奢侈品巨头LVMH集团的创始人兼首席执行官伯纳德·阿诺特再次失去全球首富桂冠,不过这位亿万富翁可不需要同情。

5月31日, LVMH股价下跌了2.6%,阿诺特的首富之位被科技大亨埃隆·马斯克夺走。

与此同时,由于5月特斯拉股价上涨了约24%,今年执掌特斯拉和推特的马斯克掌握财富增长了40.3%。

根据彭博亿万富翁榜统计,目前马斯克净资产约为1920亿美元,阿诺特约为1870亿美元。

两人争夺世界首富头衔的拔河游戏已持续一年多,马斯克在这个位置上坐得也不太安稳。毕竟2022年12月特斯拉股价下跌期间,马斯克曾经在非常相似的情况下失去首富的位置。

今年4月初,阿诺特的财富首次超过2000亿美元,之后一个月由于股价暴跌,他的财富曾在一天之内缩水超过110亿美元。

但对于普通人来说,阿诺特财富小幅缩水的规模已经超过他们一辈子能赚到的钱。

那么阿诺特第一桶金究竟来自何处?

创业初尝试

1971年,阿诺特的职业生涯始于父亲的房地产公司,期间他充分证明了自己年轻时就具备企业家的头脑。25岁的阿诺特说服父亲卖掉建筑业务,将重点转向房地产。

随后他前往美国,希望继续扩大父亲的帝国,但却受到一名出租车司机启发——司机不知道法国总统是谁,却知道法国时装。所以他回到家乡,决心在奢侈品行业打拼出一片天地。

这也是阿诺特职业生涯中的大突破最成迷的地方。

一些报道称,1984年35岁的阿诺特用家族企业的1500万美元收购了濒临倒闭的奢侈品公司Boussac Saint-Frères,该公司旗下有时尚品牌克里斯汀·迪奥(Christian Dior)。

奇怪的是,其他报道称他仅用象征性的1法郎收购了濒临破产的奢侈品公司。

不管阿诺特实际出了多少钱,最终是控制了Boussac及其所有资产——包括克里斯汀·迪奥、乐蓬马歇百货公司(Le Bon Marché)、零售商店Conforama和尿布制造商Peaudouce。

《财富》杂志联系了LVMH,希望澄清围绕迪奥收购的神秘说法,后者现在掌握着LVMH 41.4%的股份。

“终结者”阿诺特

阿诺特收购Boussac后解雇了9000名员工,出售集团的大部分资产(除了迪奥品牌),也因此获得“终结者”的外号。

但他的强硬手腕很是奏效,1987年该公司开始盈利,报道称19亿美元的收入流水产生了1.12亿美元利润。

随后,他将目光投向了迪奥的香水业务,此前该业务已被出售给LVMH。

就在那时,这家奢侈品巨头开始了一系列敌意收购和大胆举措,也见证了阿诺特的崛起。

但首先让我们回顾一下LVMH的诞生:1987年,路易威登(Louis Vuitton)总裁亨利·拉卡米耶和酩悦轩尼诗(Moët Hennessy)首席执行官阿兰·谢瓦利埃联手成立了奢侈品集团酩悦·轩尼诗-路易·威登。

