活,靠道琼斯;死,也怨道琼斯。

股市及其主要的指数,与实际经济状况是不同的,但它们是指标,对那些每次查看退休金余额都冒一身冷汗的人来说,更是重要的指标。

唐纳德·特朗普经常玩这一手,市场行情好时,他就居功。从他的推特帐户可以看到一些例子:

2017年12月23日,“股市一次次地创下新纪录,就业率降到17年来最低点。特朗普政府开年就有众多成就,或许超过任何其他总统。”

2019年6月15日,“特朗普治下,经济创下纪录,还会长时间向上走…不过,如果其他人在2020年取代我(我很了解总统宝座的竞争),市场将会崩溃,以一种前所未见的方式崩溃!”

2020年1月9日,特朗普写道,“股市创历史新高!你的退休金情况如何?涨了70%、80%还是90%?只涨了50%!你做错了什么?”

不过,此一时,彼一时。

如果市场好时,有人声称是他的功劳,那么最终在市场情况不好时,他也得承担骂名。特朗普确实也挨骂了。周二强劲的上扬,也未能弥补阻止持续恐慌性的下跌,以及此前所有的回落。

最近的股市下跌,使得特朗普第一个任期内创下的收益,远低于奥巴马第一个任期内的市场收益。

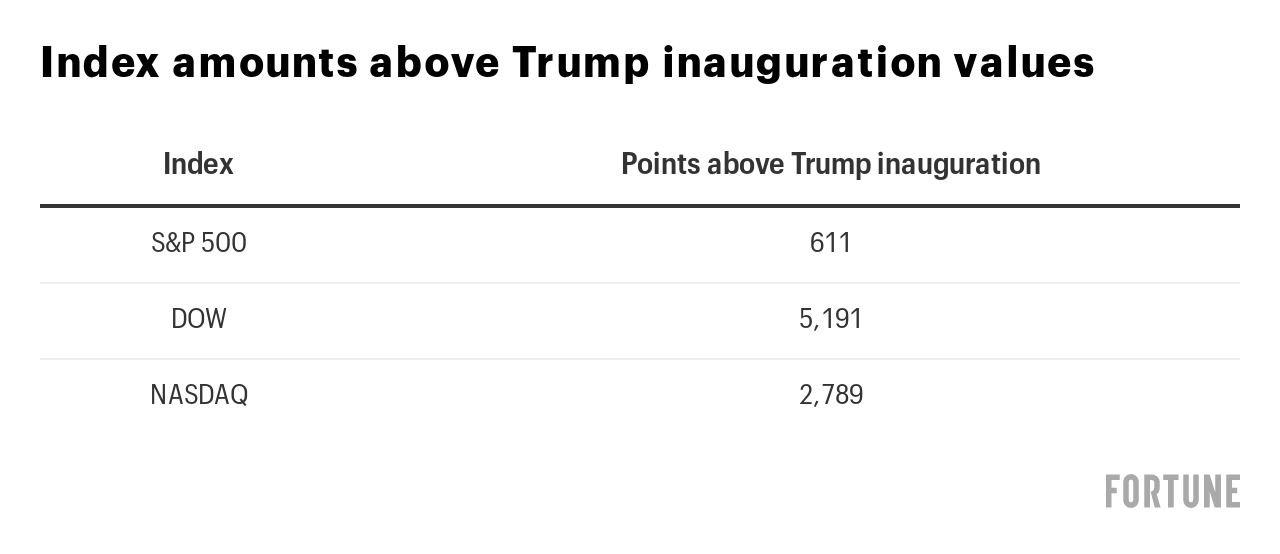

不论他的任期内市场收益高低,在总统竞选之际,特朗普任期的市场收益还能维持多久,这是一个问题。罗素2000指数——即中小资本企业的指数——已经回落到奥巴马离开白宫时的水平。下表显示其他指数尚有的收益状况。

詹姆斯·卡维尔有一句著名的选举真言:“要紧的是经济。傻瓜。”弗吉尼亚理工学院政治科学系助教尼可拉斯·歌德特也认为,总统大选“与经济深度相关。”

歌德特表示,总统大选前的9个月,尤其如此。他认为,多项研究显示,总统任期内头两年的经济状况,关系不大。第三年呢,也不紧要。罗纳德·里根曾有著名的一问,“你的日子比四年前好过了吗?”显然,人们不会记得那么久的事。他们所关心的,是总统近期为他们做了什么。

如果股市是衡量总统作为的指标,那么就如特朗普反复说的,答案或许是,“没做多少。”

