投资银行业巨

头高盛(Goldman Sachs)一直在大力发展消费者银行业务,这并不是什么秘密。高盛通过其快速增长的Marcus平台,涉足储蓄账户和个人贷款等领域,并且很快将支持支票账户。但Marcus正在考虑进军竞争异常激烈的自动化投资管理领域,或者更为人所知的机器人顾问领域。金融科技初创公司和老牌券商都向零售客户成功推出了基于算法的自动化投资产品,向大众推广服务费和最低账户金额要求较低的财富管理服务。

高盛也跟随这种趋势,在去年宣布了自动化投资服务Marcus Invest。高盛CEO苏德巍在上个月的一份内部备忘录中表示,Marcus将在其Beta测试项目中向员工提供服务,并计划在2021年第一季度向公众正式发布Marcus Invest。

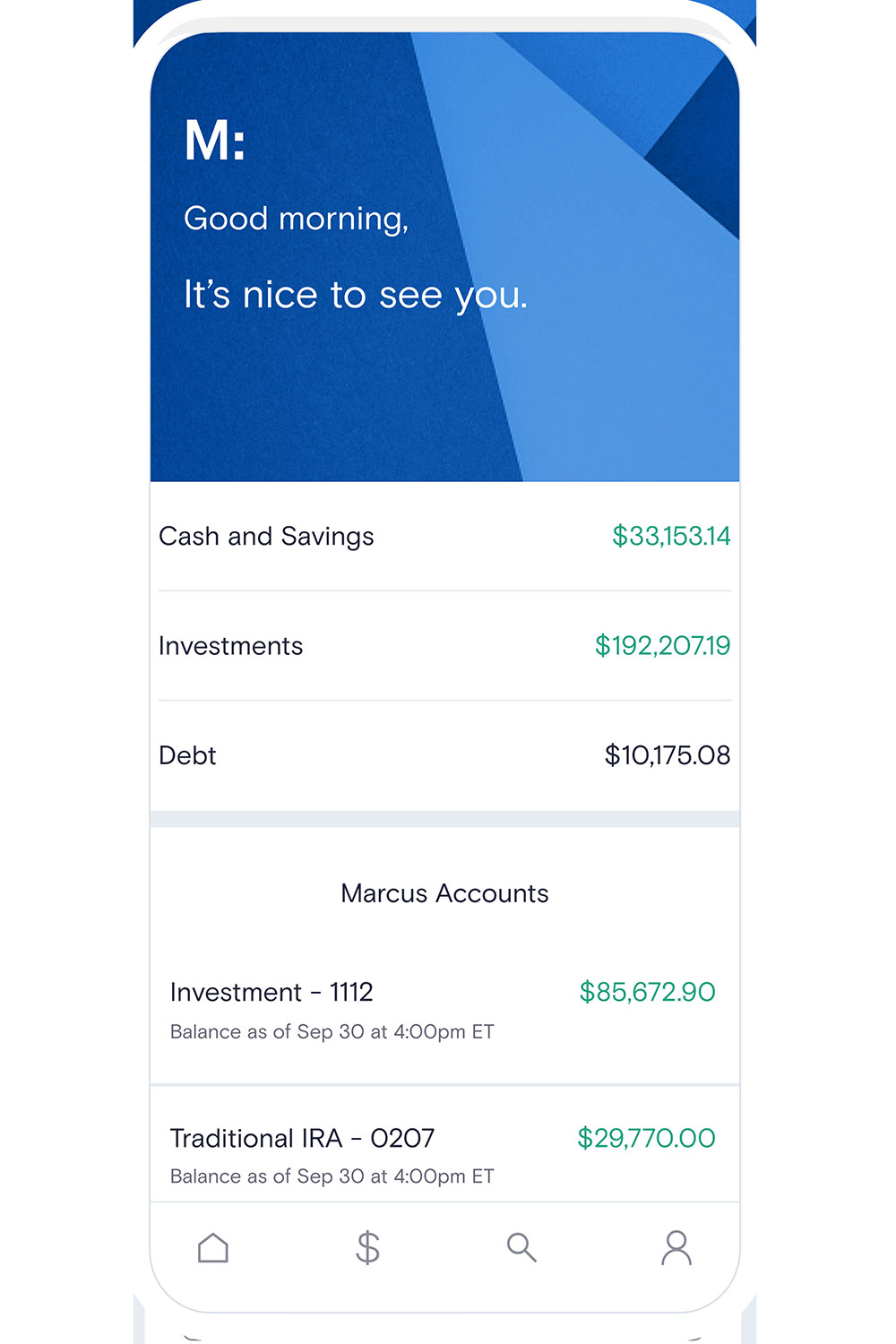

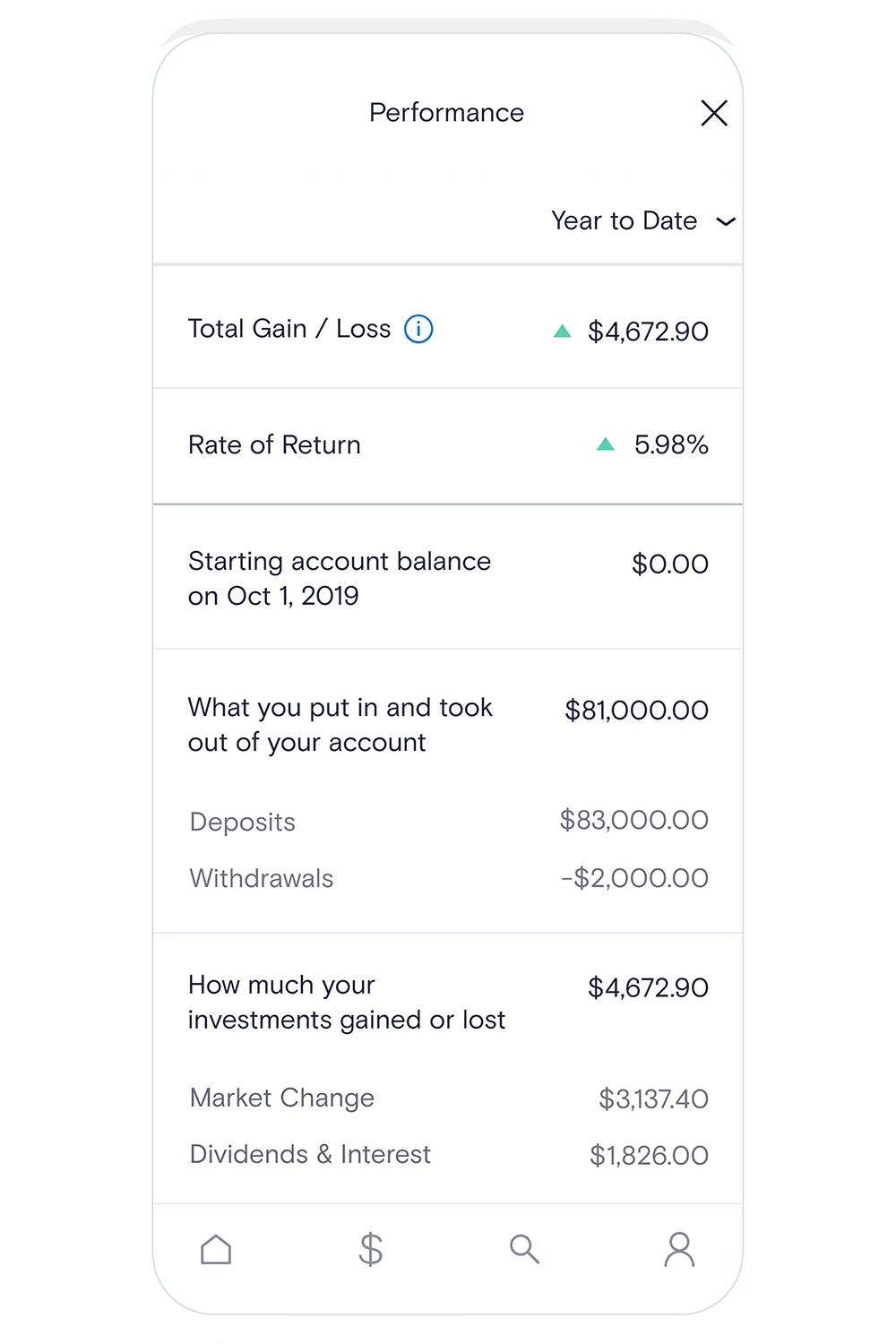

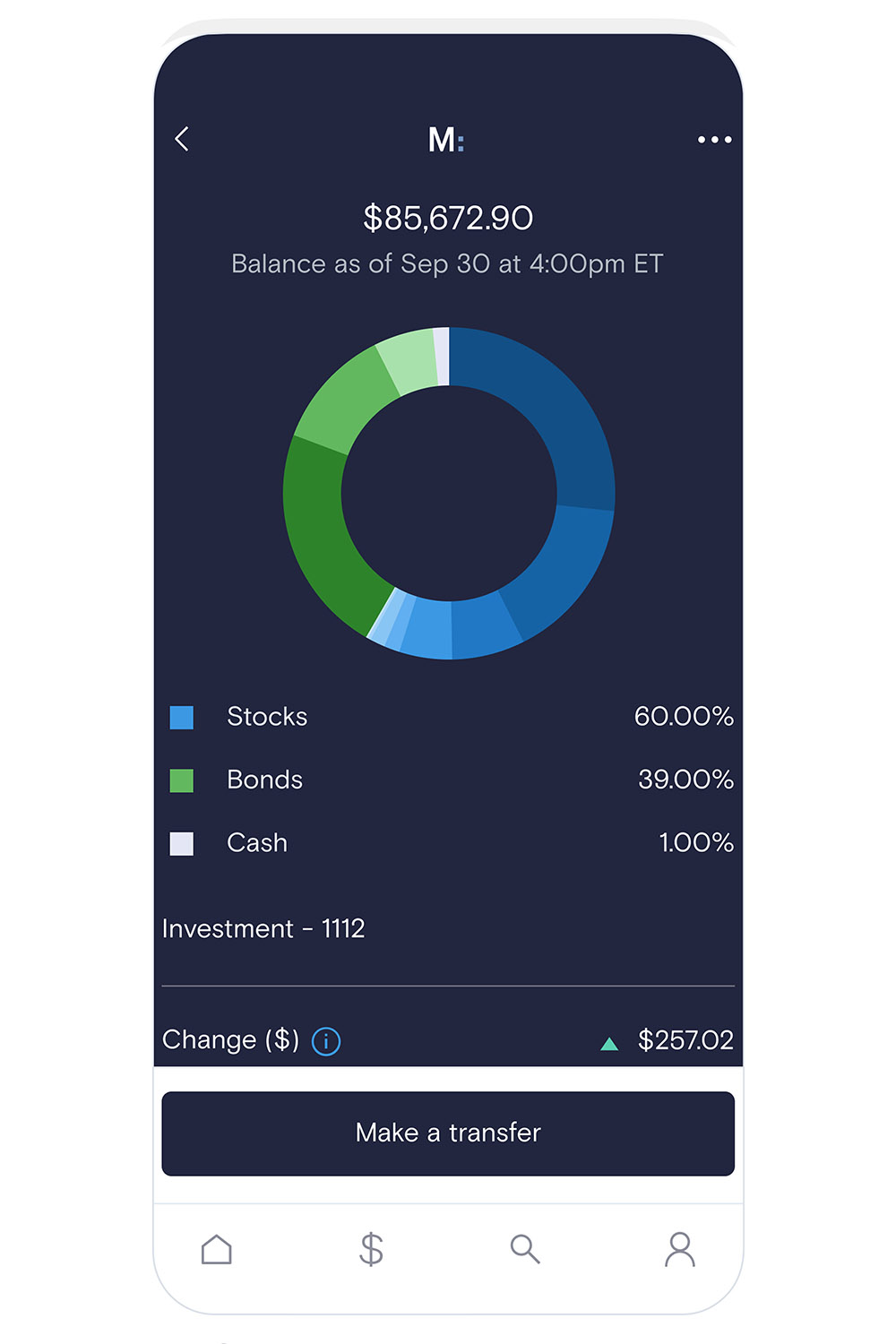

高盛目前仅披露了Marcus Invest平台的外观,为《财富》杂志提供了提前了解该服务的移动应用界面的独家机会:

