比亚和澳大利亚的项目。她说,这段生活充斥着冒险和旅行,但她对环境不断增长的焦虑最终让其感到自己的工作难以为继。她在2015年选择离开BP,并加入了专注于负责任投资的伦敦非营利性组织ShareAction。

在BP去年的股东大会上,亚历山大站起来发表了讲话。她对高管们说,BP内部有很多人都存在促使她离职的类似顾虑。她说:“我曾经问过他们:‘BP什么时候才能提供有意义的工作?’”高管们对此感到吃惊。会后,鲁尼找到她,对她说:“答应我一定要回来,咱两再探讨下这件事情。”她花费了数个月的时间悄悄地评估公司内部所熟知之人的观点。然后在去年年底,她在BP总部与鲁尼见了面。当时,已经有传言称时任BP上游业务的负责人鲁尼将接替鲍勃•杜德利,担任公司新首席执行官。亚历山大分享了其准备的有关BP雇员观点的数据。然后鲁尼告诉她自己将实施一个截然不同的策略。亚历山大立即觉得这正是自己想要参与的工作。她说:“没有我你做不成这件事。这是我说过的最厚颜无耻的话。”

她的胆识得到了回报。鲁尼聘请了39岁的亚历山大,并为其创建了一个职位——“使命管理经理”,其职责在于动员BP员工参与“重构能源”这一新的使命。鲁尼如今在每次说到变革时都会提到她,不论在2月的“净零”演讲,还是在我采访期间均是如此。亚历山大坚持认为,她的出现并不是为了给鲁尼的形象镀金。她在谈论BP的净零计划时表示:“我并不幼稚。我并不认为这个计划是一件轻而易举的事情。”不过,她还说:“所有人都接受了这个使命,人们的自豪感真的又回来了。”

然而,并非所有的BP员工都对此抱有同样乐观的态度,例如类似于亚历山大的另一名工程师迈克•柯芬,他出于环保顾虑而退出了BP。34岁的柯芬于2008年从剑桥大学毕业之后就以地质学家的身份加入BP。与亚历山大一样,他也在BP的各大勘探项目上工作了10年的时间,并称该工作基本上就是其心目中的理想工作:工作十分有趣,而且稳健的职业道路能够让他有能力买房、成家。他说:“10至12年前,这一点非常有吸引力。”

然而,柯芬对原油生产造成的环境破坏越发感到不安。他担心BP是否能在这场能源转型中生存下来,而且就算活了下来,像他这样专注于寻找重大新发现的勘探工程师可能会不复存在。他说:“我感觉未来不一定需要石油和天然气。”

去年早些时候,柯芬终于离开了BP,并成为了伦敦非盈利机构Carbon Tracker Initiative的油气分析师,该机构致力于研究石油公司的气候应对举措对金融市场的影响。在鲁尼于今夏宣布开展大规模的化石燃料削减之后,柯芬说:“BP如今成为了应对气候变化的行业领头羊。”即便如此,他依然对石油公司是否真的能够像其说的那样重构自身存在很大的疑问。他还质疑大型石油公司是否会抛弃其长期以来将分红与化石燃料生产挂钩的做法。(BP称从现在开始,公司将在考虑分红时增加环保的权重。)

随着激进投资者变得越来越有组织性,出于对环保以及金融风险的考虑,从资产组合中剔除能源股的动作亦是如此。Carbon Tracker Initiative的油气和开采负责人安德鲁•格兰特说:“投资者可能对环境一点都不关心。但他们收到了来自于其客户的压力。在眼下,金融法规真的已经与环保法规接轨。”

在美国和欧洲,数十只养老基金和多家政府机构已经开始通过抛售化石燃料股票回笼了数十亿美元的资金。激进投资机构Fossil Free称,总资产额超过14万亿美元的各大机构投资者如今正专注于撤资。马萨诸塞州剑桥市研究与倡议机构Union of Concerned Scientists问责运动总监凯西•穆尔维说:“投资者越来越了解这些公司。”她还表示,环保主义者担心各大公司将通过“商业手段”而不是真正的碳排放削减来实现净零目标。她说:“要让这些企业真正能够悬崖勒马,还有不少工作要做。”

股东们也在寻求从公司内部推动这一变革。自2016年以来,激进人士为推动气候决议的通过一直在多家石油巨头的年度股东大会上集结股东,以便达到进行投票表决所需的门槛。

2016年,由机械工程师转而成为积极人士的荷兰人马克•范巴尔成立了股东组织Follow This,旨在通过股东决议向原油公司施压,从而让它们致力于实施环保政策。他说:“有人说,‘哦,你想改变壳牌?做梦吧。’”他在壳牌2016年年度股东大会上提出的第一份决议十分生猛:“我们告诉壳牌公司应摒弃油气资源勘探业务。”这个决议很难通过,因为它是这家原油巨头的唯一业务。他说:“不可思议的是,该决议得到了2.6%的支持。”

该组织的策略自那之后变得越发成熟,如今还包括直接与原油高管协商。去年11月,范巴尔从阿姆斯特丹坐上了欧洲之星列车,前往BP伦敦总部与鲁尼会面。鲁尼当时已经被任命为新首席执行官。这两位举行了闭门会面,当时鲁尼向范巴尔透露BP将发生重大变化。范巴尔说:“鲁尼坚信,他有必要在执掌之后做出重大声明,而且需要股东的支持。”范巴尔决定,不会在5月召开的鲁尼上任后首个股东会议上提出激进的决议,而是与鲁尼合作,针对明年的会议制定一个联合决议,从而让BP致力于实施净零策略。他说:“如果得到合理实施,它将带来颠覆性的转变。”

范巴尔成功地让壳牌、道达尔、挪威国家石油公司以及BP对决议进行了投票。在美国,美国证券交易委员会阻碍了类似的激进决议,包括埃克森美孚和雪佛龙的年度股东大会,该机构称投资者曾经尝试干扰公司管理层决策。范巴尔对此十分乐观,他坚信石油行业必须向现实低头。他说:“我曾经梦想原油巨头的首席执行官能够顿悟,可以彻夜不眠地思考其孩子的未来。但这是不可能的。让曾经的油气大亨鲁尼幡然悔悟的是公司的股东。”

然而,范巴尔认为BP的“油气大亨”终于成为了他可以携手的首席执行官。而且他认为鲁尼在8月宣布的计划对于行业来说具有里程碑式的意义。范巴尔说:“这是第一家针对2050年目标采取实际行动,而不只是纸上谈兵的石油巨头。削减40%的原油产能真的是很激进的目标。如果有一个石油巨头站了出来,而且得到了股东的奖励,那么其他公司就会效仿。”

当鲁尼描述他的早期生活时,令人感到不可思议的是,他可以成为任何领域的游戏改变者。他对BP尤为感激。他说:“相对于我的背景而言,公司给了我一个我以前做梦都没有想到的机会。我并非出身与名校,或有着深厚的背景。”

这个说法着实十分低调。鲁尼的父母在11岁便离开了学校,并在爱尔兰凯利郡乡下的一个奶牛场抚养了5个孩子。他说自己与自己的兄弟在年轻时就学会了如何通过工作来赚外快。当我询问鲁尼其伦敦家中书架上的绿色玩具拖拉机时,他称这是在追忆自己的孩提时代。他说:“家里从来没有买过什么好机器,但我们一直都想要好东西。我们通过倒卖旧拖拉机来赚钱。只要能赚钱的活都干。”

他最深刻的记忆便是自己与同龄人的不同。他说:“男孩们擅长玩爱尔兰曲棍球[传统的爱尔兰体育运动,类似于长曲棍球]和橄榄球,但说实话,我觉得自己一无是处。我觉得自己的手很笨,然而在农场,一切活都得用手来完成。”

鲁尼是家里的第一个大学生。他在从都柏林大学毕业后直接以钻探工程师的身份加入了BP,而且先后数年效力于英国北海、阿拉斯加、挪威和美国的一些项目。他最终被前首席执行官约翰•布朗尼钦点为“海龟”(名字取自于忍者神龟),也就是有望向高层发展的高管助理。为了帮助其打好基础,布朗尼将他派往斯坦福商学院学习了一年。

即便在现在,鲁尼说自己的童年给他留下了不可磨灭的印记。他认为,童年让自己意识到非常有必要招募那些感觉自己与众不同或受到歧视的人士。自他担任首席执行官之后接受的少数几次采访中,有一次便是接受跨性别维权人士、制片人杰克•格拉夫的采访,鲁尼对杰克说,如果任何BP员工不支持性少数群体权益,“那么他就不属于BP这个大家庭”。在轰动的“黑人生命亦宝贵”抗议活动中,他在6月1日致BP全球员工的信中敦促员工大声揭露其生活中以及BP公司内部的种族主义。他说,自己随后与员工召开了痛彻心扉的视频会议,“员工们有的留下了眼泪,有的失声痛哭”。

作为首席执行官,鲁尼已经将心理健康作为BP的首要慈善事业,公司向英国精神健康机构Mind捐献了大量的资金。他将其看作公司内部的一个关键问题,并认为疫情让其出现了“进一步升级”,但这明显也是私人问题。他说:“在人际关系方面,我自己也面临着一些挑战。我也接受过心理咨询等服务。我认为每个员工都会受到影响。”然而,他并没有透露这方面的细节。在封锁期间,鲁尼向BP员工推荐了冥想应用程序Headspace,他称自己如今每天晚上都会使用。他说:“它就在我的床边,其播放的阵阵波涛声能够让我的心境平静下来。”