但是,市场亏损的局面会持续,还是反转,从而给特朗普吹嘘的资本呢?一些金融专家认为,持续下跌不大可能。“这是一次恐慌性的抛售,”Tigress Financial Partners的研究主管兼首席投资官伊万·费恩塞斯说。“每次大抛售后,股市就会走高。一个季度内或许市场会趋于缓和。”

“到某个点,抛售也会到头,”也就是说,在激烈的恐慌性抛售后,股价最终会到达自然的价格底部,并开始回升,保德信金融集团的首席市场战略师昆西·克洛斯比持这一观点。

不过,要让股市回转向上,得花点时间。“问题在于,我们刚从历史新高上下来,而过度估值的市场对谁都不利,”乔治城大学的金融教授詹姆斯·安吉尔说。采用多种股票估值的传统手段分析,安吉尔认为,“市场对股票的定价,真的是非常乐观。”

二次资本的首席投资官南希·戴维斯认为,只要美国债券利率(收益率)维持在历史低点,股市亏损将持续。她说,尤其是10年期的债券,目前的交易价格很低,乃至意味着经济萧条的来临。“现在我们完全处在一个疯狂的境地,”戴维斯说。

为了研究在理论上指数要跌去多少才能抹去特朗普执政期间的收益,《财富》分析了标普500、道琼斯和纳斯达克,标注了它们在2020年的高点,并计算它们每个交易日的平均损失——甚至计算了过去几周起起伏伏中的周期性大涨——来算得周二收盘时的价格。

我们无法预测市场的未来。但如果过去几周的整体节奏持续,标普500将在17个交易日后回到特朗普就职时的水平,而道琼斯需要21个交易日,纳斯达克需27个交易日。

换句话说,也就在一个月内,投资者们可以像2017年那样,准备开派对了。(财富中文网)

译者:宣峰

活,靠道琼斯;死,也怨道琼斯。

股市及其主要的指数,与实际经济状况是不同的,但它们是指标,对那些每次查看退休金余额都冒一身冷汗的人来说,更是重要的指标。

唐纳德·特朗普经常玩这一手,市场行情好时,他就居功。从他的推特帐户可以看到一些例子:

2017年12月23日,“股市一次次地创下新纪录,就业率降到17年来最低点。特朗普政府开年就有众多成就,或许超过任何其他总统。”

2019年6月15日,“特朗普治下,经济创下纪录,还会长时间向上走…不过,如果其他人在2020年取代我(我很了解总统宝座的竞争),市场将会崩溃,以一种前所未见的方式崩溃!”

2020年1月9日,特朗普写道,“股市创历史新高!你的退休金情况如何?涨了70%、80%还是90%?只涨了50%!你做错了什么?”

不过,此一时,彼一时。

如果市场好时,有人声称是他的功劳,那么最终在市场情况不好时,他也得承担骂名。特朗普确实也挨骂了。周二强劲的上扬,也未能弥补阻止持续恐慌性的下跌,以及此前所有的回落。

最近的股市下跌,使得特朗普第一个任期内创下的收益,远低于奥巴马第一个任期内的市场收益。

不论他的任期内市场收益高低,在总统竞选之际,特朗普任期的市场收益还能维持多久,这是一个问题。罗素2000指数——即中小资本企业的指数——已经回落到奥巴马离开白宫时的水平。下表显示其他指数尚有的收益状况。

詹姆斯·卡维尔有一句著名的选举真言:“要紧的是经济。傻瓜。”弗吉尼亚理工学院政治科学系助教尼可拉斯·歌德特也认为,总统大选“与经济深度相关。”

歌德特表示,总统大选前的9个月,尤其如此。他认为,多项研究显示,总统任期内头两年的经济状况,关系不大。第三年呢,也不紧要。罗纳德·里根曾有著名的一问,“你的日子比四年前好过了吗?”显然,人们不会记得那么久的事。他们所关心的,是总统近期为他们做了什么。

如果股市是衡量总统作为的指标,那么就如特朗普反复说的,答案或许是,“没做多少。”

但是,市场亏损的局面会持续,还是反转,从而给特朗普吹嘘的资本呢?一些金融专家认为,持续下跌不大可能。“这是一次恐慌性的抛售,”Tigress Financial Partners的研究主管兼首席投资官伊万·费恩塞斯说。“每次大抛售后,股市就会走高。一个季度内或许市场会趋于缓和。”

“到某个点,抛售也会到头,”也就是说,在激烈的恐慌性抛售后,股价最终会到达自然的价格底部,并开始回升,保德信金融集团的首席市场战略师昆西·克洛斯比持这一观点。

不过,要让股市回转向上,得花点时间。“问题在于,我们刚从历史新高上下来,而过度估值的市场对谁都不利,”乔治城大学的金融教授詹姆斯·安吉尔说。采用多种股票估值的传统手段分析,安吉尔认为,“市场对股票的定价,真的是非常乐观。”

