英伟达经历了相当不寻常的一周。

这家专门生产人工智能芯片的科技公司上周四一天市值增加了2770多亿美元,打破了此前由Meta保持的单日市值增长纪录。英伟达公布的最新财报超出分析师预期,上季度营收约为221亿美元。该公司目前是美国第三大最有价值的公司,仅次于苹果(Apple)和微软(Microsoft)。

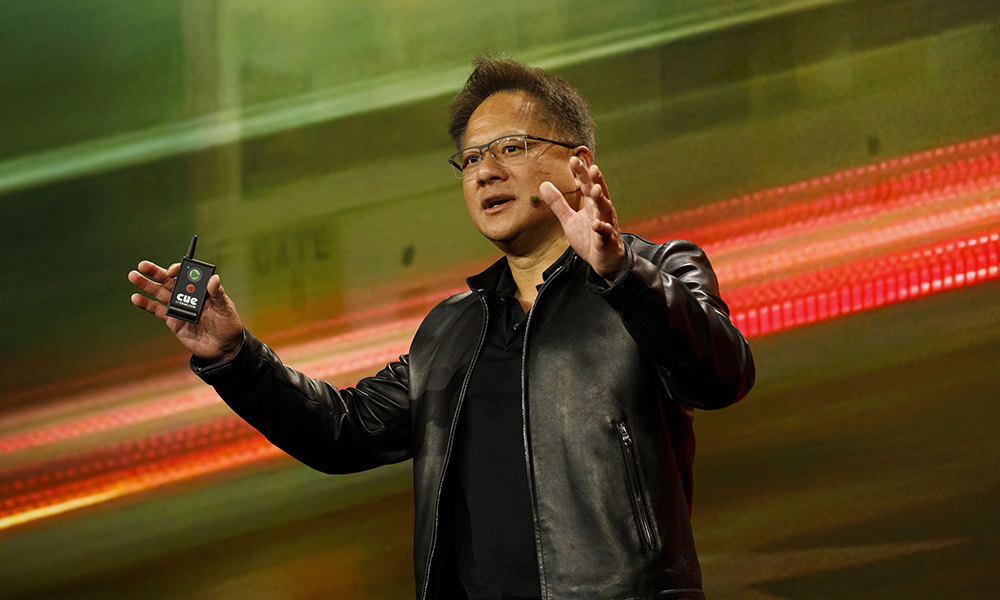

英伟达创始人兼首席执行官黄仁勋上周写道:“加速计算和生成式人工智能已达临界点。世界各地的公司、行业和国家的需求都在飙升。”

但是,这家有望成为全球最重要公司的芯片制造商在创业期微不足道,诞生于一家丹尼连锁餐厅(Denny’s),其成功之路也并非一帆风顺。以下是英伟达和黄仁勋给出的关于培养领导力的关键经验。黄仁勋将恐惧视为一种动力,与高管通力合作,并提醒员工,公司距离倒闭不超过一个月时间。

坚持己见

面对科技行业的不确定性,黄仁勋将赌注押在了一种特定的技术上,即GPU。

GPU是图形处理器(Graphics Processing Unit)的缩写,以前被认为是一种小众技术,主要供游戏玩家使用。如今,它对人工智能至关重要,一位分析师将人工智能的繁荣比作一场战争,并称英伟达是“唯一的军火商”。

但是,黄仁勋在其他人还不清楚GPU会带来回报的时候,就已经在GPU上下注了,并且无论顺境还是逆境都坚持了这一决定。Deepwater Asset Management管理合伙人吉恩·蒙斯特(Gene Munster)告诉《财富》杂志:“黄仁勋所做的就是认识到,尽管GPU市场起起伏伏,但最终只要有足够多的用例,就会实现相互抵消。”

蒙斯特补充说:“黄仁勋的与众不同之处在于,他是一位战时首席执行官。”即使在英伟达不被投资者看好、面临短期挫折的情况下,该公司仍“坚持对未来走向的看法”。

无知是福

黄仁勋曾公开表示,如果他知道创办和维护一家公司有多艰难,他可能就不会创办英伟达了。

去年,黄仁勋在Acquired播客节目中说:“创办一家公司和创办英伟达比我预想的要难一百万倍,也比我们任何人预想的要难一百万倍。”

他补充说,无知不仅对他个人很重要,对所有创始人来说都很重要。

他说:“我认为这是创业者的一种超能力。他们不知道创业有多难。他们只会问自己:'这能有多难?’直到今天,我还让自己的大脑误认为:'这能有多难?’”