鲁尼并没有大企业高管的典型做派,他似乎对于这种负面形象很在意。当BP的官方网页便将其称为“伯纳德”,他创建了一个新Instrgram账户,其为数不多的几十张照片除了常规的企业照之外还包括同性恋骄傲大游行的彩虹,热带雨林,他通常在这些场合下身穿蓝色牛仔,很少扎领带,即便在5月召开的股东大会上也没有扎领带。

这位新首席执行官敦促员工与外界沟通,有一些员工采纳了他的建议,使用新冠疫情封锁这个机会与他进行在线沟通。在一个视频电话中,英国加油站工作人员向鲁尼讲述了疫情期间作为必要一线员工拿低薪的难处。鲁尼随后便为他们涨了工资。在托莱多BP-Husky炼油厂运营协调员何塞•罗德里格兹因一时冲动,使用公司的内部社交网Yammer向鲁尼发牢骚,并邀请他参加员工会议。罗德里格兹对于能够得到鲁尼的反馈感到震惊。鲁尼迅速地确定了一个日期,而且通过视频与炼油厂工人聊了20分钟。罗德里格兹眉飞色舞地说:“我们感到他真的是很关心我们。”他还表示,鲁尼不同于其此前29年BP职业生涯中所经历的四位首席执行官。罗德里格兹说:“一位工厂经理的母亲刚刚去世。伯纳德说,‘别忘了你的父亲,他可能在掩饰自己的悲痛。’”罗德里格兹和鲁尼自此之后便一直保持着联系。

我们很容易将其看作BP形象重塑举措的一部分,因为在眼下,公司已经承诺对发展方向进行重大调整。然而据我们所知,它似乎也反映了鲁尼真实的管理风格和个性。

即便如此,这位首席执行官也很难说服那些记性好的外部怀疑人士。公司于1997年推出的“超越石油”品牌重构计划便是由Ogilvy Public Relations Worldwide设计的一个价值2亿美元的公关活动。当时BP向世界宣布,公司将“思考油桶之外的事情”。为了凸显这一理念,时任首席执行官布朗尼将公司的名称从英国石油简化为BP。

对于一些人来说,鲁尼的“重构能源”计划听起来没有多少区别。Union of Concerned Scientists的穆尔维说:“我们此前也听说过类似的计划,也就是BP的‘超越石油’计划。人们当时对此抱有很大的希望,这个计划听起来非常有突破性。”她说,环保主义者担心会再次失望。

布朗尼称,他的举措在当时取得了实质性的进展,意味着公司真正开始担心碳排放问题,也是公司有别于其他石油巨头的一个地方。他说:“业界认为此举对整个行业构成了很大的威胁,并认为BP已经走上了歧路,但我们并不是在洗绿自己。”

在该活动推出之际,BP刚好在美国进行了80亿美元的太阳能电板投资,但这场冒险对于BP来说可谓是血本无归,因为当时中国开始了大规模的电板制造运动,而且价格比BP低得多。BP随后收购了英国太阳能公司Lightsource 50%的股份,并通过其修建和运营太阳能电厂,但没有制造面板。布朗尼称,石油公司在上个世纪90年代便清楚地意识到,其碳排放对全球气候造成了严重的破坏。然而,当时人们并没有多少紧迫感。布朗尼说:“当时的状况与眼下相距甚远,我们有大把的时间。”

但时间对于鲁尼来说是件奢侈品。为了在30年内实现净零排放,他必须迅速地改变BP,而且刻不容缓。布朗尼称,此外,与上个世纪90年代相比,当前的投资者不会容忍任何虚伪行径。他在谈到用植树或保护现有森林等举措来平衡碳排放时说:“光把抵消碳印记挂在口头上是不行的,得付诸实际行动。”

投资者和基金人士终于听到了鲁尼的“实际行动”计划。(而且他说,该计划并不依赖于碳抵消)。BP策略部门新负责人奇尔琪娅称,疫情让变革需求变得更加紧迫。她说:“说到其中的教训,疫情告诉我们,我们所处的这个环境非常脆弱。它凸显了我们多元化的需求。”她说自己在今年早些时候辞掉了麦肯锡的工作,因为鲁尼此前说服了自己,称BP将专注于削减排放,而且会不折不扣地去做。她说:“我想,‘哇,这些人对此是认真的。’我认为如果我们获得成功,其他公司便会效仿。”

位于纽约的环境捍卫基金的负责人科拉普曾经与鲁尼多次会面,包括在疫情期间的视频会面,来探讨BP的净零计划。他说BP从今年开始就需要部署一系列解决方案,这样才能满足其2050年目标。科拉普建议鲁尼迅速地从化石燃料转变为低碳能源生产,减少原油设施的甲烷等污染物的排放,并中和任何存在的碳排放,包括通过保护现有的热带雨林。他还说,所有这一切都应该大规模地开展。他说:“他们实现转变的里程碑必须减少对油气的投资。我们敦促伯纳德要实现这一转变过程中的里程碑。”

一个超越一切的关键问题在于:这家能源巨头愿意放弃多少油气资源?BP称公司将使用其油气生产来资助低碳能源。如今,公司账面上有193亿桶的储备。

然而按照净零策略,数亿桶油气可能将永远沉睡地底,成为财务领域所谓的搁浅资产。环保主义者担心,随着全球价格的上涨,BP可能会因此而扩大钻井活动,而各大石油公司和欧佩克富油国在过去数十年间都是如此。BP称,公司去年在可再生能源领域的投资不到其152亿美元资本支出的3%。市场情报公司Rystad Energy的能源服务研究业务副总裁马修•菲茨蒙斯称,当前整个行业未来五年在清洁能源方面的开支预计将达到资本总支出的9%。这些数字对环保主义者来说无异于杯水车薪。伦敦非政府组织ClientEarth的律师苏菲•马佳纳克说:“在过去20年中,整个行业一直对这个问题视而不见,但愿它如今能够得到重视。”

对于鲁尼及其大型石油同行来说,终极挑战在于既要改变这一态势,又要找到方式来交付股东要求的利润。有一件事似乎是肯定的:在今后数年内,BP和其他公司可能会继续其油气生产。鲁尼在8月公布其计划时说:“要通过关闭龙头来实现一家110岁公司的转型基本上是不可能的。”位于巴黎的国际能源机构称,即便油气公司在太阳能、电动汽车和风力发电机方面投入重金,但随着新兴国家财富的增加,全球对石油的需求预计至少在未来10年内依然会呈现出上扬态势。

当我问鲁尼,随着公司减少化石燃料产能,BP是否必然会面临利润率下降的问题?他说,相反,他认为BP将从能源转型获得巨大收益。各大政府正在投入海量的资金来推动能源转型,包括欧盟数万亿美元的疫情恢复计划。这些原油巨头可以借助数万名工程师和国际化的供应链参与这一进程。鲁尼说:“各国将花费数万亿美元来重建和更换全球的能源系统,继而会为像BP这样的专业公司带来巨大的机遇。”

除了提及财务机遇之外,鲁尼听起来越来越像一位真正的气候保护主义者。他说:“目前各大公司有站队的趋势。我对这个不感兴趣。我希望大家去做我认为有益于这个世界的事情。关键在于找到适合BP的发展之路,以及适合所有人的发展之路,这个没有什么区别。”

10年之后:Deepwater Horizon灾难让BP发生了哪些转变

10年前,BP油井的爆炸导致了美国史上最严重的原油泄漏事件。公司依然在为此买单。

2010年4月20日,Deepwater Horizon井架正在钻探位于路易斯安那州近海的一个名为“马贡多”的超深油藏,油田名字取自于加夫列尔•加西亚•马尔克斯知名著作《百年孤独》(One Hundred Years of Solitude)中的地名。随后,该项目成为了一个史诗级的灾难。

气体撕裂了油井,在墨西哥湾深达1.5英里的海底发生爆炸,11名平台员工因此而丧生。它所引发的火焰束在太空中清晰可见,同时也对海湾的渔业资源和湿地造成了巨大破坏。在这场持续了87天、美国史上最大的漏油事件中,约320万桶的原油流入了墨西哥湾,还有81万桶油被BP回收。

10年过去了,特朗普政府已经回滚了多项Deepwater Horizon事件之后制定的重要监管法规,包括独立检查和安全要求,例如预防爆裂的备用系统。

这场事故让BP的可信度在随后的数年中一蹶不振,直到如今才开始有所好转。当时帮助监管清理举措的BP高级副总裁、BP现任首席执行官鲁尼说:“这是一个令人绝望的困难经历。”法院认为BP在安全方面走捷径,奥巴马总统谴责公司“行事粗心大意”。

BP依然在支付约690亿美元和解费用以及当地社区和海湾沿线各州补助金的剩余部分,包括去年支付的约24亿美元。公司预计自己在未来13年内每年将支付约10亿美元的费用。

尽管出现了这一灾难,BP依然在墨西哥湾深水井的钻探方面投入了大量资金,而且其目标是到2020年中期实现该海域每天约40万桶的产量,与爆炸前2009年的产量一致。但鲁尼称,Deepwater Horizon让公司发生了永久性的变化。他说,安全环境目前已经成为BP运营的首要考虑因素,而且公司也学会了不能过于依赖某一个单体项目,这是评论人士在2010年事故之后用来批判BP的一个罪名。