合并后几个月内,拉卡米耶和谢瓦利埃闹翻了,所以1989年夏天,拉卡米耶邀请阿诺特投资LVMH,并帮着赶走酩悦主管。

然而完成第一步投资后,阿诺特将拉卡米耶从他自己的家族企业中赶下了台。为了成为公司最大股东,他斥资26亿美元买入股票,1989年成为公司董事长兼首席执行官。

接下来几年里他继续收购品牌,甚至通过子公司和股权交换秘密收购了爱马仕(Hermès)20%的股份。

LVMH的成功

如今,LVMH旗下拥有约75个奢侈品牌。在阿诺特领导下,该集团已发展成为欧洲市值最大的公司。

就在上个月,总部位于巴黎的LVMH还成为欧洲第一家市值超过5000亿美元的公司。

公司的成功直接影响到阿诺特的钱包。因为阿诺特的财富很大程度上与LVMH股价挂钩,包括迪奥97.5%的股份。

这位74岁的商界巨头并没有急流勇退的意思。

他有五个掌握巨额财富的孩子竞相等着有朝一日接管公司,目前每人都在LVMH品牌担任高级职务,然而最近LVMH将首席执行官的年龄限制从75岁提高到80岁。

真的,他“才刚刚开始。”有报道称,阿诺特告诉英国《金融时报》,“我们的业务仍然很小…没错我们是第一,但还能走得更远。”(财富中文网)

译者:梁宇

审校:夏林

奢侈品巨头LVMH集团的创始人兼首席执行官伯纳德·阿诺特再次失去全球首富桂冠,不过这位亿万富翁可不需要同情。

5月31日, LVMH股价下跌了2.6%,阿诺特的首富之位被科技大亨埃隆·马斯克夺走。

与此同时,由于5月特斯拉股价上涨了约24%,今年执掌特斯拉和推特的马斯克掌握财富增长了40.3%。

根据彭博亿万富翁榜统计,目前马斯克净资产约为1920亿美元,阿诺特约为1870亿美元。

两人争夺世界首富头衔的拔河游戏已持续一年多,马斯克在这个位置上坐得也不太安稳。毕竟2022年12月特斯拉股价下跌期间,马斯克曾经在非常相似的情况下失去首富的位置。

今年4月初,阿诺特的财富首次超过2000亿美元,之后一个月由于股价暴跌,他的财富曾在一天之内缩水超过110亿美元。

但对于普通人来说,阿诺特财富小幅缩水的规模已经超过他们一辈子能赚到的钱。

那么阿诺特第一桶金究竟来自何处?

创业初尝试

1971年,阿诺特的职业生涯始于父亲的房地产公司,期间他充分证明了自己年轻时就具备企业家的头脑。25岁的阿诺特说服父亲卖掉建筑业务,将重点转向房地产。

随后他前往美国,希望继续扩大父亲的帝国,但却受到一名出租车司机启发——司机不知道法国总统是谁,却知道法国时装。所以他回到家乡,决心在奢侈品行业打拼出一片天地。

这也是阿诺特职业生涯中的大突破最成迷的地方。

一些报道称,1984年35岁的阿诺特用家族企业的1500万美元收购了濒临倒闭的奢侈品公司Boussac Saint-Frères,该公司旗下有时尚品牌克里斯汀·迪奥(Christian Dior)。

奇怪的是,其他报道称他仅用象征性的1法郎收购了濒临破产的奢侈品公司。

不管阿诺特实际出了多少钱,最终是控制了Boussac及其所有资产——包括克里斯汀·迪奥、乐蓬马歇百货公司(Le Bon Marché)、零售商店Conforama和尿布制造商Peaudouce。

《财富》杂志联系了LVMH,希望澄清围绕迪奥收购的神秘说法,后者现在掌握着LVMH 41.4%的股份。

“终结者”阿诺特

阿诺特收购Boussac后解雇了9000名员工,出售集团的大部分资产(除了迪奥品牌),也因此获得“终结者”的外号。

但他的强硬手腕很是奏效,1987年该公司开始盈利,报道称19亿美元的收入流水产生了1.12亿美元利润。

随后,他将目光投向了迪奥的香水业务,此前该业务已被出售给LVMH。

就在那时,这家奢侈品巨头开始了一系列敌意收购和大胆举措,也见证了阿诺特的崛起。

但首先让我们回顾一下LVMH的诞生:1987年,路易威登(Louis Vuitton)总裁亨利·拉卡米耶和酩悦轩尼诗(Moët Hennessy)首席执行官阿兰·谢瓦利埃联手成立了奢侈品集团酩悦·轩尼诗-路易·威登。

