葡萄酒销量下滑,唯独这款酒出人意料热销

有人称,千禧一代扼杀了葡萄酒(连瓶塞都没有放过)。不管是真是假,但桃红肯定不在扼杀范围之列。

相反,桃红葡萄酒或许正是因为他们才得以崛起。数年前,很多反对者可能会认为桃红只是昙花一现的事物,但它并未就此消亡。

国际葡萄酒及烈酒研究所的市场分析师莱恩·李说:“在过去很长一段时间里,美国人认为桃红是一种甜美、果味十足的葡萄酒,其种类因为接受度不高而较为单一。法国生产商通过数年的时间成功地营销并扩大了桃红品尝活动,并借此改变了美国消费者对桃红的看法。此举帮助提升了人们对这类酒品的兴趣,并极大地丰富了桃红的品种数量。如今,桃红已经成为了家喻户晓、深受人们喜爱的酒品,而且越来越多的生产商,尤其是本土生产商都推出了自有的桃红干红。”

然而,尽管法国普罗旺斯产区是桃红的代言词,而且美国消费者对桃红的兴趣日渐高涨,但他们也在学习,然后向外延伸,并从其他产区购买桃红。他们不仅放眼美国和其他新世界红酒生产商,还将目光瞄向了法国在欧洲的邻国。这些国家有着类似的气候,也能够生产类似品质的红酒,但单瓶或每箱的价格通常会低很多。

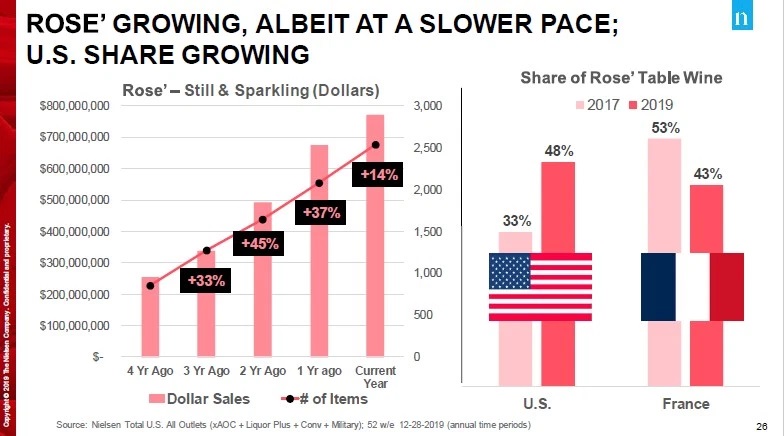

这些红酒生产商如今有充分的理由来投资桃红酿造。尼尔森公司称,美国桃红酒的销售额在过去三年中一直保持着同比增长,2019年的增速达到了42%。

国际葡萄酒及烈酒研究所的数据显示,2019年,桃红佐餐酒的销量同比增长了3.2%,而无气葡萄酒整体出现了1%的下滑。在过去五年中(从2014年到2019年),桃红斩获了1.7%的复合年增长率,而整个无气葡萄酒行业为0.8%。

这家市场研究公司调查了新冠疫情爆发之前桃红的非现场饮用销售额,发现其销量在过去三个月中出现了大幅增长。然而分析师称,这种从现场饮用(酒吧和餐馆)向非现场饮用(零售)转变,而不是行业整体增长的现象更具代表性。(尼尔森的美国非现场饮用的全口径衡量渠道包括百货店、药店、大型商超、精选一美元店、精选仓储俱乐部、军方供应、便利店和烈酒店。)

美国本土佐餐酒的增速要高于进口酒,也带动了桃红的整体销量,但价位却更低。来自于意大利的桃红在美国的销量尤为强劲,销售额同比增长了近20%,尤其是8美元至11美元的价格区间的桃红。另一种销量名列前茅的佐餐桃红来自于新西兰,其销售额同比增长了16%,主力产品位于11美元至15美元的价格区间。

尼尔森的酒精饮品行业高级副总裁丹尼·布拉格说:“法国佐餐桃红在美国的非现场饮用领域依然在增长,尤其是高价位酒,但其市场份额正在下滑。”国际葡萄酒及烈酒研究所称,截至2020年2月,法国桃红销售份额同比实际上下降了1.7个百分点。去年美国市场上的法国无气葡萄酒整体销量下滑了4.9个百分点。

不管怎么样,法国依然是桃红市场的霸主,在美国桃红佐餐酒前十大进口国榜单中排名第一,意大利、新西兰、西班牙、葡萄牙、阿根廷、智利、澳大利亚、南非和德国紧随其后。

尽管市场上也有普通价格的法国桃红,但大多数都属于高档酒系列(按照国际葡萄酒及烈酒研究所定义,超过10美元/瓶的葡萄酒)。

李表示:“法国桃红对于普通消费者来说还是偏贵。”国际葡萄酒及烈酒研究所的研究显示,美国桃红佐餐酒平均零售价格为8.32美元。“作为对比,美国本土酒庄生产的桃红价格更具吸引力。本土酒庄额外的库存和供给过剩也为新的高品质品牌进入美国市场创造了机会,而且这些品牌的价格比以往更低。”

