音乐、时尚和政治等领域的代际分歧由来已久,而现在房地产领域的代际差异也在日渐扩大。

如下图所示,自20世纪90年代开始,每代人在房地产上的投资金额及相应的投资价值都出现了巨大分化。代际问题专家称,尽管这一现象与运气和时机不无关系,但也深深塑造了每一代人对拥有住房的整体感受。

代际动力学中心(Center for Generational Kinetics)是一家位于奥斯汀的研究与战略公司,该公司的总裁兼代际研究负责人杰森•多尔西表示,这种现象是多种因素共同作用的结果。这些因素不仅影响了每代人可支配财富的多寡,也影响了他们在支出上的选择。

•Z世代:如果你以为Z世代只关心零工和租赁经济,那就大错特错了。多尔西说:“大衰退时,Z世代已经开始记事,而且年龄尚小,价值观很容易受到影响。他们曾经耳闻目睹父辈的挣扎以及失业的痛楚。”多尔西认为,总体而言,Z世代在财务上偏于保守,对借贷和负债态度偏怀疑,他们喜欢从事有稳定福利的工作,并且更有可能使用鼓励储蓄或能提高信用分数的应用。他说:“我们称Z世代为‘倒退的一代’,他们在很多方面真的更像‘婴儿潮’一代。” 房地美近期进行的一项调查也支持该观察。调查显示,86%的Z世代受访者表示“希望未来能拥有自己的房产”,且平均估计“能在30岁前实现,比当前的房产购置中位年龄(33岁)早三年。”通过与之前的调查进行比较,房地美发现:“与千禧一代相同年纪时相比,年龄在18至23岁的Z世代成员中,认为租房比购房更有吸引力、租房能获得归属感、租房比持有房产成本更低的比例都更低,比例分别为19%对30%、33%对39%和40%对51%。”

•千禧一代:千禧一代并不是不想拥有自己的房子,不过赶上大衰退对经济造成严重冲击,成家立业只得推迟。许多人大学毕业后找不到理想的工作,或因为经济环境不佳而从事低薪工作,还有人连工作都找不到。再加上教育成本的大幅提升,这一代人还背着非常沉重的学生贷款债务。皮尤研究中心对人口普查数据的分析显示,“与前几代人同年龄时相比,千禧一代在三大家庭生活指标——购房成家比例、结婚率和生育率方面都偏低”。皮尤研究发现,2019年,在千禧一代中,有55%住在自有房屋里。而2003年,在X世代中,这一比例为66%;1987年时,婴儿潮一代中这一比例为69%;1968年,沉默的一代中这一比例为85%。新冠疫情爆发前,千禧一代刚刚掀起一波置业潮,但就在他们即将购买第一套住房时,就遭逢疫情打击。

•X世代:X世代对房产的态度主要取决于自己所处地区房价是否已经从大衰退中完全恢复。如果房价恢复了,那么他们往往会将购置房产当作积累财富的一种积极手段,反之则更偏向于看空房产。多尔西表示,“房产的两面——快速升值和崩盘,X世代都经历过了。”

•婴儿潮一代:婴儿潮一代往往会毫不掩饰地将房地产视为一种投资,认为房产既能创造财富,也能保值增值。这就引出了另一个有趣的代际传承问题:千禧一代能否通过从婴儿潮一代的父母那里继承巨额财富来实现经济上的跃升?虽然很多人早已对此作出预言,但多尔西却认为这种情况未必会真的出现。他说:“婴儿潮一代都很长寿,养老会花去很多积蓄,也就无法给孩子留下太多的财产。”

•沉默的一代:多尔西称,这代人与后几代有着截然不同的人生经历,“他们都亲历了二战后郊区快速发展的时期。作为婴儿潮一代的父母,他们见证了农村的城市化进程,也见证了城市的兴衰起伏。”他表示,这代人越来越倾向于给自己的房产做减法,减少自己的家务负担。换句话说,就是搬到空间小一点或更易维护的地方居住。在设法“保持生活品质、获取医疗服务以及与亲朋好友比邻而居”的同时,他们也在做遗产继承方面的规划。(财富中文网)