合并后几个月内,拉卡米耶和谢瓦利埃闹翻了,所以1989年夏天,拉卡米耶邀请阿诺特投资LVMH,并帮着赶走酩悦主管。

然而完成第一步投资后,阿诺特将拉卡米耶从他自己的家族企业中赶下了台。为了成为公司最大股东,他斥资26亿美元买入股票,1989年成为公司董事长兼首席执行官。

接下来几年里他继续收购品牌,甚至通过子公司和股权交换秘密收购了爱马仕(Hermès)20%的股份。

LVMH的成功

如今,LVMH旗下拥有约75个奢侈品牌。在阿诺特领导下,该集团已发展成为欧洲市值最大的公司。

就在上个月,总部位于巴黎的LVMH还成为欧洲第一家市值超过5000亿美元的公司。

公司的成功直接影响到阿诺特的钱包。因为阿诺特的财富很大程度上与LVMH股价挂钩,包括迪奥97.5%的股份。

这位74岁的商界巨头并没有急流勇退的意思。

他有五个掌握巨额财富的孩子竞相等着有朝一日接管公司,目前每人都在LVMH品牌担任高级职务,然而最近LVMH将首席执行官的年龄限制从75岁提高到80岁。

真的,他“才刚刚开始。”有报道称,阿诺特告诉英国《金融时报》,“我们的业务仍然很小…没错我们是第一,但还能走得更远。”(财富中文网)

译者:梁宇

审校:夏林

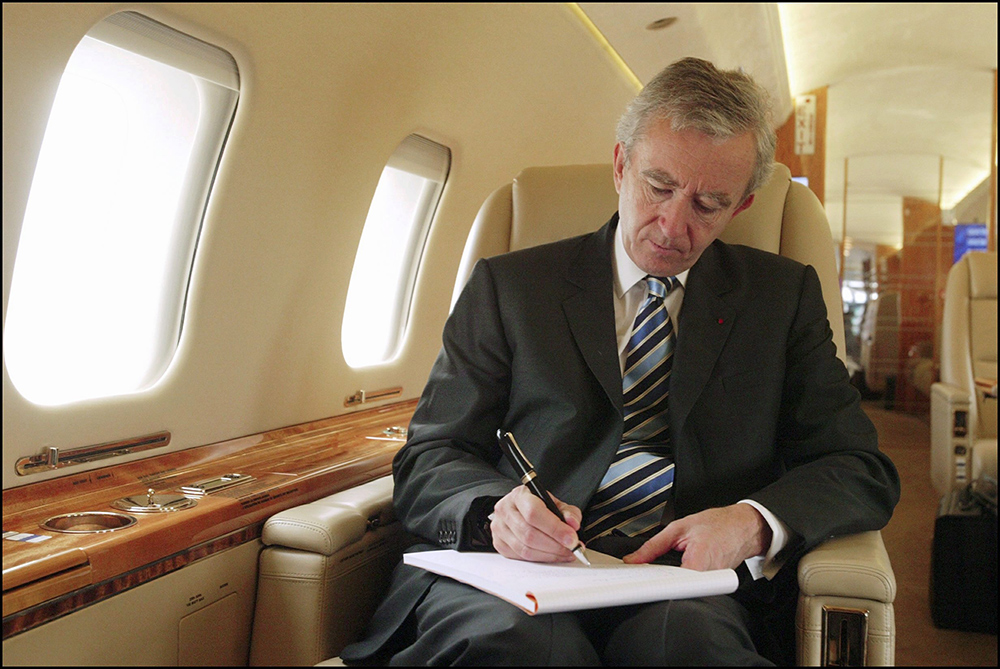

The founder and CEO of the luxury powerhouse LVMH, Bernard Arnault, has once again lost his crown as the richest person on the planet—but the billionaire is in no need of sympathy.

Tech tycoon Elon Musk dethroned the French businessman from the top spot after shares of the latter’s LVMH tumbled by 2.6% on Wednesday.

Meanwhile Musk, the owner of Tesla and Twitter, saw his wealth jump 40.3% this year after shares of the electric car maker rose by about 24% in May.