如今,似乎有无穷无尽的新桃红品牌在等着消费者去发现。葡萄酒进口商Evaton专营伊比利亚佐餐酒,其首席执行官史蒂芬·布劳尔说:“消费者愿意花更多的钱购买桃红,但桃红本身的特质才是让他们成为回头客的真正原因。幸运的是,人们无需花太多的钱便可以享用到优质桃红。”

桃红类酒品之所以大获成功,千禧一代比其他年龄段的人士功劳更大。桃红全球跟踪网站称,在过去17年中,桃红在全球的销量一直在飙升,2002年至2018年的增速达到了40%。布劳尔说,美国市场的千禧一代消费者想要的是轻盈、口感好的葡萄酒,同时这也是他们追求的生活方式。他说:“桃红不仅仅是一款夏季饮品,它的特别之处在于价格亲民。粉红色的酒体能够给任何场合带来欢愉,适合各种预算类型的消费者。”

瓶中信息

在消费者继续寻找下一款划时代酒品之际,葡萄牙成为了首选替代目标。在新冠疫情爆发以及还未出现非必要旅行这个问题之前,大批美国民众如潮水般涌向葡萄牙。最近几年,葡萄牙成为了顶级旅游胜地,而且被世界旅游大奖连续三年(2017-2019)评选为欧洲最佳旅游胜地。《葡萄酒爱好者》还将其评选为2019年10大最佳红酒旅游胜地。

布劳尔说:“人们在葡萄牙发现,红酒的性价比出奇的好。桃红近些年的走红也源于市场在售桃红整体品质的大幅提升,而且桃红的适用场合亦非常广泛。在全球范围内,桃红可以用于勾兑鸡尾酒,作为开胃酒,或作为多种夏季菜肴的佐餐酒。”

葡萄牙红酒制造商苏加比集团的美国分公司Evaton正在庆祝其Mateus桃红干红的重新推出。Mateus是葡萄牙首要的家族酒庄,位于波尔图东北部,也是苏加比集团旗下的顶级酒庄之一。1942年,最初的Mateus桃红被设计和开发为一款甜美的气泡酒。随着这些年消费者口味的变化,Mateus也随之进行了调整(主要针对美国市场),并推出了首款桃红干红。布劳尔说:“借助Mateus桃红干红,我们根据当前消费者的口味调整了红酒的口感,而且相信这款不俗的产品可以与法国普罗旺斯顶级桃红相抗衡。”

Mateus的葡萄酒业务主任安东尼奥·布拉加说:“在我们生产的所有桃红中,我们最看重的一个元素就是可饮用性,也就是将优雅、迷人的风味和平衡度融于一体。以Mateus桃红干红为例,我们追求的是新鲜、果味表达以及完整的酸度,这些都能带来绝佳的口感。”

Mateus现已进驻120多个市场,其最大的市场还是其产地葡萄牙。当地的消费能力十分强劲,从2010年的17.9万箱增至2019年的27.5万箱。

但美国是Mateus干红桃红的唯一市场。苏加比集团执行委员会委员拉奎尔·瑟布拉说:“在美国,我们根据美国人的口感需求采取了一种不同的前卫方式,并开发了一款干红桃红,这是一款有着浅粉酒体,甜度更低的葡萄酒。我们非常专注于通过数字手段来开发品牌,并投入了很多精力来打造我们的社交渠道,我们认为这类渠道体现了Mateus所要表达的生活真谛。粉红色的葡萄酒、标志性的包装,以及爱意满满的品牌形象这个完美组合有助于我们在社交媒体领域吸引我们的核心目标消费者。”

瑟布拉还提到了在美国消费者心目中大获成功的几个外形因素,尤其是其187毫升的瓶体(作为对比的是平均750毫升的标准瓶体)。瑟布拉说:“对消费者来说,这个量在任何场合都是刚刚好,而且瓶体的形状也是十分独特。”她解释说,这个瓶体是一战期间士兵们所携带酒瓶的再现。

未开发的潜力

寻求意大利夏季饮品的美国民众如今可能只能选择阿佩罗鸡尾酒。然而,受益于这款Instagram推崇的鸡尾酒,意大利桃红葡萄酒的产量得以大幅提升,而且其销量近些年来在本土市场以及欧盟和美国市场也迎来了迅猛增长。

Chiaretto是一款有着清爽口感的干红桃红,其原料为红葡萄,采用了白葡萄酒的酿造工艺,产自米兰和威尼斯之间的加尔达湖周边地区。(其名称Chiaretto源于意大利语chiaro,意为“浅色”、“苍白”。)

