美国超过一半年收入10万美元及以上者都是月光族

美国月光族的人数几乎达到了疫情初期、封控、停业和大众恐慌期间的最高水平。

PYMNTS的最新版《新现实调查:月光族报告》(New Reality Check: The Paycheck-to-Paycheck Report)显示,2022年12月,约64.4%(1.66亿)的美国成年人表示,每到月底就会分文不剩,略低于2020年3月65.7%的月光族比例。

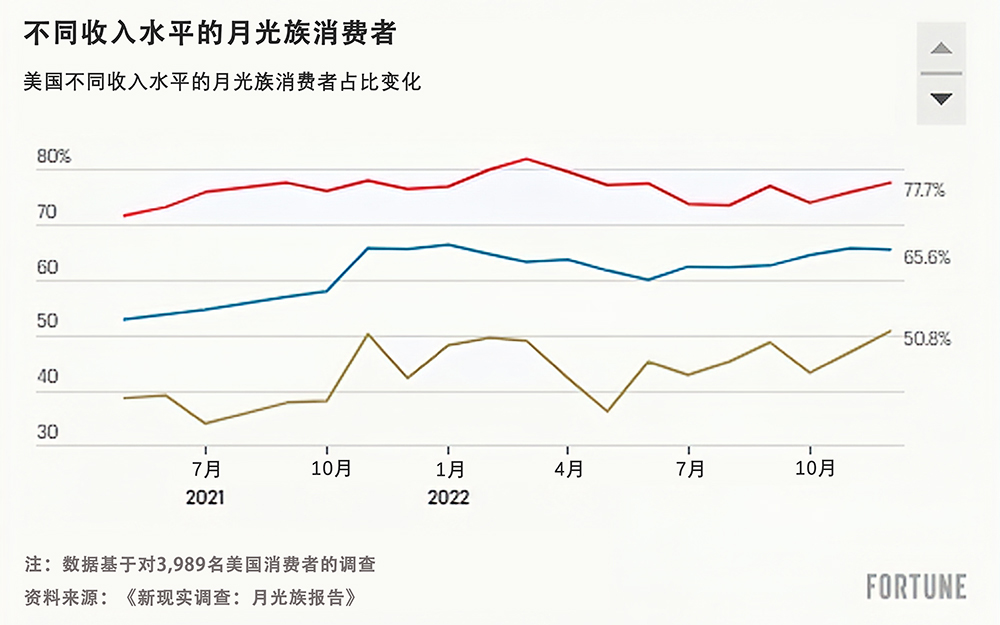

2021年底也有约930万月光族。但这一次,高收入者也未能幸免:新增的约800万勉强维持生计的美国人来自高收入阶层。PYMNTS的调查显示,12月,约50.8%收入超过10万美元的美国人表示自己是月光族。

去年12月,美国高收入月光族的数量,较2021年12月的42%增长了9个百分点。相比之下,去年,美国中低收入月光族的比例相对稳定。

报告发现:“然而,随着物价持续上涨削弱人们的购买力,越来越多消费者发现更难偿还每个月的债务。高收入消费者也感到捉襟见肘,去年有越来越多收入者变成了月光族。”

为什么现在美国高收入群体处境更艰难?持续高通胀肯定是原因之一,但近在眼前的经济衰退、高利率、金融市场波动和白领裁员,也对高收入者产生了影响。

在通胀方面,据盖洛普(Gallup)9月发布的调查报告显示,大部分美国人(56%)表示,物价上涨加剧了家庭的财务困难。在经济周期早期,通胀上涨问题主要集中在燃料和二手车价格方面。这对于黑人、拉丁裔和中产家庭的影响更大。

例如,纽约联邦储备银行(Federal Reserve Bank of New York)的研究显示,2021年,美国中产阶层面临的通胀率最高,主要是因为交通成本上涨。但随着通货膨胀向其他行业蔓延并产生更大影响,包括食品和消费品等,通胀对中产家庭产生的过大影响也有所减少。

PYMNTS研究发现,尽管美国勉强维持生计的人数众多,但消费者对今年的财务前景持相当乐观的态度。约40%的美国月光族预计2023年,其收入能够追上通胀,原因包括加薪和额外收入来源等。

同样有约40%的美国人预计今年个人财务状况会有所好转,比2022年7月33%的乐观者占比提高了7个百分点。(财富中文网)