他说:“我们永远不会忘记,而且必须始终铭记。我们在事故之后感到羞愧难当,对此,我个人完全有理由认为羞愧感从很多方面来讲是件好事。”然而,对于BP和海湾沿岸来说,这是一个异常惨痛的教训。(财富中文网)

本文另一版本刊载于《财富》杂志2020年8/9月刊,标题为《BP终于准备“另起炉灶”了吗?》

译者:冯丰

审校:夏林

数个月以来,BP一直在策划把今年的年度股东大会办的时髦一些。公司的新任首席执行官将登上伦敦ExCeL会展中心,向数千名股东宣传其绿色革命理念。但在2020年,鲜有事情能够按照计划进行。当会议最终于5月底召开时,现场没有观众,也没有掌声。

实际情况是,全球最大石油公司的掌门人伯纳德•鲁尼坐在BP空空如也的总部大楼的一个没有家具的房间中,对着摄像头讲话,身旁坐着一名董事和公司高管。截至当时,英国已经有3.8万多人因为疫情而丧生。与此同时,ExCeL中心也并没有用来举行BP的大型活动,而是被改造为一座新冠病患的分诊医院。在家隔离了数个月而刚出来不久的鲁尼看起来并不像是一位有着111年历史的知名石油巨头负责人,而是像一名落魄的船长,驾驶着一艘向地球传播坏消息的太空船。他对那些看不到的与会投资者说:“当前的挑战的规模可谓是前所未有。”他将其称之为“残酷的环境”。

就在三个月前,鲁尼开始了其BP的首席执行官职业生涯,并通过推出一个激进的公司改造方案让人们大吃一惊。他承诺在2050年之前实现“净零”碳排放,该策略旨在对公司进行大刀阔斧的调整,随后多个竞争对手也开始匆忙效仿这一举措。

然而鲁尼还没来得及庆祝,新冠疫情便给全球经济带来了重创。飞机和汽车数个月以来都处于闲置的状态,因为封锁令而迫使数十亿人口居家隔离,包括鲁尼自己及其团队。在家中,BP高管亲眼看到了全球原油需求的崩塌,创下了二战以来的最高跌幅。由于没有地方来储存数千万桶无法出售的油品,原油期货价格在4月一度跌至负值,这在历史上还是首次。

现实确实够残酷。BP第一季度财报显示,公司的债务超过了60亿美元,亏损达到了44亿美元,而去年同期则是近30亿美元的盈利。6月,该公司宣布裁员一万人,相当于全球总员工数的七分之一,并将这一坏消息归咎于公司的净零目标重组。同月,公司警告称即将对其资产价值进行高达175亿美元的减记。(实际减记额为174亿美元。)8月初则传来了一个更不幸的消息:BP财报称第二季度亏损168亿美元,并将派息减半。

不过,原油行业的危机并非源于新冠疫情。即便在新冠病毒开始在全球肆虐之前,全球主要股市指数的各大石油公司股价都已经严重落后其他股票,原因在于运营成本的上升和原油价格的低位徘徊。然而,类似于BP这样的超级石油巨头远没有到破产的边缘。至于证据,不妨看看今年的《财富》世界500强排名,其中排名前十的都是油气公司,BP位列第八,2019年营收达到了2830亿美元,利润40亿美元。

尽管这些公司斩获了数万亿美元的销售业绩,但它们内部逐渐出现了一种不安感,因为整个世界逐渐变得越来越注重环保,而身处其中的它们也在评估自身的前景。在一系列综合因素的作用下,引发变革的外部压力越来越大,这包括加快恶化的气候危机;愤怒、目标明确的年轻一代;以及可能最为关键的是,越来越多的股东正威胁抛售其油气股票,除非他们能看到这些公司做出重大改变。

在去年的气候游行中,数千万青年在各大原油公司门前游行,指责其引发了全球变暖现象;科学家预计,大气中三分之一的温室气体都与油气行业有关。去年10月,示威者向参加伦敦“石油与货币大会”的代表扔甜菜根汁。在2月鲁尼担任首席执行官的第一日,Greenspace激进人士在BP伦敦总部周围设置了路障,迫使办公室临时关闭。明智的是,鲁尼选择在当日去拜会了BP德国炼油厂。

扔甜菜根汁和设置路障倒不是什么大事。然而,各大原油公司已经无法对这些更深层次的问题视而不见。为了避免其核心业务在未来数十年内突然崩塌,这些原油公司需要执行其悠久历史中最为激进的转型举措。至少,这是众多外界人士得出的结论。1月,就在鲁尼担任首席执行官不久,全球最大的资产管理基金贝莱德集团创始人兼首席执行官拉里•芬克通过其年度信件让投资者震惊了一把,他在信中写道,“气候变化应对计划已经成为公司长期前景的决定性因素。”他说,随着新一代人成长为投资者和首席执行官,这一点将越来越明确。简而言之,公司要么加入气候变化应对大军,要么逐渐消亡。

对于能源巨头来说,这个选择确实非常痛苦。从逻辑上来讲,此举可能意味着放任数亿桶原油和数万亿公吨的天然气躺在地底下,不去钻探和勘探。这一点与其与生俱来的业务特征格格不入。非营利性组织“环境捍卫基金”(Environmental Defense Fund)的总裁弗雷德克•拉普说:“原油行业面临的挑战就在眼前。这件事情实施起来将困难重重。”

这个理念在BP内部并未彻底消失。在贝莱德集团的芬克发布其信件之前,鲁尼已经得出了同样的结论。2月12日,也就是上任一周后,他通过沉重的标题“重构能源,重建BP”,宣布了其对公司的巨大调整。该理念的核心宗旨是在2050年或之前将碳排放降为零,也印证了气候科学家所宣扬的规避环境灾难应采取的必要措施。

石油行业分析师和环保主义者对此的反应可谓是希望与无奈并存。在采访中,多位人士提到了BP在上个世纪90年代末的品牌重新定位运动,以及随之而来的口号“超越原油”,它也成为了业界探索清洁能源未果的典型案例。如今,BP再次成为了这场运动名义上的先锋,而且鲁尼坚持认为,这一次BP将全身心地投入其中。鲁尼在2月说:“方向已经确定。我们将朝净零排放进发,而且没有回头路可走。”

如果真是这样,鲁尼的计划对于BP来说可谓是颠覆性的转变,因为该公司自1909年以来的发展动力一直都源于从地下和海底开采石油和天然气,然后提炼,卖给全球加油站。如今,BP需要在不超过30年的时间内,来抵消公司每年向大气排放的4.25吨碳,方法包括使用风力发电或太阳能电厂等非碳可再生能源、削减原油设施释放的甲烷、捕捉碳并将其储存在地底、保护森林,以及最困难的一点——首先停止生产部分含碳产品。

鲁尼在8月初对投资者说,BP将在10年内将其油气产能削减40%,并停止在新国家开采化石燃料。他说,在从事这一行业一个多世纪之后,BP如今将成为一家“综合性能源公司”。确保这一转型的实施有可能成为一个史诗级的挑战。但BP的这位新老板坚持认为,这是不可逆的。鲁尼在一个长篇采访中向《财富》杂志透露:“我真的认为这个趋势是无可阻挡的。我真是这么认为的。”

事后看来,有鉴于投资者不断施加的压力,各大公司争相调整公司发展方向的现象似乎是必然的。伦敦Sanford C. Bernstein公司的分析师奥斯瓦尔德•克林特说,“毫无疑问”,这一举措的影响是“非常巨大的”。他认为原油公司的高管们自身已经变得对气候问题非常在意,并非是被迫采取行动。克林特说:“也许各大公司在过去是被迫的,但如今不是,而是完全接受,其文化发生了变化。”

BP成为这一历史性转变的先驱似乎出乎很多人的预料。早些时候,BP通过利用现如今的伊朗、伊拉克、利比亚以及其他地区的政治动荡,而得以发展壮大。最近,BP成为了过街老鼠,因为公司对不安全作业环境视而不见,并造成了灾难性的后果。美国民众应该非常清楚地记得BP的两个重大事故,均源于操作的粗心大意,分别是2005年得州得克萨斯城的BP炼油厂爆炸,造成了15名工人死亡;以及2010年路易斯安那州近Deepwater Horizon的爆炸,造成11名员工死亡,并给墨西哥湾造成了巨大损失。此次事故是美国历史上最严重的原油泄漏事件。到目前为止,BP依然在向当地社区支付数十亿美元的资金。

鲁尼升任公司首席执行官最终也为公司提供了一个向全新角色转变的机会。在其净零决策发布数周之后,BP在欧洲的竞争对手争相效仿,可能是觉得如果自己没有这么做便会被视为环境罪人。在鲁尼演讲数周后,荷兰皇家壳牌、意大利原油巨头ENI以及法国的道达尔均宣布到2050年实现净零碳排放的目标。西班牙石油公司雷普索尔和挪威国家石油公司也在早些时候做出了类似的声明,承诺加大对可再生能源的投资,并提升原油生产的能源效率。

鲁尼在8月推出的计划将大幅改变BP的面貌。按照该计划,公司在2030年前对低碳能源资源的投资将增加10倍,并最终以峰值水平为基准,将其油气业务削减75%。他说:“我们知道这件事并不容易,但我们坚信它对于公司的所有利益相关方来说都是件好事。”该计划将逐渐影响BP的所有决策。BP策略与可持续发展部门新执行副总裁的吉尤里亚•奇尔琪娅说:“人们会看到低碳业务的增长,化石燃料在今后很长一段时间内将呈现下降趋势。我们会做出选择,而这些选择将是低碳的。”奇尔琪娅于4月加入BP担任这一职务,帮助管理净零转型。