加尔达湖是意大利桃红最重要的产区,每年平均产量超过了1000万瓶,而桃红占意大利红酒市场总量的6%。尽管遭遇新冠疫情,但桃红的上扬趋势有望得以延续,而该产区在2020年第一季度发送了260万支Chiaretto,较2019年第一季度增长了50万支。

Cantina Gorgo酒庄位于加尔达湖东南部。得益于意大利和海外市场,其Chiaretto销量在过去三年中增长了60%。该酒庄的主要市场是广大的欧盟地区,主要是德国。但Gorgo酒庄的联合所有者、红酒酿造商罗伯塔·布里克罗称,最大和最近的订单需求均来自于美国(尤其是纽约和马萨诸塞州)、加拿大和英国,同时连锁超市维特罗斯(Waitrose)已经将Gorgo Chiaretto葡萄酒摆上了旗下所有店面的货架。

布里克罗说,尽管消费者的初恋可能一直是普罗旺斯产区的桃红,但她认为全球市场还存在大量未挖掘的潜力。她补充说:“公司崛起的关键在于引入意大利在桃红领域的专长和风味。”

离Gorgo不远的Cavalchina也迎来了其桃红销量的激增,而Chiaretto是其最畅销的酒品之一。这家酒庄平均每年生产80万箱葡萄酒,其中有半数出口。但唯一的问题在于,这家酒庄每年的酒都会售罄。2019年,意大利、欧盟地区和美国买光了Cavalchina所有的桃红,而且酒庄发现这些市场的需求仍在上涨。

尽管销量在不断增,拥有110公顷(约合272英亩)的皮奥纳家族并不打算扩张或购买更多的土地,因为他们希望这个家族业务能够可持续地发展下去。

弗朗西斯科·皮奥纳说:“说真的,我认为这些趋势一直都是起起伏伏,目前桃红也在经历这一现象。”弗朗西斯科的父亲路西阿诺与其兄弟于1962年创建了酒厂。销售业绩显示,桃红在近期的需求依然坚挺。但Chiaretto尤为特殊的一点在于,它是少数能够陈酿的桃红之一,而且如果放置数年后口感会更好。皮奥纳说:“市场需要浅龄酒,但我们的桃红可以陈酿两到三年的时间。”

良好的声誉

美国并不像意大利加达尔湖和法国普罗旺斯那样有特定的桃红产区。但行业专家认为加州和俄勒冈州是其有力的竞争对手,涵盖从圣路易斯奥比斯波一直到威拉梅特谷的地区。

旧金山湾区Cameron Hughes Wine与 Vintage Wine Estates的首席营销官杰西卡·科甘认为,美国式的桃红“通常更为顺滑和现代”。大多数在这里酿造的桃红都是干红,而且通常酒精度较低,也让其更为适合夏季饮用。

科甘说:“大多数消费者想要一款加州产桃红,其唯一能感知的甜度来自于葡萄本身的天然红色水果风味。很多消费者认为桃红是一种更加纯粹的饮酒体验,因为这种葡萄酒可以轻易地与各种食品搭配,也十分适合独饮。”

科甘说,她最近遇到了一名来自于得州的客户,后者告诉她已经预定了一箱[Cameron Hughes]桃红作为其“夏季门廊酒”,因为它非常清爽,而且口感很好。她解释说:“消费者通常会选择桃红而不是白葡萄酒,因为它能够让饮用者感到放松和清爽,它没有加州主流白葡萄酒品种的陈酿感或酸感,很多葡萄酒饮用者认为这些白葡萄酒的口感太过了。”由其是霞多丽,因其橡木味和绵密感过重而失去了人们的好感,而长相思时常又由于草味和植物味过重而受到诟病。

然而,与白葡萄酒相比,桃红给人的感觉更加亲切一些,但在高温季节饮用时并没有红葡萄酒的厚重感。科甘说:“我们通常在喝第一口之前便对桃红的口感有了判断,它应该有着微妙的红色葡萄果味、清爽的回味以及往往较为顺滑的口感。”

然而桃红,由其是美国市场的桃红,在改善了其自身不好的声誉之后才拥有了今天的境地。

科甘说:“很长一段时间以来,可以追溯至上个世纪70年代,桃红被认为是一种劣质葡萄酒,例如盒装酒,通常是甜的。直到五年前,桃红开始通过直销渠道进行硬性推销,而且通常不会对红酒俱乐部发货。对桃红认知的改善以及直接让消费者品尝一直都是其走红的关键。”(财富中文网)