According to a Bloomberg Billionaires tally, Musk’s net worth is now about $192 billion, compared to Arnault’s $187 billion.

The two have been playing a game of tug-of-war for the title of world’s richest person for over a year now, so Musk—who lost the prime position in very similar circumstances back in December 2022 when Tesla’s share price dropped—shouldn’t sit too comfortably.

Earlier this year in April, Arnault saw his fortune surpass $200 billion for the first time before losing more than $11 billion in a single day the following month due to a share price bloodbath.

But for the average person—who earns less than £40,000 in the U.K., or around $60,000 in the U.S—the current small dip in Arnault’s fortune is more money than they’ll see in a lifetime.

So how exactly did he become so rich in the first place?

An early taste for entrepreneurialism

In 1971, Arnault kick-started his career by working at his father’s real estate company, where he proved he had an entrepreneurial mind from a young age: A 25-year-old Arnault convinced his father to sell the construction side of the business and shift its focus to property.

He then traveled to the States in the hopes of growing his father’s empire there, but instead was inspired by a taxi driver (who knew French couture, but not the French president) to go back home and forge a name for himself in the luxury sector.

This is where Arnault’s big break becomes a big mystery.

Some reports claim that the then-35-year-old businessman used $15 million from the family business to buy the failing luxury goods company that owned the fashion brand Christian Dior, Boussac Saint-Frères, in 1984.

Strangely, other reports claim that he acquired the near-bankrupt textile company for a ceremonious 1 franc.

However much he paid, Arnault took control of Boussac along with all of its assets—including Christian Dior, the department store Le Bon Marché, the retail shop Conforama, and the nappy manufacturer Peaudouce.

Fortune has reached out to LVMH to clarify the mysterious circumstances surrounding Dior’s acquisition —which now controls 41.4% of LVMH.

Arnault, “the Terminator”

Following Arnault’s buyout of Boussac, the billionaire fired 9,000 people working for the company, sold off most of the group’s assets (except the Dior brand), and earned the nickname “the Terminator.”

But his tough approach worked: By 1987, the company started making profits, reportedly generating $112 million in earnings from a revenue stream of $1.9 billion.

He then set his eyes on Dior’s perfume division, which had been sold to Louis Vuitton Moët Hennessy.

It was then that a series of hostile takeovers and bold moves at the luxury powerhouse began—and saw Arnault come up on top.

But first, let’s rewind to the birth of LVMH: In 1987 Henry Racamier, president of Louis Vuitton, and Alain Chevalier, CEO of Moët Hennessy, teamed up to form the luxury group Louis Vuitton Moët Hennessy.

Within months of the merger Racamier and Chevalier fell out, so by the summer of ’89, Racamier had invited Arnault to invest in LVMH and help oust Moët’s chief.

But after tackling the first order of business, Arnault ousted Racamier too (from his own family business, no less). He spent $2.6 billion buying up shares in order to become the company’s largest shareholder, and by 1989 became its chairman and CEO.

In the years that followed, he continued to buy brands to bring them into the fold, and even secretly acquired a 20% stake in Hermès through its subsidiaries and via equity swaps.

LVMH’s success

Today, LVMH has some 75 luxury brands in its portfolio and, under Arnault’s leadership, has grown to become the largest company by market capitalization in Europe.

Just last month, the Paris-headquartered conglomerate became the first European company ever to cross $500 billion in market valuation.

Its success directly impacts the wallet of Arnault, whose wealth is largely tied to LVMH’s shares, including a 97.5% stake in Dior.

And the 74-year-old businessman shows no signs of reining it in.

Although his five ultrawealthy children—all of whom hold senior roles at LVMH brands—are vying to one day take over, LVMH recently hiked its age limit for chief executives from 75 to 80.

Really, he’s “just getting started.” Reportedly, Arnault told the FT, without a shred of irony, “We’re still small… We are number one, but we can go further.”