恐惧是强大动力

英伟达在早期曾遭遇严重挫折。

在2002年互联网泡沫破裂和2008年金融危机期间,这家初创公司举步维艰,当时对其产品的需求急剧下降。

在诸事不顺时,公司毫不避讳地向员工表明,公司离破产有多近。事实上,英伟达早年的口头禅是:“我们公司再有30天就要倒闭了。“”

去年11月,黄仁勋在《哈佛商业评论》的“未来商业”线上会议表示:“我们的优势在于白手起家,毫不夸张地说经历了数次几近倒闭的事件。我们不必假装公司总是处于危险之中,而是真切感觉到,公司总是处于危险之中。”

黄仁勋认为,领导者必须时刻牢记自己离失败有多近。去年秋天,他在哥伦比亚商学院的“数字未来倡议”中表示:“你总是在破产的路上。如果不将这种敏锐内化于心,你就会被淘汰出局。”

合作是关键

如果不与高管合作,黄仁勋就不可能建立起自己的人工智能和芯片帝国。

在建立公司治理体系时,英伟达决定将决策权分配给黄仁勋和其他创始人克里斯·马拉乔斯基(Chris Malachowsky)和柯蒂斯·普里姆(Curtis Priem)。尽管马拉乔斯基和普里姆在黄仁勋的指导下工作,但他们在公司内部掌权,并领导自己的部门。

普里姆去年12月告诉《华尔街日报》:"我们会就彼此的决定进行讨论或争论,但会默认由在该领域拥有专业知识的人做出最终决定。这不是'求同存异'。这一决定终结了所有分歧,指出了前进方向。”

分享失败经历

黄仁勋认为"必须分享失败经历",而且他从不回避承担责任,勇于指出导致全公司出现更大问题的错误。

早在21世纪初,英伟达就曾因显卡风扇声音过大而陷入困境。黄仁勋并没有解雇产品经理,而是召开了一个会议,让相关人员回顾导致出现不良品的错误环节。

展示自己的失败经历已经成为英伟达的一种既定文化模式,但这并不适合所有人。

去年11月,英伟达软件部门主管德怀特·迪克斯(Dwight Diercks)在接受《纽约客》采访时表示:“你一眼就能看出谁能在这里坚持下去,谁不能。如果有人开始采取防御措施,我就知道他们无法坚持下来。”(财富中文网)

译者:中慧言-王芳

英伟达经历了相当不寻常的一周。

这家专门生产人工智能芯片的科技公司上周四一天市值增加了2770多亿美元,打破了此前由Meta保持的单日市值增长纪录。英伟达公布的最新财报超出分析师预期,上季度营收约为221亿美元。该公司目前是美国第三大最有价值的公司,仅次于苹果(Apple)和微软(Microsoft)。

英伟达创始人兼首席执行官黄仁勋上周写道:“加速计算和生成式人工智能已达临界点。世界各地的公司、行业和国家的需求都在飙升。”

但是,这家有望成为全球最重要公司的芯片制造商在创业期微不足道,诞生于一家丹尼连锁餐厅(Denny’s),其成功之路也并非一帆风顺。以下是英伟达和黄仁勋给出的关于培养领导力的关键经验。黄仁勋将恐惧视为一种动力,与高管通力合作,并提醒员工,公司距离倒闭不超过一个月时间。

坚持己见

面对科技行业的不确定性,黄仁勋将赌注押在了一种特定的技术上,即GPU。

GPU是图形处理器(Graphics Processing Unit)的缩写,以前被认为是一种小众技术,主要供游戏玩家使用。如今,它对人工智能至关重要,一位分析师将人工智能的繁荣比作一场战争,并称英伟达是“唯一的军火商”。