译者:Feb

有人称,千禧一代扼杀了葡萄酒(连瓶塞都没有放过)。不管是真是假,但桃红肯定不在扼杀范围之列。

相反,桃红葡萄酒或许正是因为他们才得以崛起。数年前,很多反对者可能会认为桃红只是昙花一现的事物,但它并未就此消亡。

国际葡萄酒及烈酒研究所的市场分析师莱恩·李说:“在过去很长一段时间里,美国人认为桃红是一种甜美、果味十足的葡萄酒,其种类因为接受度不高而较为单一。法国生产商通过数年的时间成功地营销并扩大了桃红品尝活动,并借此改变了美国消费者对桃红的看法。此举帮助提升了人们对这类酒品的兴趣,并极大地丰富了桃红的品种数量。如今,桃红已经成为了家喻户晓、深受人们喜爱的酒品,而且越来越多的生产商,尤其是本土生产商都推出了自有的桃红干红。”

然而,尽管法国普罗旺斯产区是桃红的代言词,而且美国消费者对桃红的兴趣日渐高涨,但他们也在学习,然后向外延伸,并从其他产区购买桃红。他们不仅放眼美国和其他新世界红酒生产商,还将目光瞄向了法国在欧洲的邻国。这些国家有着类似的气候,也能够生产类似品质的红酒,但单瓶或每箱的价格通常会低很多。

这些红酒生产商如今有充分的理由来投资桃红酿造。尼尔森公司称,美国桃红酒的销售额在过去三年中一直保持着同比增长,2019年的增速达到了42%。

国际葡萄酒及烈酒研究所的数据显示,2019年,桃红佐餐酒的销量同比增长了3.2%,而无气葡萄酒整体出现了1%的下滑。在过去五年中(从2014年到2019年),桃红斩获了1.7%的复合年增长率,而整个无气葡萄酒行业为0.8%。

这家市场研究公司调查了新冠疫情爆发之前桃红的非现场饮用销售额,发现其销量在过去三个月中出现了大幅增长。然而分析师称,这种从现场饮用(酒吧和餐馆)向非现场饮用(零售)转变,而不是行业整体增长的现象更具代表性。(尼尔森的美国非现场饮用的全口径衡量渠道包括百货店、药店、大型商超、精选一美元店、精选仓储俱乐部、军方供应、便利店和烈酒店。)

美国本土佐餐酒的增速要高于进口酒,也带动了桃红的整体销量,但价位却更低。来自于意大利的桃红在美国的销量尤为强劲,销售额同比增长了近20%,尤其是8美元至11美元的价格区间的桃红。另一种销量名列前茅的佐餐桃红来自于新西兰,其销售额同比增长了16%,主力产品位于11美元至15美元的价格区间。

尼尔森的酒精饮品行业高级副总裁丹尼·布拉格说:“法国佐餐桃红在美国的非现场饮用领域依然在增长,尤其是高价位酒,但其市场份额正在下滑。”国际葡萄酒及烈酒研究所称,截至2020年2月,法国桃红销售份额同比实际上下降了1.7个百分点。去年美国市场上的法国无气葡萄酒整体销量下滑了4.9个百分点。

不管怎么样,法国依然是桃红市场的霸主,在美国桃红佐餐酒前十大进口国榜单中排名第一,意大利、新西兰、西班牙、葡萄牙、阿根廷、智利、澳大利亚、南非和德国紧随其后。

尽管市场上也有普通价格的法国桃红,但大多数都属于高档酒系列(按照国际葡萄酒及烈酒研究所定义,超过10美元/瓶的葡萄酒)。

李表示:“法国桃红对于普通消费者来说还是偏贵。”国际葡萄酒及烈酒研究所的研究显示,美国桃红佐餐酒平均零售价格为8.32美元。“作为对比,美国本土酒庄生产的桃红价格更具吸引力。本土酒庄额外的库存和供给过剩也为新的高品质品牌进入美国市场创造了机会,而且这些品牌的价格比以往更低。”

如今,似乎有无穷无尽的新桃红品牌在等着消费者去发现。葡萄酒进口商Evaton专营伊比利亚佐餐酒,其首席执行官史蒂芬·布劳尔说:“消费者愿意花更多的钱购买桃红,但桃红本身的特质才是让他们成为回头客的真正原因。幸运的是,人们无需花太多的钱便可以享用到优质桃红。”

桃红类酒品之所以大获成功,千禧一代比其他年龄段的人士功劳更大。桃红全球跟踪网站称,在过去17年中,桃红在全球的销量一直在飙升,2002年至2018年的增速达到了40%。布劳尔说,美国市场的千禧一代消费者想要的是轻盈、口感好的葡萄酒,同时这也是他们追求的生活方式。他说:“桃红不仅仅是一款夏季饮品,它的特别之处在于价格亲民。粉红色的酒体能够给任何场合带来欢愉,适合各种预算类型的消费者。”