译者:Feb

音乐、时尚和政治等领域的代际分歧由来已久,而现在房地产领域的代际差异也在日渐扩大。

如下图所示,自20世纪90年代开始,每代人在房地产上的投资金额及相应的投资价值都出现了巨大分化。代际问题专家称,尽管这一现象与运气和时机不无关系,但也深深塑造了每一代人对拥有住房的整体感受。

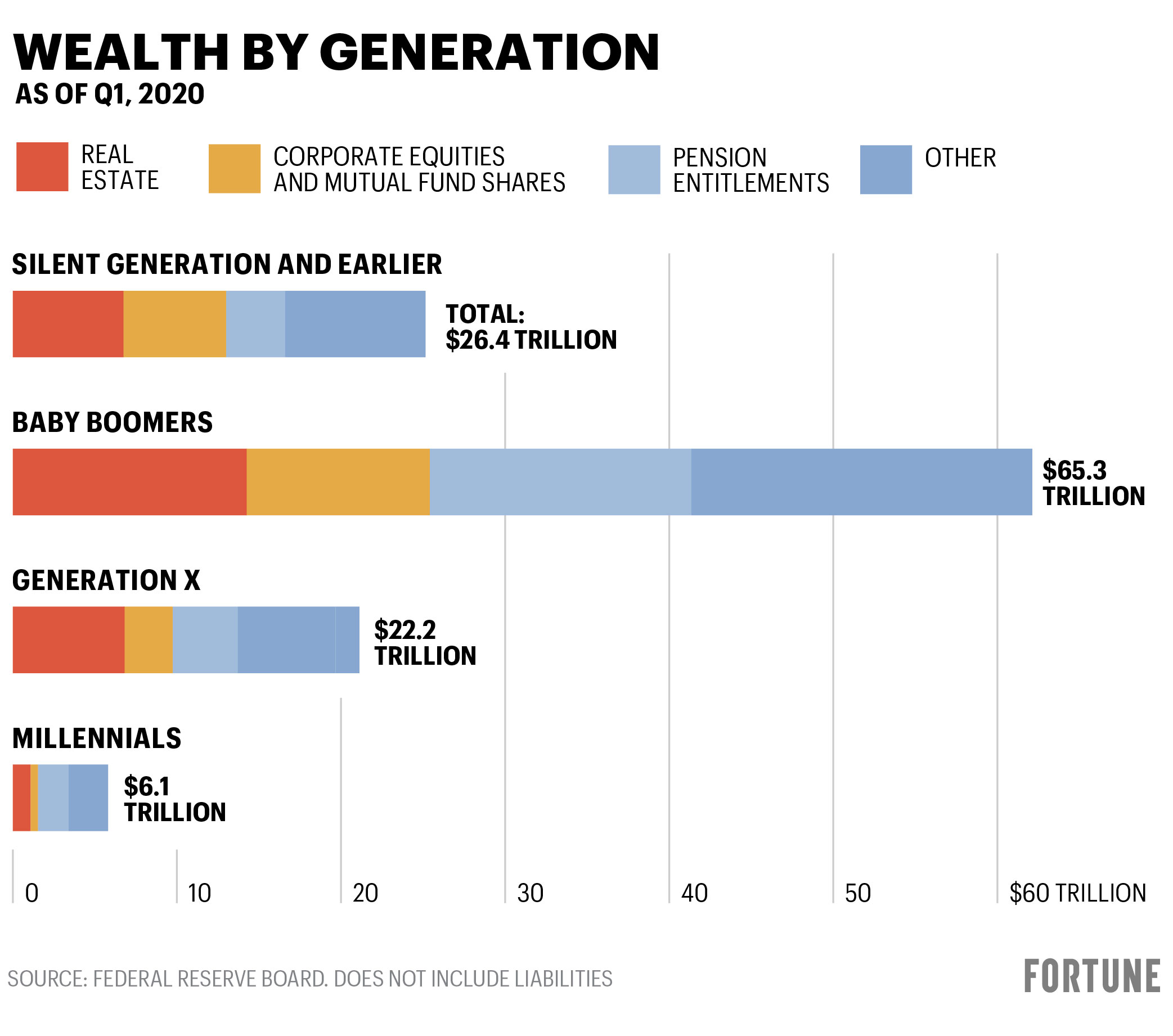

图:截至2020年第一季度,各代人所掌握的财富。

图:1990-2020年,各代人所掌握的房产财富。

代际动力学中心(Center for Generational Kinetics)是一家位于奥斯汀的研究与战略公司,该公司的总裁兼代际研究负责人杰森•多尔西表示,这种现象是多种因素共同作用的结果。这些因素不仅影响了每代人可支配财富的多寡,也影响了他们在支出上的选择。

• Z世代:如果你以为Z世代只关心零工和租赁经济,那就大错特错了。多尔西说:“大衰退时,Z世代已经开始记事,而且年龄尚小,价值观很容易受到影响。他们曾经耳闻目睹父辈的挣扎以及失业的痛楚。”多尔西认为,总体而言,Z世代在财务上偏于保守,对借贷和负债态度偏怀疑,他们喜欢从事有稳定福利的工作,并且更有可能使用鼓励储蓄或能提高信用分数的应用。他说:“我们称Z世代为‘倒退的一代’,他们在很多方面真的更像‘婴儿潮’一代。” 房地美近期进行的一项调查也支持该观察。调查显示,86%的Z世代受访者表示“希望未来能拥有自己的房产”,且平均估计“能在30岁前实现,比当前的房产购置中位年龄(33岁)早三年。”通过与之前的调查进行比较,房地美发现:“与千禧一代相同年纪时相比,年龄在18至23岁的Z世代成员中,认为租房比购房更有吸引力、租房能获得归属感、租房比持有房产成本更低的比例都更低,比例分别为19%对30%、33%对39%和40%对51%。”

