比特币向来以剧烈波动著称,但最近几个月却异乎寻常地安静。在过去的三个月里,这种数字货币一直在9,000美元和10,000美元之间的狭小区间徘徊。可是,在过去一周,比特币突然暴涨。

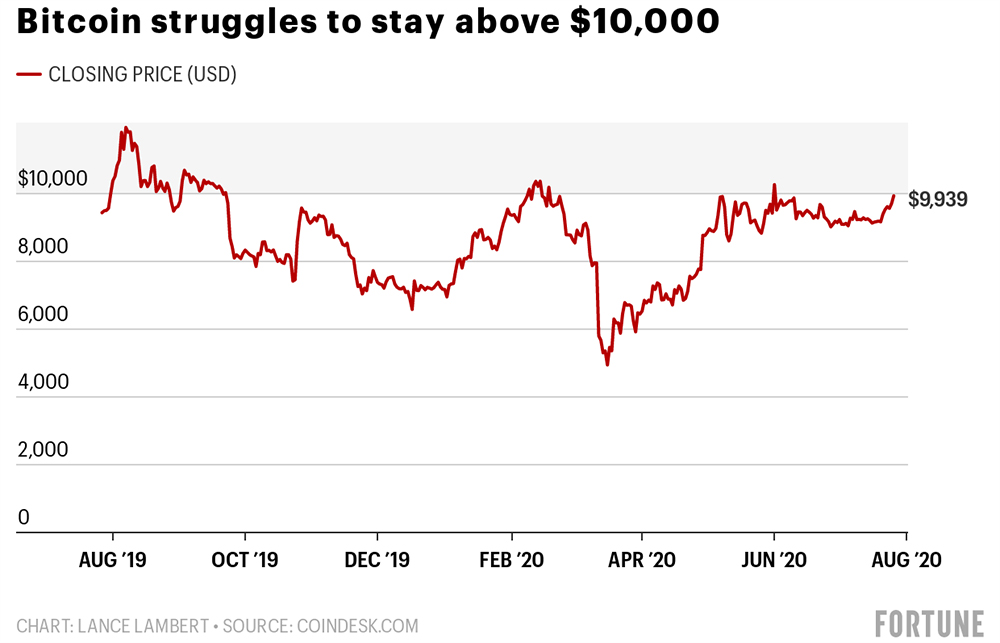

周一(7月27日),比特币的价格冲破11,000美元,较一周前的9,100美元左右显著增长。考虑到比特币在过去几次突破这一关口时都未能保持在10,000美元以上,而且近一年来也没有突破10,500美元,这种涨幅显得很不寻常。下图显示的是比特币在过去一年的价格变动情况:

那么,是什么推动了新一轮价格飙升呢?专家们认为,助推此次暴涨的似乎不是单一的催化剂,而是几个相互重叠的因素。

比特币研究机构Messari Research分析师埃里克•特纳在一封写给《财富》的电子邮件中指出,在所谓的“去中心化金融(DeFi)”平台上,加密交易员最近从一些不知名的数字货币中获得了巨大收益。特纳推测称,许多交易员持续不断地将其收益投入到两种最主流的加密资产(即比特币和以太币)上,由此推高了价格。

比特币价格暴涨也可能得益于美国货币监理署(OCC)上周发布的一封信函。这封信函指出,银行可以代表客户持有比特币。许多业内人士将其视为一个看涨信号,并预测这可能会推动大型基金加大对加密货币的投资。

最近价格飙涨的另一个可能原因是弥漫于全球的恐慌和不确定性心理。这种情绪可能导致投资者寻求黄金等资产。随着人们对新冠疫情和地缘政治不确定性的担忧不断加剧,金价一直在疯狂上涨。来自数字资产研究机构The Block的一份报告显示,比特币或许也受益于同样的现象。

还有一种理论认为,比特币的暴涨可能是基于基本面因素。

Fundstrat Global Advisors技术策略师罗伯•斯拉格默对彭博社表示:“我们仍然看好整体结构非常精确的比特币,并预计它将突破10,000美元至10,500美元,这是其长期看涨的技术特征的一部分。”

斯拉格默还指出,比特币需要突破10,500美元这样一个“阻力区间”。一旦比特币做到这一点(就像它在周一似乎做到的那样),他预计这种货币将向下一个“阻力区间”13,800美元发起冲击。

这种技术分析与价格走势的“波动理论”,以及一种被称为“斐波那契序列”的相关分析工具是一致的。这种分析工具在2017年加密货币泡沫期间广受追捧。

然而,这些理论似乎都不能提供一个令人信服的解释。就像许多其他加密货币近些年来的涨势一样,比特币最近的暴涨很可能只是昙花一现。(财富中文网)

译者:任文科

比特币向来以剧烈波动著称,但最近几个月却异乎寻常地安静。在过去的三个月里,这种数字货币一直在9,000美元和10,000美元之间的狭小区间徘徊。可是,在过去一周,比特币突然暴涨。