瓶中信息

在消费者继续寻找下一款划时代酒品之际,葡萄牙成为了首选替代目标。在新冠疫情爆发以及还未出现非必要旅行这个问题之前,大批美国民众如潮水般涌向葡萄牙。最近几年,葡萄牙成为了顶级旅游胜地,而且被世界旅游大奖连续三年(2017-2019)评选为欧洲最佳旅游胜地。《葡萄酒爱好者》还将其评选为2019年10大最佳红酒旅游胜地。

布劳尔说:“人们在葡萄牙发现,红酒的性价比出奇的好。桃红近些年的走红也源于市场在售桃红整体品质的大幅提升,而且桃红的适用场合亦非常广泛。在全球范围内,桃红可以用于勾兑鸡尾酒,作为开胃酒,或作为多种夏季菜肴的佐餐酒。”

葡萄牙红酒制造商苏加比集团的美国分公司Evaton正在庆祝其Mateus桃红干红的重新推出。Mateus是葡萄牙首要的家族酒庄,位于波尔图东北部,也是苏加比集团旗下的顶级酒庄之一。1942年,最初的Mateus桃红被设计和开发为一款甜美的气泡酒。随着这些年消费者口味的变化,Mateus也随之进行了调整(主要针对美国市场),并推出了首款桃红干红。布劳尔说:“借助Mateus桃红干红,我们根据当前消费者的口味调整了红酒的口感,而且相信这款不俗的产品可以与法国普罗旺斯顶级桃红相抗衡。”

Mateus的葡萄酒业务主任安东尼奥·布拉加说:“在我们生产的所有桃红中,我们最看重的一个元素就是可饮用性,也就是将优雅、迷人的风味和平衡度融于一体。以Mateus桃红干红为例,我们追求的是新鲜、果味表达以及完整的酸度,这些都能带来绝佳的口感。”

Mateus现已进驻120多个市场,其最大的市场还是其产地葡萄牙。当地的消费能力十分强劲,从2010年的17.9万箱增至2019年的27.5万箱。

但美国是Mateus干红桃红的唯一市场。苏加比集团执行委员会委员拉奎尔·瑟布拉说:“在美国,我们根据美国人的口感需求采取了一种不同的前卫方式,并开发了一款干红桃红,这是一款有着浅粉酒体,甜度更低的葡萄酒。我们非常专注于通过数字手段来开发品牌,并投入了很多精力来打造我们的社交渠道,我们认为这类渠道体现了Mateus所要表达的生活真谛。粉红色的葡萄酒、标志性的包装,以及爱意满满的品牌形象这个完美组合有助于我们在社交媒体领域吸引我们的核心目标消费者。”

瑟布拉还提到了在美国消费者心目中大获成功的几个外形因素,尤其是其187毫升的瓶体(作为对比的是平均750毫升的标准瓶体)。瑟布拉说:“对消费者来说,这个量在任何场合都是刚刚好,而且瓶体的形状也是十分独特。”她解释说,这个瓶体是一战期间士兵们所携带酒瓶的再现。

未开发的潜力

寻求意大利夏季饮品的美国民众如今可能只能选择阿佩罗鸡尾酒。然而,受益于这款Instagram推崇的鸡尾酒,意大利桃红葡萄酒的产量得以大幅提升,而且其销量近些年来在本土市场以及欧盟和美国市场也迎来了迅猛增长。

Chiaretto是一款有着清爽口感的干红桃红,其原料为红葡萄,采用了白葡萄酒的酿造工艺,产自米兰和威尼斯之间的加尔达湖周边地区。(其名称Chiaretto源于意大利语chiaro,意为“浅色”、“苍白”。)

加尔达湖是意大利桃红最重要的产区,每年平均产量超过了1000万瓶,而桃红占意大利红酒市场总量的6%。尽管遭遇新冠疫情,但桃红的上扬趋势有望得以延续,而该产区在2020年第一季度发送了260万支Chiaretto,较2019年第一季度增长了50万支。

Cantina Gorgo酒庄位于加尔达湖东南部。得益于意大利和海外市场,其Chiaretto销量在过去三年中增长了60%。该酒庄的主要市场是广大的欧盟地区,主要是德国。但Gorgo酒庄的联合所有者、红酒酿造商罗伯塔·布里克罗称,最大和最近的订单需求均来自于美国(尤其是纽约和马萨诸塞州)、加拿大和英国,同时连锁超市维特罗斯(Waitrose)已经将Gorgo Chiaretto葡萄酒摆上了旗下所有店面的货架。

布里克罗说,尽管消费者的初恋可能一直是普罗旺斯产区的桃红,但她认为全球市场还存在大量未挖掘的潜力。她补充说:“公司崛起的关键在于引入意大利在桃红领域的专长和风味。”

离Gorgo不远的Cavalchina也迎来了其桃红销量的激增,而Chiaretto是其最畅销的酒品之一。这家酒庄平均每年生产80万箱葡萄酒,其中有半数出口。但唯一的问题在于,这家酒庄每年的酒都会售罄。2019年,意大利、欧盟地区和美国买光了Cavalchina所有的桃红,而且酒庄发现这些市场的需求仍在上涨。