对于49岁的鲁尼来说,这是他在深思熟虑之后做出的决定。在6月底一个长达一小时的视频采访中,他表示自己意识到,公司每天生产3800万桶油气的事实无法让其去应对日益严峻的气候变化。必须有所付出。鲁尼在伦敦家中周边跑完3英里之后,穿着黑色的T恤衫坐在家中的办公室说:“过去几年很明显的一个现象在于,公司在很多方面都在逆势而为。”我问他,如果BP和其他石油巨头不采取碳印迹清零举措会有什么样的结果。他说:“如果不采取行动,全球的未来将会黯淡无光。”

鲁尼称,他在思考BP未来时对两个人群进行了重点权衡:雇员以及投资者。很明显,这两个人群会因此而深感不安。他说:“我们可以感觉到,投资者真的开始敦促我们,并质疑我们的目标,而这一现象也开始影响整个行业的财务业绩。公司的雇员则会感到焦虑,焦虑的原因也就是我所说的个人目标与公司目标出现了偏差。”

乔•亚历山大便是这样一位焦虑的雇员。她是一名地质科学家,留着一头红色长发,自2003年毕业于牛津大学后便加入了BP,然后在十年间一直从事一些主要的原油项目,包括利比亚和澳大利亚的项目。她说,这段生活充斥着冒险和旅行,但她对环境不断增长的焦虑最终让其感到自己的工作难以为继。她在2015年选择离开BP,并加入了专注于负责任投资的伦敦非营利性组织ShareAction。

在BP去年的股东大会上,亚历山大站起来发表了讲话。她对高管们说,BP内部有很多人都存在促使她离职的类似顾虑。她说:“我曾经问过他们:‘BP什么时候才能提供有意义的工作?’”高管们对此感到吃惊。会后,鲁尼找到她,对她说:“答应我一定要回来,咱两再探讨下这件事情。”她花费了数个月的时间悄悄地评估公司内部所熟知之人的观点。然后在去年年底,她在BP总部与鲁尼见了面。当时,已经有传言称时任BP上游业务的负责人鲁尼将接替鲍勃•杜德利,担任公司新首席执行官。亚历山大分享了其准备的有关BP雇员观点的数据。然后鲁尼告诉她自己将实施一个截然不同的策略。亚历山大立即觉得这正是自己想要参与的工作。她说:“没有我你做不成这件事。这是我说过的最厚颜无耻的话。”

她的胆识得到了回报。鲁尼聘请了39岁的亚历山大,并为其创建了一个职位——“使命管理经理”,其职责在于动员BP员工参与“重构能源”这一新的使命。鲁尼如今在每次说到变革时都会提到她,不论在2月的“净零”演讲,还是在我采访期间均是如此。亚历山大坚持认为,她的出现并不是为了给鲁尼的形象镀金。她在谈论BP的净零计划时表示:“我并不幼稚。我并不认为这个计划是一件轻而易举的事情。”不过,她还说:“所有人都接受了这个使命,人们的自豪感真的又回来了。”

然而,并非所有的BP员工都对此抱有同样乐观的态度,例如类似于亚历山大的另一名工程师迈克•柯芬,他出于环保顾虑而退出了BP。34岁的柯芬于2008年从剑桥大学毕业之后就以地质学家的身份加入BP。与亚历山大一样,他也在BP的各大勘探项目上工作了10年的时间,并称该工作基本上就是其心目中的理想工作:工作十分有趣,而且稳健的职业道路能够让他有能力买房、成家。他说:“10至12年前,这一点非常有吸引力。”

然而,柯芬对原油生产造成的环境破坏越发感到不安。他担心BP是否能在这场能源转型中生存下来,而且就算活了下来,像他这样专注于寻找重大新发现的勘探工程师可能会不复存在。他说:“我感觉未来不一定需要石油和天然气。”

去年早些时候,柯芬终于离开了BP,并成为了伦敦非盈利机构Carbon Tracker Initiative的油气分析师,该机构致力于研究石油公司的气候应对举措对金融市场的影响。在鲁尼于今夏宣布开展大规模的化石燃料削减之后,柯芬说:“BP如今成为了应对气候变化的行业领头羊。”即便如此,他依然对石油公司是否真的能够像其说的那样重构自身存在很大的疑问。他还质疑大型石油公司是否会抛弃其长期以来将分红与化石燃料生产挂钩的做法。(BP称从现在开始,公司将在考虑分红时增加环保的权重。)

随着激进投资者变得越来越有组织性,出于对环保以及金融风险的考虑,从资产组合中剔除能源股的动作亦是如此。Carbon Tracker Initiative的油气和开采负责人安德鲁•格兰特说:“投资者可能对环境一点都不关心。但他们收到了来自于其客户的压力。在眼下,金融法规真的已经与环保法规接轨。”

在美国和欧洲,数十只养老基金和多家政府机构已经开始通过抛售化石燃料股票回笼了数十亿美元的资金。激进投资机构Fossil Free称,总资产额超过14万亿美元的各大机构投资者如今正专注于撤资。马萨诸塞州剑桥市研究与倡议机构Union of Concerned Scientists问责运动总监凯西•穆尔维说:“投资者越来越了解这些公司。”她还表示,环保主义者担心各大公司将通过“商业手段”而不是真正的碳排放削减来实现净零目标。她说:“要让这些企业真正能够悬崖勒马,还有不少工作要做。”

股东们也在寻求从公司内部推动这一变革。自2016年以来,激进人士为推动气候决议的通过一直在多家石油巨头的年度股东大会上集结股东,以便达到进行投票表决所需的门槛。

2016年,由机械工程师转而成为积极人士的荷兰人马克•范巴尔成立了股东组织Follow This,旨在通过股东决议向原油公司施压,从而让它们致力于实施环保政策。他说:“有人说,‘哦,你想改变壳牌?做梦吧。’”他在壳牌2016年年度股东大会上提出的第一份决议十分生猛:“我们告诉壳牌公司应摒弃油气资源勘探业务。”这个决议很难通过,因为它是这家原油巨头的唯一业务。他说:“不可思议的是,该决议得到了2.6%的支持。”

该组织的策略自那之后变得越发成熟,如今还包括直接与原油高管协商。去年11月,范巴尔从阿姆斯特丹坐上了欧洲之星列车,前往BP伦敦总部与鲁尼会面。鲁尼当时已经被任命为新首席执行官。这两位举行了闭门会面,当时鲁尼向范巴尔透露BP将发生重大变化。范巴尔说:“鲁尼坚信,他有必要在执掌之后做出重大声明,而且需要股东的支持。”范巴尔决定,不会在5月召开的鲁尼上任后首个股东会议上提出激进的决议,而是与鲁尼合作,针对明年的会议制定一个联合决议,从而让BP致力于实施净零策略。他说:“如果得到合理实施,它将带来颠覆性的转变。”

范巴尔成功地让壳牌、道达尔、挪威国家石油公司以及BP对决议进行了投票。在美国,美国证券交易委员会阻碍了类似的激进决议,包括埃克森美孚和雪佛龙的年度股东大会,该机构称投资者曾经尝试干扰公司管理层决策。范巴尔对此十分乐观,他坚信石油行业必须向现实低头。他说:“我曾经梦想原油巨头的首席执行官能够顿悟,可以彻夜不眠地思考其孩子的未来。但这是不可能的。让曾经的油气大亨鲁尼幡然悔悟的是公司的股东。”

然而,范巴尔认为BP的“油气大亨”终于成为了他可以携手的首席执行官。而且他认为鲁尼在8月宣布的计划对于行业来说具有里程碑式的意义。范巴尔说:“这是第一家针对2050年目标采取实际行动,而不只是纸上谈兵的石油巨头。削减40%的原油产能真的是很激进的目标。如果有一个石油巨头站了出来,而且得到了股东的奖励,那么其他公司就会效仿。”

当鲁尼描述他的早期生活时,令人感到不可思议的是,他可以成为任何领域的游戏改变者。他对BP尤为感激。他说:“相对于我的背景而言,公司给了我一个我以前做梦都没有想到的机会。我并非出身与名校,或有着深厚的背景。”

这个说法着实十分低调。鲁尼的父母在11岁便离开了学校,并在爱尔兰凯利郡乡下的一个奶牛场抚养了5个孩子。他说自己与自己的兄弟在年轻时就学会了如何通过工作来赚外快。当我询问鲁尼其伦敦家中书架上的绿色玩具拖拉机时,他称这是在追忆自己的孩提时代。他说:“家里从来没有买过什么好机器,但我们一直都想要好东西。我们通过倒卖旧拖拉机来赚钱。只要能赚钱的活都干。”

他最深刻的记忆便是自己与同龄人的不同。他说:“男孩们擅长玩爱尔兰曲棍球[传统的爱尔兰体育运动,类似于长曲棍球]和橄榄球,但说实话,我觉得自己一无是处。我觉得自己的手很笨,然而在农场,一切活都得用手来完成。”