但是,黄仁勋在其他人还不清楚GPU会带来回报的时候,就已经在GPU上下注了,并且无论顺境还是逆境都坚持了这一决定。Deepwater Asset Management管理合伙人吉恩·蒙斯特(Gene Munster)告诉《财富》杂志:“黄仁勋所做的就是认识到,尽管GPU市场起起伏伏,但最终只要有足够多的用例,就会实现相互抵消。”

蒙斯特补充说:“黄仁勋的与众不同之处在于,他是一位战时首席执行官。”即使在英伟达不被投资者看好、面临短期挫折的情况下,该公司仍“坚持对未来走向的看法”。

无知是福

黄仁勋曾公开表示,如果他知道创办和维护一家公司有多艰难,他可能就不会创办英伟达了。

去年,黄仁勋在Acquired播客节目中说:“创办一家公司和创办英伟达比我预想的要难一百万倍,也比我们任何人预想的要难一百万倍。”

他补充说,无知不仅对他个人很重要,对所有创始人来说都很重要。

他说:“我认为这是创业者的一种超能力。他们不知道创业有多难。他们只会问自己:'这能有多难?’直到今天,我还让自己的大脑误认为:'这能有多难?’”

恐惧是强大动力

英伟达在早期曾遭遇严重挫折。

在2002年互联网泡沫破裂和2008年金融危机期间,这家初创公司举步维艰,当时对其产品的需求急剧下降。

在诸事不顺时,公司毫不避讳地向员工表明,公司离破产有多近。事实上,英伟达早年的口头禅是:“我们公司再有30天就要倒闭了。“”

去年11月,黄仁勋在《哈佛商业评论》的“未来商业”线上会议表示:“我们的优势在于白手起家,毫不夸张地说经历了数次几近倒闭的事件。我们不必假装公司总是处于危险之中,而是真切感觉到,公司总是处于危险之中。”

黄仁勋认为,领导者必须时刻牢记自己离失败有多近。去年秋天,他在哥伦比亚商学院的“数字未来倡议”中表示:“你总是在破产的路上。如果不将这种敏锐内化于心,你就会被淘汰出局。”

合作是关键

如果不与高管合作,黄仁勋就不可能建立起自己的人工智能和芯片帝国。

在建立公司治理体系时,英伟达决定将决策权分配给黄仁勋和其他创始人克里斯·马拉乔斯基(Chris Malachowsky)和柯蒂斯·普里姆(Curtis Priem)。尽管马拉乔斯基和普里姆在黄仁勋的指导下工作,但他们在公司内部掌权,并领导自己的部门。

普里姆去年12月告诉《华尔街日报》:"我们会就彼此的决定进行讨论或争论,但会默认由在该领域拥有专业知识的人做出最终决定。这不是'求同存异'。这一决定终结了所有分歧,指出了前进方向。”

分享失败经历

黄仁勋认为"必须分享失败经历",而且他从不回避承担责任,勇于指出导致全公司出现更大问题的错误。

早在21世纪初,英伟达就曾因显卡风扇声音过大而陷入困境。黄仁勋并没有解雇产品经理,而是召开了一个会议,让相关人员回顾导致出现不良品的错误环节。

展示自己的失败经历已经成为英伟达的一种既定文化模式,但这并不适合所有人。

去年11月,英伟达软件部门主管德怀特·迪克斯(Dwight Diercks)在接受《纽约客》采访时表示:“你一眼就能看出谁能在这里坚持下去,谁不能。如果有人开始采取防御措施,我就知道他们无法坚持下来。”(财富中文网)

译者:中慧言-王芳

Nvidia is having quite a week.

The tech company, which specializes in making chips used for AI, added more than $277 billion in market value on Thursday, beating the record for single-day market gains previously held by Meta. The surge followed company earnings on Wednesday, in which Nvidia beat analyst expectations and reported revenues of around $22.1 billion last quarter. It is now the third most valuable company in the U.S., behind Apple and Microsoft.

