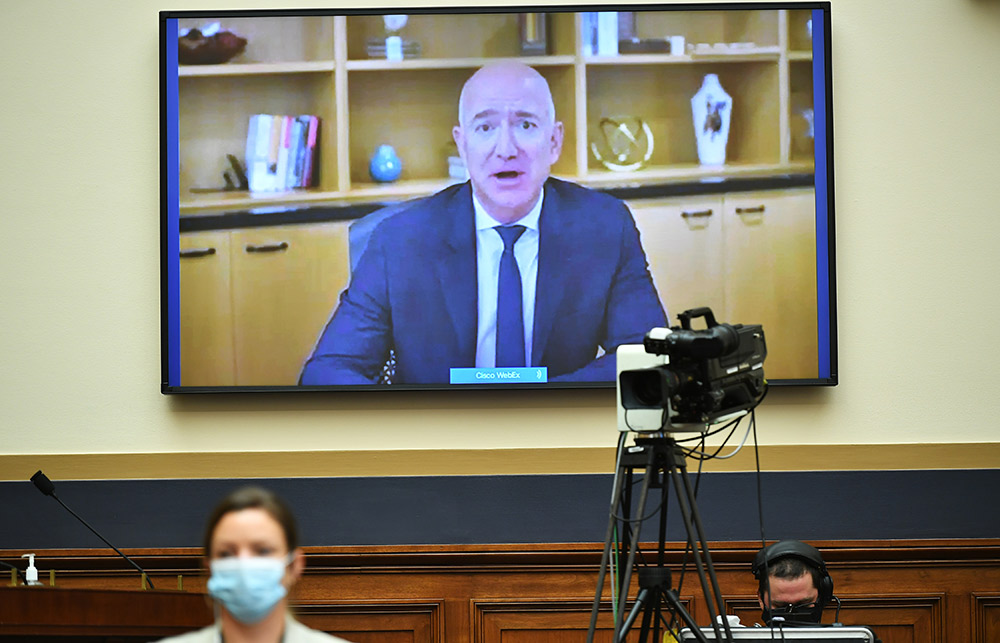

周二,亚马逊CEO杰夫•贝佐斯宣布,他将于今年晚些时候辞职。但这并不意味着他的竞争对手们就可以弹冠相庆了。

27年前,贝佐斯在他家的车库里缔造了亚马逊。根据eMarketer的数据,经过27年的发展,亚马逊已经从一家网上书店,转型成独占美国电商市场40%份额的零售巨头。虽然沃尔玛、塔吉特百货、Tractor Supply和诺德斯特龙等零售企业也都成为了电商市场上的有力竞争者,但亚马逊的份额依然在逐年缓慢上升。

此外,这些公司也一直活在亚马逊Prime的威胁之下。亚马逊的用户可以按月订购Prime服务,从而享受无限量的快递服务。这一招本来是为了提高用户忠诚度的,但现在,它在美国已经拥有将近1.26亿用户,成了娱乐产品销售的一个主渠道。

亚马逊的影响力有多大,从一个例子便可见一斑。去年,亚马逊将Prime会员日挪到了10月份,所有主要零售商也纷纷跟随亚马逊调整了假日季的促销活动时间。因为除了紧跟亚马逊,他们几乎没有其他选择。

即便贝佐斯即将于今年辞职,但也很少会有人认为,亚马逊将偏离贝佐斯制定的成功战略,而实际上,贝佐斯退休后,将继续担任亚马逊的常务董事长,也就是说,就算他不参与公司的日常运营了,他依然还在亚马逊拥有重要的话语权。

另外,在贝佐斯辞职后,接下来将领导公司的这些高管们仍然是贝佐斯路线的坚定支持者。贝佐斯的继任者安迪•雅西原本是亚马逊云计算部门的负责人,他已经与贝佐斯共事了20年。另外,亚马逊零售业务的新任负责人戴夫•克拉克,也是贝佐斯在5个月前“钦点”的。

况且,贝佐斯依然是亚马逊的最大股东,持有公司10.6%的股份。所以他也拥有强大的投票权。

有一点毋庸置疑,贝佐斯和他的高管团队最重视的就是电商业务,只有不断在电商上投资,亚马逊才能持续保持对线下实体零售业的巨大领先优势。

福雷斯特公司分析师苏查里塔•科达利对《财富》表示:“他们有Prime,还有亚马逊‘飞轮’和庞大的基础设施,使他们能获得越来越多的市场份额。可以说,就算他们再怎么不关注电商,它也依然会继续增长。”

不过,安迪•雅西的上台也释放了一个信号,那就是亚马逊希望加大云计算在整体业务中的比重。亚马逊的云服务只为公司创造了12%的收益,却贡献了高达60%的营业利润。相比之下,亚马逊的零售业务长期以来一直难以盈利,因为它还得建设配送中心等基础设施,同时还要确保高效的配送服务和具有竞争力的价格,这些都需要持续付出大量成本。