鲁尼是家里的第一个大学生。他在从都柏林大学毕业后直接以钻探工程师的身份加入了BP,而且先后数年效力于英国北海、阿拉斯加、挪威和美国的一些项目。他最终被前首席执行官约翰•布朗尼钦点为“海龟”(名字取自于忍者神龟),也就是有望向高层发展的高管助理。为了帮助其打好基础,布朗尼将他派往斯坦福商学院学习了一年。

即便在现在,鲁尼说自己的童年给他留下了不可磨灭的印记。他认为,童年让自己意识到非常有必要招募那些感觉自己与众不同或受到歧视的人士。自他担任首席执行官之后接受的少数几次采访中,有一次便是接受跨性别维权人士、制片人杰克•格拉夫的采访,鲁尼对杰克说,如果任何BP员工不支持性少数群体权益,“那么他就不属于BP这个大家庭”。在轰动的“黑人生命亦宝贵”抗议活动中,他在6月1日致BP全球员工的信中敦促员工大声揭露其生活中以及BP公司内部的种族主义。他说,自己随后与员工召开了痛彻心扉的视频会议,“员工们有的留下了眼泪,有的失声痛哭”。

作为首席执行官,鲁尼已经将心理健康作为BP的首要慈善事业,公司向英国精神健康机构Mind捐献了大量的资金。他将其看作公司内部的一个关键问题,并认为疫情让其出现了“进一步升级”,但这明显也是私人问题。他说:“在人际关系方面,我自己也面临着一些挑战。我也接受过心理咨询等服务。我认为每个员工都会受到影响。”然而,他并没有透露这方面的细节。在封锁期间,鲁尼向BP员工推荐了冥想应用程序Headspace,他称自己如今每天晚上都会使用。他说:“它就在我的床边,其播放的阵阵波涛声能够让我的心境平静下来。”

鲁尼并没有大企业高管的典型做派,他似乎对于这种负面形象很在意。当BP的官方网页便将其称为“伯纳德”,他创建了一个新Instrgram账户,其为数不多的几十张照片除了常规的企业照之外还包括同性恋骄傲大游行的彩虹,热带雨林,他通常在这些场合下身穿蓝色牛仔,很少扎领带,即便在5月召开的股东大会上也没有扎领带。

这位新首席执行官敦促员工与外界沟通,有一些员工采纳了他的建议,使用新冠疫情封锁这个机会与他进行在线沟通。在一个视频电话中,英国加油站工作人员向鲁尼讲述了疫情期间作为必要一线员工拿低薪的难处。鲁尼随后便为他们涨了工资。在托莱多BP-Husky炼油厂运营协调员何塞•罗德里格兹因一时冲动,使用公司的内部社交网Yammer向鲁尼发牢骚,并邀请他参加员工会议。罗德里格兹对于能够得到鲁尼的反馈感到震惊。鲁尼迅速地确定了一个日期,而且通过视频与炼油厂工人聊了20分钟。罗德里格兹眉飞色舞地说:“我们感到他真的是很关心我们。”他还表示,鲁尼不同于其此前29年BP职业生涯中所经历的四位首席执行官。罗德里格兹说:“一位工厂经理的母亲刚刚去世。伯纳德说,‘别忘了你的父亲,他可能在掩饰自己的悲痛。’”罗德里格兹和鲁尼自此之后便一直保持着联系。

我们很容易将其看作BP形象重塑举措的一部分,因为在眼下,公司已经承诺对发展方向进行重大调整。然而据我们所知,它似乎也反映了鲁尼真实的管理风格和个性。

即便如此,这位首席执行官也很难说服那些记性好的外部怀疑人士。公司于1997年推出的“超越石油”品牌重构计划便是由Ogilvy Public Relations Worldwide设计的一个价值2亿美元的公关活动。当时BP向世界宣布,公司将“思考油桶之外的事情”。为了凸显这一理念,时任首席执行官布朗尼将公司的名称从英国石油简化为BP。

对于一些人来说,鲁尼的“重构能源”计划听起来没有多少区别。Union of Concerned Scientists的穆尔维说:“我们此前也听说过类似的计划,也就是BP的‘超越石油’计划。人们当时对此抱有很大的希望,这个计划听起来非常有突破性。”她说,环保主义者担心会再次失望。

布朗尼称,他的举措在当时取得了实质性的进展,意味着公司真正开始担心碳排放问题,也是公司有别于其他石油巨头的一个地方。他说:“业界认为此举对整个行业构成了很大的威胁,并认为BP已经走上了歧路,但我们并不是在洗绿自己。”

在该活动推出之际,BP刚好在美国进行了80亿美元的太阳能电板投资,但这场冒险对于BP来说可谓是血本无归,因为当时中国开始了大规模的电板制造运动,而且价格比BP低得多。BP随后收购了英国太阳能公司Lightsource 50%的股份,并通过其修建和运营太阳能电厂,但没有制造面板。布朗尼称,石油公司在上个世纪90年代便清楚地意识到,其碳排放对全球气候造成了严重的破坏。然而,当时人们并没有多少紧迫感。布朗尼说:“当时的状况与眼下相距甚远,我们有大把的时间。”

但时间对于鲁尼来说是件奢侈品。为了在30年内实现净零排放,他必须迅速地改变BP,而且刻不容缓。布朗尼称,此外,与上个世纪90年代相比,当前的投资者不会容忍任何虚伪行径。他在谈到用植树或保护现有森林等举措来平衡碳排放时说:“光把抵消碳印记挂在口头上是不行的,得付诸实际行动。”

投资者和基金人士终于听到了鲁尼的“实际行动”计划。(而且他说,该计划并不依赖于碳抵消)。BP策略部门新负责人奇尔琪娅称,疫情让变革需求变得更加紧迫。她说:“说到其中的教训,疫情告诉我们,我们所处的这个环境非常脆弱。它凸显了我们多元化的需求。”她说自己在今年早些时候辞掉了麦肯锡的工作,因为鲁尼此前说服了自己,称BP将专注于削减排放,而且会不折不扣地去做。她说:“我想,‘哇,这些人对此是认真的。’我认为如果我们获得成功,其他公司便会效仿。”

位于纽约的环境捍卫基金的负责人科拉普曾经与鲁尼多次会面,包括在疫情期间的视频会面,来探讨BP的净零计划。他说BP从今年开始就需要部署一系列解决方案,这样才能满足其2050年目标。科拉普建议鲁尼迅速地从化石燃料转变为低碳能源生产,减少原油设施的甲烷等污染物的排放,并中和任何存在的碳排放,包括通过保护现有的热带雨林。他还说,所有这一切都应该大规模地开展。他说:“他们实现转变的里程碑必须减少对油气的投资。我们敦促伯纳德要实现这一转变过程中的里程碑。”

一个超越一切的关键问题在于:这家能源巨头愿意放弃多少油气资源?BP称公司将使用其油气生产来资助低碳能源。如今,公司账面上有193亿桶的储备。

然而按照净零策略,数亿桶油气可能将永远沉睡地底,成为财务领域所谓的搁浅资产。环保主义者担心,随着全球价格的上涨,BP可能会因此而扩大钻井活动,而各大石油公司和欧佩克富油国在过去数十年间都是如此。BP称,公司去年在可再生能源领域的投资不到其152亿美元资本支出的3%。市场情报公司Rystad Energy的能源服务研究业务副总裁马修•菲茨蒙斯称,当前整个行业未来五年在清洁能源方面的开支预计将达到资本总支出的9%。这些数字对环保主义者来说无异于杯水车薪。伦敦非政府组织ClientEarth的律师苏菲•马佳纳克说:“在过去20年中,整个行业一直对这个问题视而不见,但愿它如今能够得到重视。”

对于鲁尼及其大型石油同行来说,终极挑战在于既要改变这一态势,又要找到方式来交付股东要求的利润。有一件事似乎是肯定的:在今后数年内,BP和其他公司可能会继续其油气生产。鲁尼在8月公布其计划时说:“要通过关闭龙头来实现一家110岁公司的转型基本上是不可能的。”位于巴黎的国际能源机构称,即便油气公司在太阳能、电动汽车和风力发电机方面投入重金,但随着新兴国家财富的增加,全球对石油的需求预计至少在未来10年内依然会呈现出上扬态势。

当我问鲁尼,随着公司减少化石燃料产能,BP是否必然会面临利润率下降的问题?他说,相反,他认为BP将从能源转型获得巨大收益。各大政府正在投入海量的资金来推动能源转型,包括欧盟数万亿美元的疫情恢复计划。这些原油巨头可以借助数万名工程师和国际化的供应链参与这一进程。鲁尼说:“各国将花费数万亿美元来重建和更换全球的能源系统,继而会为像BP这样的专业公司带来巨大的机遇。”

除了提及财务机遇之外,鲁尼听起来越来越像一位真正的气候保护主义者。他说:“目前各大公司有站队的趋势。我对这个不感兴趣。我希望大家去做我认为有益于这个世界的事情。关键在于找到适合BP的发展之路,以及适合所有人的发展之路,这个没有什么区别。”

10年之后:Deepwater Horizon灾难让BP发生了哪些转变

10年前,BP油井的爆炸导致了美国史上最严重的原油泄漏事件。公司依然在为此买单。

2010年4月20日,Deepwater Horizon井架正在钻探位于路易斯安那州近海的一个名为“马贡多”的超深油藏,油田名字取自于加夫列尔•加西亚•马尔克斯知名著作《百年孤独》(One Hundred Years of Solitude)中的地名。随后,该项目成为了一个史诗级的灾难。