• 千禧一代:千禧一代并不是不想拥有自己的房子,不过赶上大衰退对经济造成严重冲击,成家立业只得推迟。许多人大学毕业后找不到理想的工作,或因为经济环境不佳而从事低薪工作,还有人连工作都找不到。再加上教育成本的大幅提升,这一代人还背着非常沉重的学生贷款债务。皮尤研究中心对人口普查数据的分析显示,“与前几代人同年龄时相比,千禧一代在三大家庭生活指标——购房成家比例、结婚率和生育率方面都偏低”。皮尤研究发现,2019年,在千禧一代中,有55%住在自有房屋里。而2003年,在X世代中,这一比例为66%;1987年时,婴儿潮一代中这一比例为69%;1968年,沉默的一代中这一比例为85%。新冠疫情爆发前,千禧一代刚刚掀起一波置业潮,但就在他们即将购买第一套住房时,就遭逢疫情打击。

• X世代:X世代对房产的态度主要取决于自己所处地区房价是否已经从大衰退中完全恢复。如果房价恢复了,那么他们往往会将购置房产当作积累财富的一种积极手段,反之则更偏向于看空房产。多尔西表示,“房产的两面——快速升值和崩盘,X世代都经历过了。”

• 婴儿潮一代:婴儿潮一代往往会毫不掩饰地将房地产视为一种投资,认为房产既能创造财富,也能保值增值。这就引出了另一个有趣的代际传承问题:千禧一代能否通过从婴儿潮一代的父母那里继承巨额财富来实现经济上的跃升?虽然很多人早已对此作出预言,但多尔西却认为这种情况未必会真的出现。他说:“婴儿潮一代都很长寿,养老会花去很多积蓄,也就无法给孩子留下太多的财产。”

• 沉默的一代:多尔西称,这代人与后几代有着截然不同的人生经历,“他们都亲历了二战后郊区快速发展的时期。作为婴儿潮一代的父母,他们见证了农村的城市化进程,也见证了城市的兴衰起伏。”他表示,这代人越来越倾向于给自己的房产做减法,减少自己的家务负担。换句话说,就是搬到空间小一点或更易维护的地方居住。在设法“保持生活品质、获取医疗服务以及与亲朋好友比邻而居”的同时,他们也在做遗产继承方面的规划。(财富中文网)

译者:Feb

There has long been a generational divide when it comes to music, fashion, and politics…but there’s also a growing generational gap when it comes to real estate.