周一(7月27日),比特币的价格冲破11,000美元,较一周前的9,100美元左右显著增长。考虑到比特币在过去几次突破这一关口时都未能保持在10,000美元以上,而且近一年来也没有突破10,500美元,这种涨幅显得很不寻常。下图显示的是比特币在过去一年的价格变动情况:

比特币的价格很难保持在10,000美元以上。制图:LANCE LAMBERT 数据来源:COINDESK.COM

那么,是什么推动了新一轮价格飙升呢?专家们认为,助推此次暴涨的似乎不是单一的催化剂,而是几个相互重叠的因素。

比特币研究机构Messari Research分析师埃里克•特纳在一封写给《财富》的电子邮件中指出,在所谓的“去中心化金融(DeFi)”平台上,加密交易员最近从一些不知名的数字货币中获得了巨大收益。特纳推测称,许多交易员持续不断地将其收益投入到两种最主流的加密资产(即比特币和以太币)上,由此推高了价格。

比特币价格暴涨也可能得益于美国货币监理署(OCC)上周发布的一封信函。这封信函指出,银行可以代表客户持有比特币。许多业内人士将其视为一个看涨信号,并预测这可能会推动大型基金加大对加密货币的投资。

最近价格飙涨的另一个可能原因是弥漫于全球的恐慌和不确定性心理。这种情绪可能导致投资者寻求黄金等资产。随着人们对新冠疫情和地缘政治不确定性的担忧不断加剧,金价一直在疯狂上涨。来自数字资产研究机构The Block的一份报告显示,比特币或许也受益于同样的现象。

还有一种理论认为,比特币的暴涨可能是基于基本面因素。

Fundstrat Global Advisors技术策略师罗伯•斯拉格默对彭博社表示:“我们仍然看好整体结构非常精确的比特币,并预计它将突破10,000美元至10,500美元,这是其长期看涨的技术特征的一部分。”

斯拉格默还指出,比特币需要突破10,500美元这样一个“阻力区间”。一旦比特币做到这一点(就像它在周一似乎做到的那样),他预计这种货币将向下一个“阻力区间”13,800美元发起冲击。

这种技术分析与价格走势的“波动理论”,以及一种被称为“斐波那契序列”的相关分析工具是一致的。这种分析工具在2017年加密货币泡沫期间广受追捧。

然而,这些理论似乎都不能提供一个令人信服的解释。就像许多其他加密货币近些年来的涨势一样,比特币最近的暴涨很可能只是昙花一现。(财富中文网)

译者:任文科

Bitcoin is famous for it volatility, but has been unusually quiet in recent months. The digital currency had been hovering in a tight band between $9,000 and $10,000 for nearly all of the last three months—until a sudden breakout in the past week.

On Monday, the price of Bitcoin brushed $11,000, which is up from around $9,100 a week ago. This is notable given how Bitcoin has failed to stay above $10,000 on the few occasions when it's broken that mark, and how it hasn't crossed $10,500 in nearly a year. This chart shows the last year:

So what's driving the new price surge? There doesn't appear to be a single catalyst, but rather several overlapping factors, according to experts.

In an email to Fortune, Eric Turner of Messari Research noted that crypto traders have been reaping large gains from obscure digital currencies on so-called "DeFi" (decentralized finance) platforms. Turner speculates that many of these traders have been plowing their gains into the two most mainstream crypto assets, Bitcoin and Ethereum, and driving up the price.

Bitcoin prices may also be getting a tailwind thanks to last week's letter from the Office of the Controller of the Currency, which stated banks can hold Bitcoin on behalf of their customers. Many in the crypto industry have treated this as a bullish signal, and predicted it could lead to new investment in cryptocurrencies from large funds.

Another possible reason for the recent price spike is a general sense of fear and uncertainty around the globe. Such sentiments can lead investors to seek out assets like gold, which has been on a tear amid worries over the pandemic and geopolitical uncertainty. A report from the The Block suggests Bitcoin may be benefiting from same phenomenon.

Finally, Bitcoin may be surging based on underlying fundamentals.

“We remain positive on the overall precise structure for Bitcoin and do expect it push through $10,000-$10,500 as part of its longer term bullish technical profile,” Rob Sluymer, a technical strategist at Fundstrat Global Advisors told Bloomberg.

Sluymer also noted that Bitcoin needs to break through a "resistance band" of $10,500. Once it does—as it appears to have done on Monday—he suggested the currency will encounter the next such "resistant band" at $13,800.

This sort of technical analysis is consistent with a "wave theory" of price movements—and a related analytic tool known as the Fibonacci sequence—which gained traction during the cryptocurrency bubble of 2017.

None of this provides a definitive explanation for Bitcoin's latest uptick, however, and the latest surge could—like so many other crypto rallies over the years—be a temporary one.