尽管销量在不断增,拥有110公顷(约合272英亩)的皮奥纳家族并不打算扩张或购买更多的土地,因为他们希望这个家族业务能够可持续地发展下去。

弗朗西斯科·皮奥纳说:“说真的,我认为这些趋势一直都是起起伏伏,目前桃红也在经历这一现象。”弗朗西斯科的父亲路西阿诺与其兄弟于1962年创建了酒厂。销售业绩显示,桃红在近期的需求依然坚挺。但Chiaretto尤为特殊的一点在于,它是少数能够陈酿的桃红之一,而且如果放置数年后口感会更好。皮奥纳说:“市场需要浅龄酒,但我们的桃红可以陈酿两到三年的时间。”

良好的声誉

美国并不像意大利加达尔湖和法国普罗旺斯那样有特定的桃红产区。但行业专家认为加州和俄勒冈州是其有力的竞争对手,涵盖从圣路易斯奥比斯波一直到威拉梅特谷的地区。

旧金山湾区Cameron Hughes Wine与 Vintage Wine Estates的首席营销官杰西卡·科甘认为,美国式的桃红“通常更为顺滑和现代”。大多数在这里酿造的桃红都是干红,而且通常酒精度较低,也让其更为适合夏季饮用。

科甘说:“大多数消费者想要一款加州产桃红,其唯一能感知的甜度来自于葡萄本身的天然红色水果风味。很多消费者认为桃红是一种更加纯粹的饮酒体验,因为这种葡萄酒可以轻易地与各种食品搭配,也十分适合独饮。”

科甘说,她最近遇到了一名来自于得州的客户,后者告诉她已经预定了一箱[Cameron Hughes]桃红作为其“夏季门廊酒”,因为它非常清爽,而且口感很好。她解释说:“消费者通常会选择桃红而不是白葡萄酒,因为它能够让饮用者感到放松和清爽,它没有加州主流白葡萄酒品种的陈酿感或酸感,很多葡萄酒饮用者认为这些白葡萄酒的口感太过了。”由其是霞多丽,因其橡木味和绵密感过重而失去了人们的好感,而长相思时常又由于草味和植物味过重而受到诟病。

然而,与白葡萄酒相比,桃红给人的感觉更加亲切一些,但在高温季节饮用时并没有红葡萄酒的厚重感。科甘说:“我们通常在喝第一口之前便对桃红的口感有了判断,它应该有着微妙的红色葡萄果味、清爽的回味以及往往较为顺滑的口感。”

然而桃红,由其是美国市场的桃红,在改善了其自身不好的声誉之后才拥有了今天的境地。

科甘说:“很长一段时间以来,可以追溯至上个世纪70年代,桃红被认为是一种劣质葡萄酒,例如盒装酒,通常是甜的。直到五年前,桃红开始通过直销渠道进行硬性推销,而且通常不会对红酒俱乐部发货。对桃红认知的改善以及直接让消费者品尝一直都是其走红的关键。”(财富中文网)

译者:Feb

It’s been charged that millennials killed wine (right down to the cork). Regardless of how true or not that might be, they certainly haven’t killed rosé.

On the contrary, they’re probably responsible for its revival. And while many naysayers might have thought rosé was a flash in the pan a couple of years ago, it’s not fading to black.

“For a long period in the U.S., rosé wine had an image of being a sweet, fruity wine, which held the variety back from greater acceptance,” says Ryan Lee, IWSR market analyst. “French producers successfully marketed and expanded tastings over a number of years to change the American consumer’s perception of what rosé wine is. This has helped grow interest in the category and greatly increase the number of rosés available. Now that rosé wine is widely known and adored, more producers—especially domestic producers—have their own dry rosés.”

But while France’s Provence region is synonymous with rosé, as U.S. consumers further latch onto the pink-hued wine, they’re learning, branching out, and purchasing rosé wines from other regions. They’re looking not only across the U.S. and toward other New World winemakers but also toward France’s neighbors in Europe, which share similar climates and produce comparable quality wines, but often charge far less per bottle or case.

These winemakers have good reason to invest in rosé production right now. Dollar sales of rosé wine in the United States have grown year over year annually for the past three years, most recently by 42% in 2019, according to Nielsen.

Volume growth for rosé table wine grew 3.2% in 2019 year over year, compared with an overall decrease of 1% for still wine last year, according to IWSR data. Red wine decreased 0.9% and white wine dropped by 1.9%. Over the past five years (from 2014 through 2019), rosé has demonstrated a 1.7% compound annual growth rate, while total still wine has posted growth of 0.8% CAGR.