气体撕裂了油井,在墨西哥湾深达1.5英里的海底发生爆炸,11名平台员工因此而丧生。它所引发的火焰束在太空中清晰可见,同时也对海湾的渔业资源和湿地造成了巨大破坏。在这场持续了87天、美国史上最大的漏油事件中,约320万桶的原油流入了墨西哥湾,还有81万桶油被BP回收。

10年过去了,特朗普政府已经回滚了多项Deepwater Horizon事件之后制定的重要监管法规,包括独立检查和安全要求,例如预防爆裂的备用系统。

这场事故让BP的可信度在随后的数年中一蹶不振,直到如今才开始有所好转。当时帮助监管清理举措的BP高级副总裁、BP现任首席执行官鲁尼说:“这是一个令人绝望的困难经历。”法院认为BP在安全方面走捷径,奥巴马总统谴责公司“行事粗心大意”。

BP依然在支付约690亿美元和解费用以及当地社区和海湾沿线各州补助金的剩余部分,包括去年支付的约24亿美元。公司预计自己在未来13年内每年将支付约10亿美元的费用。

尽管出现了这一灾难,BP依然在墨西哥湾深水井的钻探方面投入了大量资金,而且其目标是到2020年中期实现该海域每天约40万桶的产量,与爆炸前2009年的产量一致。但鲁尼称,Deepwater Horizon让公司发生了永久性的变化。他说,安全环境目前已经成为BP运营的首要考虑因素,而且公司也学会了不能过于依赖某一个单体项目,这是评论人士在2010年事故之后用来批判BP的一个罪名。

他说:“我们永远不会忘记,而且必须始终铭记。我们在事故之后感到羞愧难当,对此,我个人完全有理由认为羞愧感从很多方面来讲是件好事。”然而,对于BP和海湾沿岸来说,这是一个异常惨痛的教训。(财富中文网)

本文另一版本刊载于《财富》杂志2020年8/9月刊,标题为《BP终于准备“另起炉灶”了吗?》

译者:冯丰

审校:夏林

For months, BP had planned this year’s annual general meeting as a sleek presentation. The company’s brand-new CEO would be onstage at London’s ExCeL convention center, trumpeting his green revolution to hundreds of shareholders. But this being 2020, nothing went as planned. When the day of the meeting finally arrived in late May, there was no audience, and no applause.

Instead, Bernard Looney, head of one of the world’s biggest oil companies, sat in a bare room in BP’s deserted London headquarters, next to a board member and a company official, talking into a camera. By then, the pandemic had killed more than 38,000 people in Britain. And rather than hosting BP’s big event, the ExCeL center had been transformed into a triage hospital for coronavirus patients. Looney, on a brief outing from months of lockdown at home, looked less like the head of an iconic 111-year-old giant than the captain of a troubled spaceship beaming bad news down to Earth. “Today’s challenge is of a different scale than any experienced before,” he told the invisible investors logged on for the meeting. He called it a “brutal environment.”

Just three months earlier, Looney had begun his tenure as CEO with a bang by unveiling a drastic overhaul for BP. He committed to “net-zero” carbon emissions by 2050—a strategy that promises to radically transform the company, and which several of his competitors then rushed to match.

Yet Looney barely had time to elaborate before COVID-19 hit the global economy with seismic force. Planes and cars sat grounded for months, with lockdown orders forcing billions of people indoors, including Looney and his team. From their homes, BP executives watched global oil demand collapse in the steepest drop since the Second World War. With no place left to store millions of barrels of unsold oil, futures prices of crude briefly dropped below $0 in April for the first time in history.

It was “brutal” indeed. BP’s first-quarter earnings showed debt of more than $6 billion and losses of $4.4 billion, compared with almost $3 billion in profits for the same period the year before. In June, the company announced 10,000 layoffs, equal to one in seven employees in its global workforce, and cast the bad news as being part of its net-zero restructuring. That same month it warned of a coming write-down in the value of its assets of up to $17.5 billion. (The actual figure turned out to be $17.4 billion.) And in early August, there was still more grim news: BP reported losses of $16.8 billion for the second quarter and slashed its dividend in half.

It didn’t take a pandemic to cause a crisis in the oil industry, however. Even before the virus began its rampage across the planet, oil companies’ stocks were lagging badly behind others on the major global indexes, as operating costs rose and crude prices remained low. And yet, oil super-majors like BP are hardly on the verge of collapse. Proof of that, if any is needed, is this year’s Global 500 list, in which five of the top 10 are oil and gas companies. BP sits at No. 8, with $283 billion in revenues and $4 billion in profits for 2019.

Yet for all their hundreds of billions of dollars in sales, a sense of unease has steadily grown inside these companies as they assess their prospects in a world increasingly committed to going green. And a combination of factors has ratcheted up the external pressure for change: a fast-worsening climate crisis; an angry and motivated younger generation; and, perhaps most critically, growing numbers of shareholders who are threatening to move their money out of oil and gas stocks unless they see serious change.

In last year’s climate marches, millions of youth railed against oil companies for causing global warming; scientists estimate that about one-third of greenhouse gases in the atmosphere today can be connected to the oil and gas industry. Protesters threw beetroot juice on delegates to the Oil & Money conference in London last October. And on Looney’s first day as CEO in February, Greenpeace activists barricaded BP’s London offices, forcing a temporary shutdown. Wisely, Looney opted to spend the day visiting a BP refinery in Germany.

Ducking beetroot juice and barricades is relatively simple. However, the bigger problems are no longer possible for oil companies to sidestep. To avoid a precipitous collapse in their core business in decades to come, they will need to execute the most dramatic pivot in their long history. At least, that’s the conclusion from many outside the industry. In January, shortly before Looney began as CEO, Larry Fink, founder and CEO of BlackRock, the world’s biggest asset management fund with more than $7 trillion under management, stunned investors by writing in his annual letter that “climate change has become the defining factor in companies’ long-term prospects.” That, he said, would become increasingly true as the new generation grow up to be investors and CEOs themselves. Simply put: Companies can either join the fight for climate, or slowly wither and die.

For the energy giants, that choice is painful indeed. Taken logically, it could well mean leaving in the ground, undrilled and unexplored, billions of barrels of oil and trillions of metric tons of gas. That seems to run contrary to their very DNA. “The oil industry has an existential challenge,” says Fred Krupp, president of the nonprofit Environmental Defense Fund. “Nothing will be easy about it.”

The message has not been lost inside BP. By the time Fink published his BlackRock letter, Looney had reached the same conclusion. On Feb. 12, one week after taking over, he announced his dramatic shift in the company under the clunky title, “Reimagining Energy, Reinventing BP.” The core promise to zero out carbon emissions by 2050 or sooner mirrors what climate scientists believe is needed to avert environmental catastrophe.

Among both oil analysts and environmentalists, the reaction was a mix of hope and eye-rolling. In interviews, several pointed to BP’s last major rebrand in the late 1990s and the accompanying slogan “Beyond Petroleum,” which became symbolic of the industry’s unfulfilled promises to explore clean energy. Now BP is nominally leading the charge again, and Looney insists that this time his company is all in. “The direction is set,” Looney said in February. “We are moving to net zero. There is no turning back.”

If that is the case, Looney’s plan is a staggering shift for BP, whose driving purpose since 1909 has been to pump oil and gas out of the ground and oceans, and to refine and sell it at gas stations around the world. Now, within 30 years tops, it needs to account for all the 415 million metric tons of carbon it adds to the atmosphere every year by offsetting it with non-carbon renewables like wind turbines or solar plants; cutting methane emissions leaking out of oil facilities; capturing carbon and storing it deep underground; protecting forests, and—the hardest of all—simply not producing some of that carbon in the first place.

Looney told investors in early August that BP would cut its oil and gas production by 40% within a decade and stop exploring for fossil fuels in new countries. After more than a century in business, BP, he says, will now become an “integrated energy company.” Seeing that transformation through could prove to be an epic challenge. But BP’s new boss insists there will be no reversal. “I really think this direction is unstoppable,” Looney told Fortune in a long interview. “I really do.”

With hindsight, the rush to switch directions seems like an inevitable development, given the intense investor pressure. The impact of that has been “massive, massive. There is no question,” says Oswald Clint, senior research analyst at Sanford C. Bernstein in London. He believes oil execs have become far more concerned about the climate themselves, rather than being dragged into taking action. “Perhaps the companies have been forced to buckle,” Clint says. “But they are not buckling today. It is full embracement, a cultural change.”

That BP could be in the vanguard of this historic shift will seem unlikely to many. Early on, the company was built by capitalizing on political upheaval in what is now Iran, Iraq, Libya, and elsewhere. And more recently, BP earned notoriety for unsafe operating conditions that went unattended—with disastrous results. Americans probably best remember BP for two major accidents, both found to have been the result of slipshod practices: the explosion at a BP refinery in Texas City, Texas, in 2005, in which 15 workers died; and the Deepwater Horizon explosion in 2010 off the coast of Louisiana, which killed 11 people and wreaked mammoth damage to the Gulf of Mexico. It was the worst oil spill in U.S. history, for which BP is still paying out billions to local communities.

Looney’s ascent as CEO finally gives the company a chance for a very new role. In the weeks following his net-zero decision, BP’s competitors in Europe rushed to do the same, perhaps sensing that if they failed to do so they would be cast as climate villains. Within weeks of Looney’s speech, Royal Dutch Shell, the Italian oil major ENI, and France’s Total all announced goals for net-zero carbon emissions by 2050. The Spanish oil company Repsol and Norway’s Equinor had made similar pronouncements earlier, promising to boost investments in renewables and increase energy efficiency in oil production.