二次资本的首席投资官南希·戴维斯认为,只要美国债券利率(收益率)维持在历史低点,股市亏损将持续。她说,尤其是10年期的债券,目前的交易价格很低,乃至意味着经济萧条的来临。“现在我们完全处在一个疯狂的境地,”戴维斯说。

为了研究在理论上指数要跌去多少才能抹去特朗普执政期间的收益,《财富》分析了标普500、道琼斯和纳斯达克,标注了它们在2020年的高点,并计算它们每个交易日的平均损失——甚至计算了过去几周起起伏伏中的周期性大涨——来算得周二收盘时的价格。

我们无法预测市场的未来。但如果过去几周的整体节奏持续,标普500将在17个交易日后回到特朗普就职时的水平,而道琼斯需要21个交易日,纳斯达克需27个交易日。

换句话说,也就在一个月内,投资者们可以像2017年那样,准备开派对了。(财富中文网)

译者:宣峰

Live by the Dow, die by the Dow.

The stock market, and the major indexes, aren't the same as the economy. But they are indicators, especially for people who, at this point, break into a cold sweat whenever they check their 401(k) balance.

Donald Trump has frequently has played this up, claiming credit for hotly performing markets. Just a few samples from his Twitter account:

Dec. 23, 2017, "The Stock Market is setting record after record and unemployment is at a 17 year low. So many things accomplished by the Trump Administration, perhaps more than any other President in first year."

Jun. 15, 2019: "The Trump Economy is setting records, and has a long way up to go....However, if anyone but me takes over in 2020 (I know the competition very well), there will be a Market Crash the likes of which has not been seen before!"

Then, on Jan. 9, 2020, Trump wrote, "STOCK MARKET AT ALL-TIME HIGH! HOW ARE YOUR 401K’S DOING? 70%, 80%, 90% up? Only 50% up! What are you doing wrong?"

That was then.

If someone claims the credit for markets, ultimately they're saddled with the blame if things go badly. Which they have. Tuesday's strong gains still don't make up for Monday's panicked tumble or all the previous retreat.

The recent drops in fact put the gains notched under Trump's first term far below the gains in the market under Obama's first term.

The question now is how long can Trump, looking for reelection, expect the market to hold whatever gains it made during his administration. The Russell 2000—the index of small- and medium-cap companies—is already back to where it was when Obama left office. The table below shows how much of the gains the other indexes still have.

James Carville's famous three-word election mantra—it's "the economy, stupid"—is more than a campaign war story. A presidential election is "deeply connected to the economy," said Nicholas Goedert, an assistant professor of political science at Virginia Tech.

That's especially true in the last nine months before the election, according to Goedert. He said multiple studies have shown that the economy in the first two years of a president's term don't appear to matter nearly as much. The third, barely. As to Ronald Reagan's famous question, "Are you better off than four years ago?", people apparently don't remember that far back. All they want to know is what a president has done for them lately.

If stock markets are the measure, as Trump has repeatedly said, the answer might be, "Not much."

But will the losses continue or reverse and again give Trump material to tout? Some financial experts think an ongoing fall is unlikely. "This has been a panicked sell-off," said Ivan Feinseth, research director and chief investment officer at Tigress Financial Partners. "The market's gone higher from every major sell-off. It may slow things for a quarter or so, maybe."

"At some point, selling will be exhausted," meaning that after intense panic selling, eventually shares hit a natural price bottom and start to rebound, agreed Quincy Krosby, chief market strategist at Prudential Financial.

And yet, a turnaround might take longer to achieve. "The problem is we're coming off record highs and an over-valued market is nobody's friend," said James Angel, a professor of finance at Georgetown University. By a variety of traditional measures of share values, Angel says "the market is very, shall we say, optimistically priced."

Nancy Davis, chief investment officer of Quadratic Capital, thinks losses could continue so long as U.S. bond interest rates (called yield) remain at historical lows. She said that the 10-year bond in particular, is now trading low enough to suggest a coming recession. "Now we're in full-borne crazy territory," Davis said.

To understand how long in theory indexes might have to lose their Trump gains, Fortune analyzed the S&P 500, Dow, and Nasdaq, marked their 2020 highs, and calculated how much, on average, they lost per trading day—even accounting for the periodic big jumps that have been part of the roller coaster ride during the last few weeks—to reach their values on Tuesday's close.

There is no way to predict the future in markets. But if the overall pace of the last few weeks did continue, the S&P 500 would be back at Trump's inauguration in 17 trading days, the Dow Jones in 21, and Nasdaq in 27.

In other words, in just over a month, investors could be ready to party like it's 2017.