The market research firm examined off-premises dollar sales of table rosé before the impacts of COVID-19 accelerated, as sales in the past three months have spiked significantly. But analysts say that is more representative of a shift from the on-premises space (bars and restaurants) to off-premises (retail) rather than total industry overall gains. (Nielsen’s total U.S. off-premises measured channels include grocery stores, drugstores, mass merchandisers, select dollar stores, select warehouse clubs, military commissaries, convenience stores, and liquor stores.)

Domestic (U.S.) table rosé is growing faster than imported table rosé—increasing its share of total rosé sales, but at lower price points. Table rosés from Italy are performing particularly well in the U.S., with nearly 20% year-over-year dollar sales growth, primarily in the $8 to $11 bottle range. Another top performer is New Zealand table rosé, which is experiencing 16% year-over-year dollar sales growth, driven by the $11 to $15 price range.

“French table rosé is still growing in the U.S. off-premises space—particularly at a higher price point—but is losing share,” says Danny Brager, senior vice president of beverage alcohol at Nielsen. French rosé dollar sales share actually declined 1.7% year over year as of February 2020. And total French still wine in the U.S. was down 4.9% in volume last year, according to ISWR.

Nevertheless, France still remains supreme in rosé, ranking No. 1 on the list of the top 10 importers of rosé table wine to the U.S., followed by Italy, New Zealand, Spain, Portugal, Argentina, Chile, Australia, South Africa, and Germany.

While there are French rosés on the market at standard prices, most fall within the premium segment (defined by IWSR as over $10 per bottle).

“French rosé wine is expensive for your average consumer,” Lee notes. According to IWSR research, the average retail price of a bottle of rosé table wine in the U.S. is $8.32. “Domestic (U.S.) producers are bringing to market products at more attractive price points, by comparison. The domestic producer’s additional inventory and supply surplus also allows for new, higher-quality brands to enter the market at lower prices than in years’ past.”

And the sheer number of new rosés for consumers to discover seems endless these days. “Consumers are willing to pay more for a rosé, but it’s the wine profile that keeps them coming back,” says Stephen Brauer, CEO of wine importer Evaton, which specializes in Iberian table wines. “Fortunately, you don’t have to spend a lot of money to enjoy a wonderful rosé.”

Millennials, more than any other demographic, have been a key driver for the rosé category’s success. Global consumption of rosé wine has soared in 17 years, growing 40% between 2002 and 2018, according to Rosé Wines World Tracking. Within the U.S. market, Brauer says millennial consumers are looking for light and easy drinking wines, but they are also looking for a lifestyle. “More than just a summertime drink, rosés offer something special that is affordable and accessible,” he says. “Pink makes every occasion glamorous, regardless of your budget.”

Message in a bottle

As consumers continue to look for the next big thing, Portugal is a prime alternative. Before the outbreak of COVID-19, when nonessential travel was not an issue, Americans were flocking to Portugal at staggering numbers. In recent years, Portugal became a top travel destination and has been dubbed the Best European Tourist Destination by the World Travel Awards three years in a row (2017 through 2019). Plus Wine Enthusiast named it one of the 10 Best Wine Travel Destinations in 2019.

“What people find in Portugal are phenomenal wines at an unbelievable value,” Brauer says. “The popularity of rosé in recent years can be attributed to the considerable improvement in overall quality of rosé wines that can now be found on the market and also the wine’s amazing versatility. Around the world, consumers enjoy rosé in cocktails, as an aperitif, or as an accompaniment to a variety of summer meals.”

Evaton, the U.S. arm of Portugal-based wine producer Sogrape Vinhos, is celebrating the relaunch of a dry rosé from Mateus, a leading Portuguese family-owned winery to the northeast of Porto, and one of the top producers within the Sogrape portfolio. The original Mateus rosé was conceived and developed as a sweet and slightly effervescent wine in 1942. As consumer tastes have changed over the years, Mateus adapted—primarily for the U.S. market—with its first dry-style rosé wine. “With Mateus dry rosé, we have adapted our wine style to current consumer tastes and believe we offer a wonderful product that can compete with the top French Provence rosés,” Brauer says.

“One of the most important elements that we look for in all of our rosé wines is drinkability, which combines elegance, delicious flavors, and balance," says António Braga, enological director at Mateus. “In the specific case of Mateus dry rosé, we are looking for freshness, fruit expression, and integrated acidity, [which] will deliver a wonderful mouthfeel.”

Mateus is available in over 120 markets, with its top market being its home country of Portugal. And local consumption has been strong, growing from 179,000 cases shipped in 2010 to 275,000 cases in 2019.

But the U.S. is the only market where the Mateus dry rosé is launching. “In the U.S., we took a bold, different approach given the American taste profile and developed a dry-style rosé, that is a lighter pink color and less sweet,” says Raquel Seabra, an executive board member of Sogrape. “We have really focused on bringing our brand into the digital space and have placed a lot of our efforts in building our social channels that we believe capture the true lifestyle essence of Mateus. The pink wine, the iconic packaging, and the overall love of the brand has been perfect in the social media landscape for reaching our core target consumer.”