The plan Looney unveiled in August would radically change BP by increasing its investment in low-carbon energy sources 10-fold by 2030, and eventually cutting oil and gas exploration by about 75% from its peak levels. “We know this will not be easy, but we are confident that this is the right thing for all our stakeholders,” he said. The plan would steadily determine all BP’s decisions. “You will see low carbon increasing, and fossil fuels in the long term decreasing,” says Giulia Chierchia, who joined BP in April, as its new executive vice president for strategy and sustainability, to help manage the net-zero transition. “We will make choices, and those choices will be low carbon.”

For Looney, 49, the decision came after much thought. In an hour-long video interview in late June, he said he came to realize that there was no way to square the growing alarm over climate change with his company’s business of pumping out 3.8 million barrels of oil and gas a day. Something had to give. “It became increasingly apparent over the last few years that we were in many ways swimming against the tide,” Looney says, sitting in a black T-shirt in his home office, back from a three-mile run around his London neighborhood. I ask him what would happen if BP and other big oil companies do not zero out their carbon footprint. “Without action,” he says, “it is a rather bleak future for the world.”

Looney says two groups of people had weighed heavily on his mind in thinking of BP’s future: his employees, and the investors. Both groups, it was clear, were deeply perturbed. “The sense that investors were really beginning to push, and question our purpose, started to weigh on the financial performance of our sector,” he says. “And our employees were becoming anxious about what I would describe as their personal purpose being misaligned with our corporate purpose.”

One of those anxious employees was Jo Alexander. A geoscientist with a long mane of red hair, she joined BP after graduating from Oxford University in 2003, then spent a decade working on major oil projects, including in Libya and Australia. It was a life of adventure and travel, she says. But her growing distress over the environment finally made the work feel untenable. She took a buyout from BP in 2015 and joined ShareAction, a nonprofit in London focusing on responsible investment.

At BP’s annual meeting last year, Alexander stood up to speak. She told the executives that many inside BP felt the same frustration that had driven her to leave the company. “I asked them, ‘When is BP going to give them jobs that are meaningful?’ ” she says. The execs were taken aback. After the meeting, Looney came to find her and said, “Promise me you’ll come talk to me about this,” she says. She spent months quietly gauging the views of people she knew within BP. Then late last year, she met with Looney at BP headquarters. Looney, who headed BP’s upstream division, was already rumored to be the next CEO, succeeding Bob Dudley. Alexander shared a presentation she had prepared with data about the views of BP’s employees. Then Looney told her that he was about to unveil a drastically different strategy. Alexander knew in an instant she wanted to be involved. “I said, ‘You cannot do that without me,’ ” she says. “It was the cheekiest thing I had ever said.”

Her boldness worked. Looney hired Alexander, 39, creating a job for her titled “purpose engagement manager,” with a brief to engage BP staff in the new purpose of “reimagining energy.” Looney now mentions her at every turn, including in his “net-zero” speech in February and in his interview with me. Alexander insists she is not there just to make Looney look good. “I am not naive. I do not think it is a slam dunk,” she says of BP’s net-zero plan. Still, she says, “everyone is on board with our purpose. A sense of pride has really returned.”

That optimism has not been shared equally by all BP alumni. Consider Mike Coffin, another engineer who, like Alexander, quit BP over environmental concerns. Coffin, 34, joined BP in 2008 as a geologist, right out of Cambridge University. Like Alexander, he spent a decade working on BP’s exploration projects and says the job offered him much of what he wanted: interesting work, and a solid career path that would enable him to buy a house and start a family. “Ten, 12 years ago, it was a very attractive proposition,” he says.

But Coffin grew increasingly uneasy about the environmental damage from oil production. He worried whether BP could even survive the energy transition, and that, even if it did, exploration engineers like him, hunting for big new finds, could become extinct. “I felt there was not necessarily a future in oil and gas,” he says.

Early last year, Coffin finally left BP and became an oil and gas analyst for Carbon Tracker Initiative, a nonprofit organization in London that researches oil companies’ climate impact on financial markets. With the stunning fossil-fuel cuts Looney announced over the summer, Coffin says, “BP is now the industry leader in responding to climate change.” Even so, he still harbors strong doubts about whether oil companies can truly reinvent themselves as dramatically as they claim. He also questions whether Big Oil will abandon its long practice of pegging bonuses to fossil-fuel production. (BP says from now on, it will increase the environmental weighting in bonus considerations.)

As activist investors have grown more organized, so has the movement to dump energy stocks from portfolios—both from environmental concern and for reasons of financial risk. “Investors maybe do not care about climate at all,” says Andrew Grant, head of oil, gas, and mining for Carbon Tracker Initiative. “But they are getting pressure from their clients,” he says. “At this point, the financial imperative has really lined up with the environmental imperative.”

In the U.S. and Europe, dozens of pension funds and governments have begun pulling billions of dollars’ worth of stocks from fossil-fuel companies. According to the activist organization Fossil Free, institutions with a total of more than $14 trillion in assets have now committed to divestment. “Investors have gotten more and more savvy about these companies,” says Kathy Mulvey, accountability campaign director at the Union of Concerned Scientists, a research and advocacy organization in Cambridge, Mass. She adds that environmentalists fear that companies will use “corporate gymnastics,” rather than real carbon emission cuts, to reach net-zero targets. “There is quite a bit of work to be done to hold their feet to the fire,” she says.

Shareholders have also sought to drive change from within the companies. Since 2016, activists have pushed climate resolutions at the annual meetings of several big oil companies by grouping shareholders together, in order to meet the required threshold for a vote.

In 2016, Mark van Baal, a Dutch mechanical engineer turned activist, founded the shareholder group Follow This, specifically to put pressure on oil companies to commit to environmental policies via shareholder resolutions. “People said, ‘Oh, you want to change Shell? Dream on,’ ” he says. His first resolution, at Shell’s 2016 annual shareholder meeting, was blunt: “We told the company they should not explore oil and gas.” That was a tough sell, considering that the oil giant’s sole purpose was to do just that. “It’s a miracle the resolution got 2.6% support,” he says.

The group’s strategy has since grown more sophisticated and now includes directly negotiating with oil executives. Last November, van Baal hopped the Eurostar train from Amsterdam to meet Looney at BP’s London headquarters. Looney had by then been named as the next CEO. The two holed up in a closed room, where Looney revealed to van Baal that big changes were coming. “He was quite convinced he would need to make a big announcement when he took the helm, and that he would need shareholder support,” van Baal says. Van Baal agreed not to push an activist resolution at Looney’s first shareholder meeting in late May and to rather work with Looney on a joint resolution for next year’s meeting, committing BP to net-zero strategies. “If implemented properly, it would be a radical shift,” he says.

Van Baal has succeeded in getting resolutions to a vote in Shell, Total, Equinor, and BP; in the U.S., the Securities and Exchange Commission has blocked similar activist resolutions, including at the annual shareholder meetings of Exxon Mobil and Chevron, claiming that investors were trying to interfere with the companies’ management decisions. Van Baal is sanguine, confident that the oil industry must bow to reality. “I used to dream about a big oil CEO having an epiphany, a sleepless night about his children’s future,” he says. “That is not going to happen. Looney was woken up by his shareholders. He’s an oil and gas guy.”

Yet van Baal believes BP’s “oil and gas guy” is finally a CEO he can work with. And he believes that the plan Looney outlined in August could be a landmark moment for the industry. “This is the first oil major to walk the walk instead of just talking about 2050. Cutting oil production by 40%, that’s really immense,” says van Baal. “If one oil major breaks ranks and shareholders reward them for it, others will follow.”

****

When Looney describes his early life, it seems extraordinary that he could emerge as a game changer of any kind. He feels hugely grateful to BP. “It has given me an opportunity I never could have dreamed of, coming from where I came from,” he says. “I didn’t come from the right school or the right background.”

That is an understatement. Looney’s parents left school at age 11 and raised their five children on a dairy farm with 14 cows in rural County Kerry, Ireland. Money was tight. He says he and his brothers learned at a young age how to work for extra cash. When I ask Looney about the green toy tractor sitting on his bookshelf at home in London, he says it is a nod to his childhood. “We never had good machinery, and we always wanted good stuff,” he says. “We made money buying old tractors and selling them. Anything to make a few pounds.”

His strongest memory was of being different from his peers. “Boys were good at hurling [a traditional Irish sport somewhat similar to lacrosse] and rugby, and to be honest with you, I was pretty useless,” he says. “I was not good with my hands, on a farm where everything is about your hands.”

Looney was the first in his family to go to college. He joined BP as a drilling engineer immediately after graduating from University College, Dublin, and spent years working on projects in Britain’s North Sea, Alaska, Norway, and the U.S. He was eventually handpicked by former CEO Lord John Browne as a “turtle”—an executive assistant (named for the Ninja Turtles) on a likely track to the top. In preparation, Browne sent him for a year to Stanford Graduate School of Business.

Even now, Looney says his childhood has indelibly marked him. He believes it left him with a heightened need to include people who feel different or disrespected. One of the few interviews since his appointment to CEO was with transsexual activist and filmmaker Jake Graf, telling him that if any BP employees do not support LGBTQ+ rights, “they don’t belong in our company.” Amid the explosive Black Lives Matter protests, he wrote to BP’s worldwide staff on June 1, urging them to “call out” racism in their lives as well as inside BP. Wrenching video meetings with staff followed, with “people in tears, people crying,” he says.