翻译:刘进龙

审校:汪皓

美国月光族的人数几乎达到了疫情初期、封控、停业和大众恐慌期间的最高水平。

PYMNTS的最新版《新现实调查:月光族报告》(New Reality Check: The Paycheck-to-Paycheck Report)显示,2022年12月,约64.4%(1.66亿)的美国成年人表示,每到月底就会分文不剩,略低于2020年3月65.7%的月光族比例。

2021年底也有约930万月光族。但这一次,高收入者也未能幸免:新增的约800万勉强维持生计的美国人来自高收入阶层。PYMNTS的调查显示,12月,约50.8%收入超过10万美元的美国人表示自己是月光族。

去年12月,美国高收入月光族的数量,较2021年12月的42%增长了9个百分点。相比之下,去年,美国中低收入月光族的比例相对稳定。

报告发现:“然而,随着物价持续上涨削弱人们的购买力,越来越多消费者发现更难偿还每个月的债务。高收入消费者也感到捉襟见肘,去年有越来越多收入者变成了月光族。”

为什么现在美国高收入群体处境更艰难?持续高通胀肯定是原因之一,但近在眼前的经济衰退、高利率、金融市场波动和白领裁员,也对高收入者产生了影响。

在通胀方面,据盖洛普(Gallup)9月发布的调查报告显示,大部分美国人(56%)表示,物价上涨加剧了家庭的财务困难。在经济周期早期,通胀上涨问题主要集中在燃料和二手车价格方面。这对于黑人、拉丁裔和中产家庭的影响更大。

例如,纽约联邦储备银行(Federal Reserve Bank of New York)的研究显示,2021年,美国中产阶层面临的通胀率最高,主要是因为交通成本上涨。但随着通货膨胀向其他行业蔓延并产生更大影响,包括食品和消费品等,通胀对中产家庭产生的过大影响也有所减少。

PYMNTS研究发现,尽管美国勉强维持生计的人数众多,但消费者对今年的财务前景持相当乐观的态度。约40%的美国月光族预计2023年,其收入能够追上通胀,原因包括加薪和额外收入来源等。

同样有约40%的美国人预计今年个人财务状况会有所好转,比2022年7月33%的乐观者占比提高了7个百分点。(财富中文网)

翻译:刘进龙

审校:汪皓

The number of Americans living paycheck to paycheck has almost reached the high levels seen during the onset of the COVID-19 pandemic, during the days of lockdowns, business closings, and mass panic.

About 64.4%, or 166 million, of U.S. adults reported having no money left over at the end of the month in December 2022—just shy of the 65.7% who reported living paycheck to paycheck in March 2020, according to the latest edition of PYMNTS’ New Reality Check: The Paycheck-to-Paycheck Report.

That’s also about 9.3 million more people who ended 2021 living paycheck to paycheck. But this time, high-income Americans are not immune: Approximately 8 million of those newly scraping-by Americans are from higher income brackets. About 50.8% of those earning over $100,000 reported living paycheck to paycheck in December, according to the PYMNTS’ research.

The number of high-income Americans living paycheck to paycheck last December was up nine percentage points from the 42% who reported similar struggles in December 2021. In contrast, the share of middle- and lower-income Americans who reported living paycheck to paycheck remained relatively stable over the past year.

“As rising prices continue to weaken their spending power, however, a growing number of consumers will find it harder to meet their monthly obligations,” the report finds. “High-income consumers are also feeling the financial strain, increasingly joining the ranks of those living paycheck to paycheck in the past year.”

But why are higher-income Americans struggling more now? Persistent high inflation is certainly part of the equation, but a looming recession, high interest rates, volatile financial markets, and white-collar layoffs are also hitting higher-income earners.

When it comes to inflation, a majority of Americans, 56%, reported price increases were causing financial hardship for their household, according to a Gallup survey published in September. Earlier in the cycle, much of the inflation spikes were concentrated in fuel and used-car prices. And that had more of an effect on Blacks, Hispanics, and middle-class households.

It was middle-income Americans, for example, who experienced the highest rates of inflation in 2021, particularly because of the spike in transportation costs, according to research by the Federal Reserve Bank of New York. But as inflation has permeated into other sectors more heavily—including food and consumer goods—the disproportionate effect on middle-class households has also narrowed.

Despite the high number of Americans struggling to cover their living expenses, consumers are fairly optimistic about their financial futures this year, the PYMNTS’ research finds. About 40% of Americans living paycheck to paycheck expect their incomes to keep up with inflation in 2023, citing raises and additional sources of income.

Similarly, about four in 10 Americans expect their personal finances to improve this year, up seven percentage points from 33% who reported such optimism in July 2022.