“Accelerated computing and generative AI have hit the tipping point,” Nvidia founder and CEO Jensen Huang wrote this week. “Demand is surging worldwide across companies, industries, and nations.”

But the chipmaker poised to become the most important company in the world has humble beginnings—it was born in a Denny’s restaurant—and its path to success has not been linear. Here are some key leadership lessons from Nvidia and Huang, who embraces fear as a motivator, collaborates with his top managers, and reminds his workers that the company is never more than a month away from shutting down.

Stick to your guns

In navigating the uncertainty of the tech industry, Huang bet on a specific kind of technology—GPUs.

That stands for graphics processing unit, which was previously considered a niche technology and mostly used by gamers. Now, it’s critical to AI, with one analyst likening the AI boom to a war, and calling Nvidia the “only arms dealer out there.”

But Huang bet on GPUs years before it was clear to everyone else that it would pay off, and stuck to that decision through bad times and good. “What he did was recognize that even though there was boom and bust around the GPU, that eventually if there were enough use cases of it, they would offset each other,” Gene Munster, managing partner at Deepwater Asset Management, told Fortune.

“What sets Jensen apart is he’s a wartime CEO,” Munster added. Even when Nvidia is out of favor with investor consensus, and facing near-term setbacks, the company stays “true to [its] view of the future.”

Ignorance is bliss

Huang has openly said that if he knew how hard it would be to create and maintain his company, he probably wouldn’t do it again.

“Building a company and building Nvidia turned out to have been a million times harder than I expected it to be, than any of us expected it to be,” Huang said last year on the Acquired podcast.

He added that ignorance wasn’t just important for him personally—it’s an important quality for all founders.

“I think that’s kind of the superpower of an entrepreneur. They don’t know how hard it is. And they only ask themselves: ‘How hard can it be?’ To this day, I trick my brain into thinking: ‘How hard can it be?’” he said.

Fear is a powerful motivator

Nvidia had some serious setbacks in its early days.

The startup struggled during the dotcom crash in 2002 and the financial crisis in 2008, when demand for its products plummeted.

When everything was going wrong, the company wasn’t shy about making clear to employees how close they were to the brink. In fact, a mantra for Nvidia in its early years was: “Our company is 30 days from going out of business.”

“We have the benefit of building the company from the ground up and having not exaggerated circumstances of nearly going out of business a handful of times,” Huang said last November at Harvard Business Review’s virtual Future of Business conference. “We don’t have to pretend the company is always in peril. The company is always in peril, and we feel it.”

Huang believes it’s critical for leaders to always remember how close they are to failure. “You’re always on the way to going out of business,” he said at Columbia Business School’s Digital Future Initiative last fall. “If you don’t internalize that sensibility, you will go out of business.”

Collaboration is key

Huang couldn’t have amassed his AI and chip empire without collaborating with his top lieutenants.

In forming a system of governance, Nvidia decided to split decision-making among Huang and his fellow founders, Chris Malachowsky and Curtis Priem. Even though Malachowksy and Priem worked under Huang’s command, they each had authority and led their own divisions within the company.

“We would talk or argue over each other’s decisions, but we would default to the final decision of the person who had the expertise in that area,” Priem told the Wall Street Journal in December last year. “It wasn’t ‘agree to disagree.’ The decision terminated any disagreements and became the direction we were going.”

Share your failures

Huang believes that “failure must be shared,” and doesn’t shy away from taking ownership and pointing out errors that led to larger companywide problems.

Back in the early 2000s, Nvidia ran into some trouble with a faulty graphic card that had a loud fan. Instead of firing the product managers, Huang held a meeting where the people involved walked through the mistakes that led to creating a bad product.

Exhibiting one’s failures has become a cultural fixture at Nvidia, but it’s not for everyone.

“You can kind of see right away who is going to last here and who is not,” Dwight Diercks, head of software for Nvidia, told The New Yorker last November. “If someone starts getting defensive, I know they’re not going to make it.”