Marcus Invest的客户只需要存款金额达到1,000美元即可使用该平台,这符合机器人顾问吸引大众消费者的低准入门槛模式。参与beta版测试的高盛员工的年咨询费费率为0.15%,但高盛表示随着Marcus Invest的正式发布,费率可能会有所调整。

该项服务还提供了与特定策略关联的不同组合选项以及退休金账户选项。根据机器人顾问模式,用户的投资组合将接受持续监控和再平衡,以确保它们适合客户的理财目标。

高盛表示,计划在3月底之前公开发布Marcus Invest,并在2021年底之前在英国推出该项服务。(财富中文网)

翻译:刘进龙

审校:汪皓

投资银行业巨头高盛(Goldman Sachs)一直在大力发展消费者银行业务,这并不是什么秘密。高盛通过其快速增长的Marcus平台,涉足储蓄账户和个人贷款等领域,并且很快将支持支票账户。

但Marcus正在考虑进军竞争异常激烈的自动化投资管理领域,或者更为人所知的机器人顾问领域。金融科技初创公司和老牌券商都向零售客户成功推出了基于算法的自动化投资产品,向大众推广服务费和最低账户金额要求较低的财富管理服务。

高盛也跟随这种趋势,在去年宣布了自动化投资服务Marcus Invest。高盛CEO苏德巍在上个月的一份内部备忘录中表示,Marcus将在其Beta测试项目中向员工提供服务,并计划在2021年第一季度向公众正式发布Marcus Invest。

高盛目前仅披露了Marcus Invest平台的外观,为《财富》杂志提供了提前了解该服务的移动应用界面的独家机会:

Marcus Invest的客户只需要存款金额达到1,000美元即可使用该平台,这符合机器人顾问吸引大众消费者的低准入门槛模式。参与beta版测试的高盛员工的年咨询费费率为0.15%,但高盛表示随着Marcus Invest的正式发布,费率可能会有所调整。

该项服务还提供了与特定策略关联的不同组合选项以及退休金账户选项。根据机器人顾问模式,用户的投资组合将接受持续监控和再平衡,以确保它们适合客户的理财目标。

高盛表示,计划在3月底之前公开发布Marcus Invest,并在2021年底之前在英国推出该项服务。(财富中文网)

翻译:刘进龙

审校:汪皓

It’s no secret that investment banking giant Goldman Sachs has been upping its game on the consumer banking front through Marcus, its fast-growing foray into the world of savings accounts, personal loans, and, soon, checking accounts.

But Marcus is also looking to get into the ever-crowded realm of automated investment management—or, as they’re more commonly known, robo-advisors. Fintech startups and established brokerages alike have found much success marketing automated, algorithm-based investment products to retail customers, bringing low-fee, low-account minimum wealth management services to the masses.

Goldman is now following that example with Marcus Invest, its own automated investment service that the bank announced last year. In an internal memo last month, Goldman CEO David Solomon said Marcus was offering the service to employees as part of its beta testing program, with an eye to rolling out Marcus Invest to the public in the first quarter of 2021.

Now, Goldman is unveiling just what the Marcus Invest platform will look like, providing Fortune with an exclusive early glance at the service’s mobile app interface:

Marcus Invest clients can get started on the platform with only a $1,000 deposit—in line with the low-entry barrier model that has made robo-advisors so appealing to Main Street customers. While Goldman employees testing the beta version were offered an annual advisory fee of 0.15%, the bank says that fee could change with Marcus Invest’s public rollout.

The service will also offer various portfolio options tied to specific strategies, as well as retirement account options. Per the robo-advisor model, users’ portfolios will monitored and rebalanced consistently to ensure they’re attuned to their financial goals.

Goldman says Marcus Invest is on schedule to make its public debut before the end of March, while the bank also aims to launch the service in the U.K. before the end of 2021.