As the charts below show, starting in the 1990s, both the amounts each generation has invested in real estate, as well as the value of those investments, have differed dramatically. And generational experts say that while some of this has to do with luck and timing—those factors have also shaped each generation’s overall feelings about owning a home.

There are a few factors at work here, says Jason Dorsey, president and lead generational researcher at the Center for Generational Kinetics, a research and strategy firm based in Austin. And they affect not just how much each generation has to spend, but what each is spending it on.

• Gen Z: If you think Gen Z is all about gig jobs and the rental economy, you couldn’t be more mistaken. Says Dorsey: “Gen Z was old enough to remember the Great Recession, but young enough to have it change their views. They saw and heard their parents struggle, lose their jobs.” Broadly speaking, Dorsey says, members of Gen Z skew conservative financially and tend to have a more skeptical attitude toward credit and debt, seek jobs with stable benefits, and are much more likely to use apps that encourage saving or improving their credit scores. “We call Gen Z a throwback generation,” Dorsey says. “In many ways they are really like baby boomers.” A recent Freddie Mac survey backs that up, finding that 86% of Gen Z respondents want to own a home someday, and estimating on average that they will “attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).” Compared with previous surveys, Freddie Mac found that “fewer 18- to 23-year-old members of Gen Z see renting as more appealing than buying a home, versus millennials at the same age (19% to 30%); fewer believe renting makes you feel like part of a community (33% to 39%); and fewer perceive that it costs less to rent a home than to own a home (40% to 51%)."

• Millennials: It’s not that millennials don’t want to own homes, but given the economic wallop of the Great Recession, their passage through adulthood has been pushed back. Many emerged from college unable to find jobs, settled for jobs that weren’t ideal, or took lower-paying jobs because of the state of the economy. Not to mention this is a generation carrying very high loads of student loan debt, given the explosion in higher ed costs. According to analysis of Census data by the Pew Research Center, “Millennials trail previous generations at the same age across three typical measures of family life: living in a family unit, marriage rates, and birth rates.” They found that in 2019, 55% of millennials lived in a family unit. This compares with 66% of Gen Xers in 2003, 69% of boomers in 1987, and 85% of members of the Silent Generation in 1968. Though millennials had just started to power a buying boom before COVID-19, they were hit with another blow just as many would have been on the verge of buying their first home.

• Gen X: Meanwhile, when it comes to Gen Xers, their experience with real estate tends to center on whether they are in an area where prices have fully recovered from the Great Recession. If they have, they generally view it as a positive way to build wealth. But if not they hold more negative views. Says Dorsey, “They’ve seen the good and bad—the rapid appreciation and the crash.”

• Boomers: If you’re a boomer, you tend to have an unabashedly positive view of real estate as an investment, thinking of it as a wealth creation vehicle as well as a nest egg. Which leads to another interesting generational twist: Will millennials be able to play financial catch-up via a huge wealth transfer from their boomer parents? Though that has long been what’s predicted, Dorsey isn’t so sure anymore. “Boomers are living so long they may end up spending what they would have given to their kids,” he says.

• The Silent Generation: They have a very different experience than later generations, says Dorsey, "because they were there during the rapid growth of the suburbs post-World War II. As the parents of boomers, they witnessed farmland become master-planned communities. They also saw the fortunes of cities rise and fall and rise again." He says that this group is increasingly trying to simplify their real estate and homeownership responsibilities—i.e. moving into a smaller place or one that is easier to maintain. They're also navigating inheritance and estate planning, while figuring out how to "maintain their quality of life, access to healthcare, and proximity to other family members and friends," says Dorsey.