彭博咨讯在一份关于贝佐斯离职的研究报告中写道:“亚马逊的云业务很可能会获得更多关注。”同时,彭博资讯和穆迪的分析师也表示,他们认为亚马逊的零售业务并不会有太大变化。

不管怎样,现在美国已经没有任何一个零售市场可以不受亚马逊的“荼毒”。很多年前亚马逊还在做线上书店的时候,它就把巴诺书店(Barnes & Noble)打得残血,把Borders书店挤得破了产。现在它又大举进军到时尚和线上生鲜市场。

不过虽然亚马逊已经收购了全食超市(Whole Foods),在线下实体店上也迈出了一步,但生鲜仍然是亚马逊的一个“痛点”。在这方面,沃尔玛是它的一个强大的对手,数千家沃尔玛门店都实现了线上下单、到店提货功能。(贝佐斯的老对手、前沃尔玛美国电商业务CEO马克•洛尔也刚刚于上周日离职。)

在亚马逊的威压下,其他零售企业只得纷纷出招相抗。有的搞了“无现金门店”,还有的积极布建配送网络,推出了更快捷可靠、退款更方便的配送服务,搞得UPS和联邦快递等专业物流公司的高管人人自危。最近几年,塔吉特特百货、诺德斯特龙、梅西百货和Petco等也成了美国电商市场的头部企业。要不是亚马逊将刀架在了他们的脖子上,他们可能也不会有今天的成就。

GlobalData公司的常务董事尼尔•桑德斯表示:“亚马逊对顾客的持续关注,和对寻找更好的经营方式的不懈追求,使它不仅成为互联网时代的‘幸存者’,更成为一名领军者。”(财富中文网)

译者:朴成奎

周二,亚马逊CEO杰夫•贝佐斯宣布,他将于今年晚些时候辞职。但这并不意味着他的竞争对手们就可以弹冠相庆了。

27年前,贝佐斯在他家的车库里缔造了亚马逊。根据eMarketer的数据,经过27年的发展,亚马逊已经从一家网上书店,转型成独占美国电商市场40%份额的零售巨头。虽然沃尔玛、塔吉特百货、Tractor Supply和诺德斯特龙等零售企业也都成为了电商市场上的有力竞争者,但亚马逊的份额依然在逐年缓慢上升。

此外,这些公司也一直活在亚马逊Prime的威胁之下。亚马逊的用户可以按月订购Prime服务,从而享受无限量的快递服务。这一招本来是为了提高用户忠诚度的,但现在,它在美国已经拥有将近1.26亿用户,成了娱乐产品销售的一个主渠道。

亚马逊的影响力有多大,从一个例子便可见一斑。去年,亚马逊将Prime会员日挪到了10月份,所有主要零售商也纷纷跟随亚马逊调整了假日季的促销活动时间。因为除了紧跟亚马逊,他们几乎没有其他选择。

即便贝佐斯即将于今年辞职,但也很少会有人认为,亚马逊将偏离贝佐斯制定的成功战略,而实际上,贝佐斯退休后,将继续担任亚马逊的常务董事长,也就是说,就算他不参与公司的日常运营了,他依然还在亚马逊拥有重要的话语权。

另外,在贝佐斯辞职后,接下来将领导公司的这些高管们仍然是贝佐斯路线的坚定支持者。贝佐斯的继任者安迪•雅西原本是亚马逊云计算部门的负责人,他已经与贝佐斯共事了20年。另外,亚马逊零售业务的新任负责人戴夫•克拉克,也是贝佐斯在5个月前“钦点”的。

况且,贝佐斯依然是亚马逊的最大股东,持有公司10.6%的股份。所以他也拥有强大的投票权。

有一点毋庸置疑,贝佐斯和他的高管团队最重视的就是电商业务,只有不断在电商上投资,亚马逊才能持续保持对线下实体零售业的巨大领先优势。

福雷斯特公司分析师苏查里塔•科达利对《财富》表示:“他们有Prime,还有亚马逊‘飞轮’和庞大的基础设施,使他们能获得越来越多的市场份额。可以说,就算他们再怎么不关注电商,它也依然会继续增长。”

不过,安迪•雅西的上台也释放了一个信号,那就是亚马逊希望加大云计算在整体业务中的比重。亚马逊的云服务只为公司创造了12%的收益,却贡献了高达60%的营业利润。相比之下,亚马逊的零售业务长期以来一直难以盈利,因为它还得建设配送中心等基础设施,同时还要确保高效的配送服务和具有竞争力的价格,这些都需要持续付出大量成本。

彭博咨讯在一份关于贝佐斯离职的研究报告中写道:“亚马逊的云业务很可能会获得更多关注。”同时,彭博资讯和穆迪的分析师也表示,他们认为亚马逊的零售业务并不会有太大变化。