As CEO, Looney has made mental health BP’s main charitable cause, with the company donating heavily to Mind, a British mental-health organization. He sees it as a critical issue within corporations and thinks it has been “turbocharged” by the pandemic. But it is clear that the issue is also personal. “I have had my own relationship challenges. I have had counseling and all of those things,” he says, without offering details. “I believe it affects each and every one of us.” Under lockdown, Looney offered BP employees access to Headspace, a meditation app, which he says he now uses every night. “It’s next to my bed,” he says. “I put on waves rolling in. It is calming.”

Looney does not sound much like the typical head of a giant corporation, and he seems to recoil from being depicted as one. “Bernard,” as he is called on BP’s official website, has a new Instagram account whose few dozen posts include Pride rainbows and rain forests amid the regular corporate photos, where he is typically dressed in blue jeans, and rarely in a tie, not even at the shareholder meeting in May.

The new CEO has urged workers to reach out, and some have taken him up on the offer, using the coronavirus lockdown as a chance to catch time with him online. On one video call, gas-station attendants in Britain spoke to Looney about their difficulties in working low-paying jobs through the pandemic as essential frontline workers; Looney afterward raised their wages. In Toledo, Jose Rodriguez, operations coordinator for the BP-Husky oil refinery, pinged Looney on a whim, using the company’s internal social network Yammer, and invited him to join one of their staff meetings. Rodriguez was stunned to hear back. Looney quickly set a date and chatted by video to the refinery workers for 20 minutes. “It made us feel like he actually cared about us,” Rodriguez says with amazement, adding that Looney was unlike the four former BP CEOs during his 29 years at the company. “One plant manager’s mom had just died,” Rodriguez says. “Bernard said, ‘Don’t forget about your dad. He might be hiding his feelings.’ ” Rodriguez and Looney have since kept in touch.

It is tempting to dismiss this all as part of BP’s image-making, at a moment when the company is promising a drastic shift in direction. But by all accounts it appears to reflect Looney’s actual management style and personality.

Even so, the CEO will have trouble winning over doubters on the outside with long memories. The company’s “Beyond Petroleum” rebrand, launched in 1997, was a $200 million PR campaign designed by Ogilvy Public Relations Worldwide. The company, the world was told, would “think outside the barrel.” For emphasis, then-CEO Browne changed the company’s name from British Petroleum to BP.

To some, Looney’s “Reimagining Energy” does not sound all that different. “We’ve heard this before from BP with ‘Beyond Petroleum,’ ” says Mulvey, from the Union of Concerned Scientists. “People were pretty hopeful at that time. It felt like it was a breakthrough.” Environmentalists fear being let down again, she says.

Browne says his efforts represented serious progress at the time, signaling the company’s real worries about carbon emissions, in a break from other oil majors. “The industry felt very threatened by it, telling us we were leaving the church,” he says. “We had no intention of greenwashing.”

The campaign coincided with BP’s $8 billion investment in solar panels in the U.S., an expenditure that cost it dearly when China began mass-producing panels at a fraction of the price; BP later took a 50% share in Lightsource, a solar company in Britain, with which it builds and operates solar plants, without manufacturing the panels. Browne says oil companies were well aware, as far back as the 1990s, that their carbon emissions were wreaking severe damage on the world’s climate. Yet there was still little sense of urgency. “We were nowhere near the position we are in today,” Browne says. “We had plenty of time.”

Looney has no such luxury. To reach net-zero in 30 years, he must race to change BP, starting now. What is more, far more than in the 1990s, investors will reject any hint of hypocrisy, Browne says. “You cannot just say you are offsetting,” he says, referring to the practice of balancing carbon emissions with, for example, planting trees or protecting existing forests. “You have to do something real.”

****

Investors and activists are finally hearing Looney’s plan for “something real.” (And, he says, it doesn’t depend on carbon offsets.) Chierchia, BP’s new head of strategy, says that the pandemic has made the need for change feel more immediate. “If anything, it’s showed us the exposure we have to an environment that is very volatile,” she says. “It reinforced our need to diversify.” She says she quit her previous position at McKinsey & Co. earlier this year, after Looney convinced her BP was fully committed to cutting emissions and would not make compromises. “I thought, ‘Wow these guys are actually serious about it,’ ” she says. “I thought if we could be successful, others would follow.”

Krupp, head of the Environmental Defense Fund in New York, has met several times with Looney to discuss BP’s net-zero plans, including by video during the pandemic. He says BP will need to deploy myriad solutions, starting this year, in order to meet its 2050 target. Krupp has advised Looney to rapidly shift from fossil fuels to low-carbon energy production; reduce pollutants like methane around oil facilities; and neutralize whatever carbon emissions remain, including by protecting existing tropical forests. All of those, he says, should be done on a massive scale. “They have to shift away from investing in more oil and gas,” he says. “We have challenged Bernard to find the milestones in that shift.”

One crucial question towers over all: Just how much oil and gas will the energy giants be willing not to drill? BP says it will use its oil and gas production to fund investment in low-carbon energy. Right now it has 19.3 billion barrels in reserves on its books.

But in a net-zero strategy, millions of barrels will likely need to remain in the ground forever, becoming so-called stranded assets, in finance-speak. Environmentalists fear that BP might be tempted to increase drilling as world prices rise—just as oil companies and OPEC’s oil-rich countries have done for decades. BP invested less than 3% on renewables last year out of its $15.2 billion capital expenditure, according to the company. The industry overall is currently projected to devote about 9% of its spending on clean energy over the next five years, says Matthew Fitzsimmons, vice president of energy service research at the market intelligence firm Rystad Energy. Those figures are hardly reassuring to environmentalists. “The industry has been kicking the can down the road for the past 20 years,” says Sophie Marjanac, a lawyer for ClientEarth, a London NGO. “Hopefully, the game is up now.”

Changing that dynamic while still finding a way to deliver the profits that shareholders demand is the ultimate challenge for Looney and his Big Oil peers. One thing seems almost certain: BP and others are likely to continue their oil and gas production for many years. “It is simply not possible to transform a company of 110 years old by shutting off the taps,” Looney said when unveiling his plans in August. And even if they invest heavily in solar power, electric vehicles, and wind turbines, oil demand is projected to continue rising for at least a decade, as wealth rises in emerging countries, according to the International Energy Agency in Paris.

When I ask Looney if BP might inevitably become less profitable as the company moves away from fossil-fuel production, he says that on the contrary, he believes BP will gain hugely from the energy transition. Governments are rolling out gargantuan investments to facilitate the energy shift, including the European Union’s trillion-dollar pandemic recovery plan. With thousands of engineers and a global supply chain, the oil majors could position themselves to be part of that rollout. “Trillions of dollars will be spent rewiring and replumbing the world’s energy system,” Looney says. “That presents an enormous opportunity for a company of our skills.”

Besides just identifying a financial opportunity, Looney is also increasingly sounding like a true climate believer. “There’s a tendency to take position. I am not into positions,” he says. “I want us to do what I think is right for the world.” The trick will be making what’s right for BP, and right for all of us, one and the same.

****

10 years after: How the Deepwater Horizon debacle changed BP

A decade ago, the explosion at a BP well caused the biggest oil spill in U.S. history. The company is still paying the price.

On April 20, 2010, the Deepwater Horizon rig was drilling into an ultra-deep oil prospect off the coast of Louisiana named Macondo, after the setting for Gabriel García Márquez’s epic novel One Hundred Years of Solitude. And then it turned into an epic disaster.

Gas ripped through the well and blew up 1.5 miles undersea in the Gulf of Mexico, killing 11 platform workers. It sent up a plume of fire visible from space and wreaked mammoth damage on the Gulf’s fishing stocks and wetlands. About 3.2 million barrels of oil poured into the Gulf over 87 days, and another 810,000 barrels were soaked up by BP, in the biggest oil spill in U.S. history.

Ten years on, the Trump administration has rolled back several key oversight regulations that were introduced after Deepwater Horizon, including independent inspections and safety requirements such as backup systems to prevent blowouts.

The incident cast a shadow for years over BP’s trustworthiness, which it is only now beginning to shake off. “It was a desperately difficult experience,” says current CEO Looney, back then a senior BP executive who helped oversee the cleanup effort. In court, BP was found to have cut corners on safety, and President Barack Obama accused the company of “recklessness.”

BP is still paying the remainder of the $69 billion or so in settlements and grants to local communities and states along the Gulf, including about $2.4 billion paid last year. The company predicts it will pay about $1 billion a year for the next 13 years.

Despite the disaster, BP still invests heavily in deepwater drilling in the Gulf of Mexico, and aims to pump about 400,000 barrels a day from its waters by the mid-2020s—about the same amount it produced in 2009, before the explosion. But Looney says Deepwater Horizon forever changed the company. He says safety conditions are now the primary consideration in BP’s operations, and that the company has learned not to get too attached to one particular project—a charge that critics leveled against BP after the 2010 accident.

“We will never forget, and we must never forget,” he says. “We walked away with a lot of humility, which I personally believe is good for all seasons.” For BP and for the Gulf Coast, it was a very costly lesson.

A version of this article appears in the August/September 2020 issue of Fortune with the headline “Is BP finally ready to ‘think outside the barrel’?”