Seabra also points to the success of multiple form factors among U.S. consumers, especially 187 milliliter bottles (versus an average of 750 milliliters in a standard bottle of table wine). “The bottle size allows consumers the perfect portion for any occasion, and the shape itself is quite unique,” Seabra says, explaining the bottle was designed to reflect the flasks worn by soldiers in World War I.

Untapped potential

Americans looking for an Italian summertime drink might be conditioned now to order an Aperol spritz. But in the shadow of the Instagram-approved cocktail, Italy has substantially grown its rosé wine production and sales both within its own market as well as across the European Union and the U.S. in recent years.

Made from red grapes using white-wine-making practices, Chiaretto is a dry and crisp rosé produced in the region surrounding Lake Garda, between Milan and Venice, in northern Italy. (The name Chiaretto derives from the Italian term chiaro, meaning “light” or “pale.”)

Lake Garda is the most important region for rosé in Italy, producing more than 10 million bottles annually on average, and rosé makes up 6% of the Italian wine market. That upward trend is poised to continue in spite of the coronavirus pandemic, as the region shipped 2.6 million bottles of Chiaretto during the first quarter of 2020—half a million more than in the first quarter of 2019.

Cantina Gorgo, a wine estate southeast of Lake Garda, has seen its Chiaretto sales shoot up 60% in the past three years, thanks to sales in Italy and abroad. The winery’s primary market is the wider European Union—notably Germany. But Gorgo co-owner and winemaker Roberta Bricolo says the largest and most recent order requests have been from the U.S. (especially New York and Massachusetts), Canada, and the U.K. as supermarket chain Waitrose has added Gorgo Chiaretto wines to all of its locations.

While consumers’ first love might have been Provence rosé, Bricolo says, she thinks there is a lot of untapped potential in the global market. “The key for us to emerge was to introduce the Italian flair and flavor to the rosé scene,” she adds.

Cavalchina, just down the road from Gorgo, has also seen its rosé sales soar, and Chiaretto is one of its bestsellers. The winery produces 800,000 cases per year, on average, and half of that is exported. The only problem: The winery sells out of its product every year. In 2019 Cavalchina sold all of its rosé within Italy, the wider EU, and the U.S., and it has observed increased demand across all of those markets.

And yet, despite the growing business, the Piona family doesn’t plan on expanding or buying more land beyond its 110 hectares (272 acres), because they want to keep it sustainable as a family business.

“Sincerely, I think that trends may come and go, and we are seeing that also for rosé wine,” says Francesco Piona, whose father, Luciano, was one of the two brothers who established the winery in 1962. Sales figures demonstrate that rosé definitely has near-term staying power, but what is extra special about Chiaretto is that it is one of the few rosés that does age well and is often received better if it is held for a few years. “The market wants a young wine, but you can age it two to three years,” Piona notes.

Rosy reputation

The U.S. doesn’t have one particular region dedicated to rosé production, akin to Lake Garda in Italy or France’s Provence. But industry experts point toward California and Oregon as competitive options, from San Luis Obispo up to the Willamette Valley.

Jessica Kogan, chief marketing officer of Cameron Hughes Wine and Vintage Wine Estates in the San Francisco Bay Area, suggests that the U.S. style of rosé is “generally more lush and modern.” And most rosés made here are dry and often lower in alcohol, making them more palatable for summer.

“Most consumers want a dry California rosé, where the only perceived sweetness is coming from the natural red fruit flavors from the grape itself,” says Kogan. “Many of our consumers consider rosé to be a more uncomplicated drinking experience as the wine can be easily paired with a variety of foods or enjoyed by itself.”

Kogan says she recently had a customer from Texas tell her he was ordering a case of [Cameron Hughes] rosé as his “summer porch pounder” because it was cool and easy to drink. “Consumers often choose rosé over white wines as it provides the wine drinker a chilled and refreshing experience without the oaked or acidic flavors of California’s leading white wine varieties that many wine drinkers find polarizing,” she explains. Chardonnay, in particular, has a rough reputation for being overly oaky and buttery, whereas a Sauvignon Blanc is oft criticized for being too grassy and vegetal.

Rosé, however, feels a bit heartier than a white wine, but not as heavy as a red on a warm day. “A rosé is usually understood before its first sip—the drinker can anticipate its subtle red fruit, its crisp finish, and its often smooth mouthfeel,” Kogan says.

But rosé—especially in the U.S.—had to overcome a poor reputation of its own to get where it is now.

“For quite some time, dating back to the 1970s, rosé was considered inferior wine—think boxed wine, often sweet,” Kogan says. “Up until five-ish years ago, rosé was definitely a hard sell through the direct-to-consumer channel and not typically included in wine club shipments. Improved education and simply getting it in customers’ hands has been key.”