不管怎样,现在美国已经没有任何一个零售市场可以不受亚马逊的“荼毒”。很多年前亚马逊还在做线上书店的时候,它就把巴诺书店(Barnes & Noble)打得残血,把Borders书店挤得破了产。现在它又大举进军到时尚和线上生鲜市场。

不过虽然亚马逊已经收购了全食超市(Whole Foods),在线下实体店上也迈出了一步,但生鲜仍然是亚马逊的一个“痛点”。在这方面,沃尔玛是它的一个强大的对手,数千家沃尔玛门店都实现了线上下单、到店提货功能。(贝佐斯的老对手、前沃尔玛美国电商业务CEO马克•洛尔也刚刚于上周日离职。)

在亚马逊的威压下,其他零售企业只得纷纷出招相抗。有的搞了“无现金门店”,还有的积极布建配送网络,推出了更快捷可靠、退款更方便的配送服务,搞得UPS和联邦快递等专业物流公司的高管人人自危。最近几年,塔吉特特百货、诺德斯特龙、梅西百货和Petco等也成了美国电商市场的头部企业。要不是亚马逊将刀架在了他们的脖子上,他们可能也不会有今天的成就。

GlobalData公司的常务董事尼尔•桑德斯表示:“亚马逊对顾客的持续关注,和对寻找更好的经营方式的不懈追求,使它不仅成为互联网时代的‘幸存者’,更成为一名领军者。”(财富中文网)

译者:朴成奎

Retail executives shouldn’t rest easy after Tuesday’s announcement that Amazon CEO Jeff Bezos would step down later this year.

The company, founded in Bezos’s garage 27 years ago, has transformed from an online bookseller with a basic e-commerce site into a retail titan commanding 40% of all U.S. e-commerce, according to eMarketer. It’s a market share that has grown slowly over time, even as rivals from Walmart and Target to Tractor Supply and Nordstrom have themselves emerged as serious e-commerce players.

Moreover, those competitors live under the constant threat of Amazon Prime, created to increase shoppers’ loyalty by offering them unlimited shipping for a monthly subscription. The service, which now has nearly 126 million U.S. members, has since become a conduit for selling entertainment.

And such is Amazon’s clout that when it moved its Prime Day sales event to October last year, all major retailers shifted their holiday season promotions to the same period. They had little choice.

After Bezos steps down later this year, few people expect Amazon to deviate much from his hugely successful strategy. In fact, Bezos, in his retirement, will serve as Amazon’s executive chairman, which means he’ll still have a major say at the company without having to manage day-to-day operations.

Moreover, many executives who will lead Amazon in the post-Bezos era had a big hand in Bezos’s strategy. His successor, Andy Jassy, head of Amazon’s cloud computing division, has worked with Bezos for 20 years. Meanwhile, the new head of Amazon retail, Dave Clark, was appointed to the job by Bezos just five months ago.

In any case, Bezos remains Amazon’s biggest shareholder, with 10.6% of the company’s shares. He therefore has huge voting power.

And there is no doubt, that Bezos’s focus and that of his management team has been on investing in e-commerce to perpetuate Amazon’s enormous lead over flat-footed brick-and-mortar chains.

“They have Prime, the Amazon flywheel, and an enormous infrastructure that is built to gain more and more market share,” Sucharita Kodali, a Forrester analyst, tells Fortune. “There’s a case to be made that even with minimal focus, it will continue to grow.”

Still, Jassy’s appointment suggests Amazon wants its cloud unit to become a bigger part of the overall business. It generates 12% of the company’s revenue but 60% of operating profit. In contrast, Amazon’s retail operations have long struggled to make a profit given the enormous, unrelenting cost of building infrastructure like distribution centers, and of ensuring fast delivery and competitive prices.

“It’s possible the company’s cloud business could get additional attention,” Bloomberg Intelligence wrote in a research note about Bezos stepping down. But Bloomberg Intelligence and Moody’s analysts were among those saying they don’t expect Amazon’s retail business to change much.

Whatever the case, no retail sector has been left untouched by Amazon, from its bookselling business that severely damaged Barnes & Noble and bankrupted Borders years ago, to its big push into fashion and online grocery.

Yet one area that has bedeviled Amazon, despite its purchase of Whole Foods for a physical footprint, has been grocery. Here, Walmart has proved to be a formidable rival, with its order-pickup capability enabled by thousands of stores. (Bezos’s longtime rival, Marc Lore, the former CEO of Walmart U.S. e-commerce, left that role on Sunday.)

Still, Amazon’s tech push into retail has forced other companies’ hands—whether it’s the cashier-less stores or the delivery network that makes executives at UPS and FedEx nervous with its faster, more reliable service and easier returns. The upshot over the years has been that chains like Target, Nordstrom, Macy’s, Petco, and many others have become the e-commerce leaders they perhaps wouldn’t have without a knife to their throat.

Says Neil Saunders, a managing director at GlobalData: “Its relentless focus on the customer and its constant pursuit of finding better ways of doing business made it not only a survivor but a leader of the Internet age.”