美国退休老人开始缩减开支

安妮塔·考尔斯计划于明年乘坐游轮畅游欧洲,领略距离她的家乡美国阿拉巴马州数千英里之外的风光,那里的各大城市充满活力、宫殿鳞次栉比,还能够参观中世纪的堡垒。

然后,她和丈夫拉塞尔计划开着他们的新房车进行为期三个月的公路旅行。这只是拉塞尔在今年2月年满65岁从美国航空公司(American Airlines)退休后,这对夫妇计划的众多旅行中的两次旅行。

但这一切都被搁置了,部分原因是汽油价格高企、消费品价格上涨,以及市场低迷吞噬了这对夫妇约四分之一的退休储蓄。63岁的安妮塔对《财富》杂志表示,自今年2月以来,这对夫妇的投资损失了约50万美元。

“那是我们退休储蓄的一大笔钱。”安妮塔说。“这非常可怕。我们原以为今年会去旅游,但这一切都戛然而止。你希望你的钱可以长久保值。”

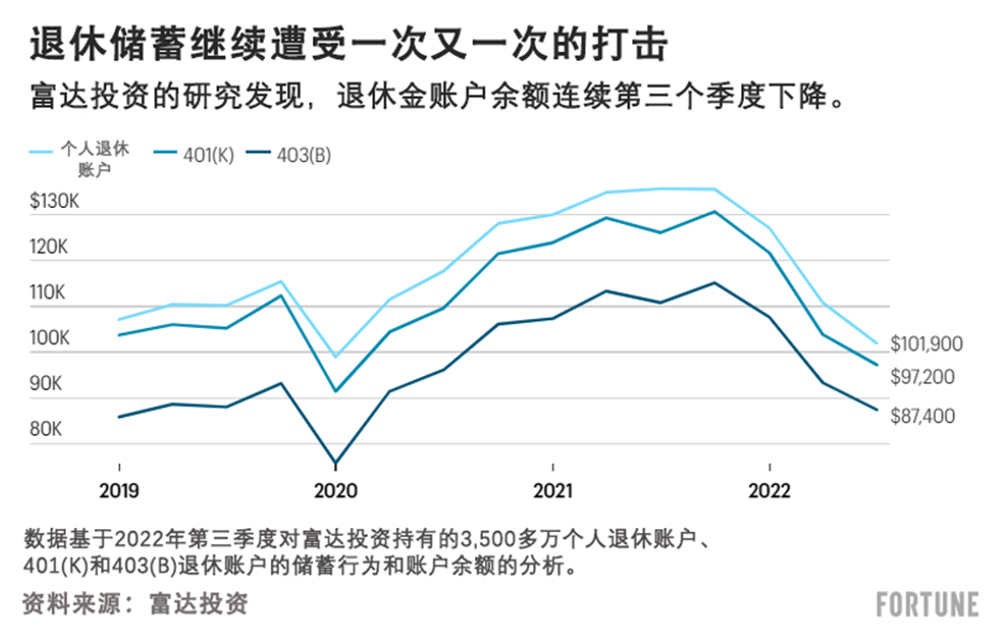

考尔斯夫妇并不是唯一面临重大损失的人,他们的退休金余额连续第三个季度下降。富达投资(Fidelity Investments)最近的研究显示,在第三季度,富达投资的401(k)(企业年金计划)退休金余额较上年同期平均下降23%。富达投资管理着约3,500万个退休账户。个人退休账户(IRA)余额同比下降了近25%,403(b)账户所持股份(通常由非营利组织提供的退休计划)减少了21%。

尽管在投资者提款之前,这些下跌只是账面损失,但心理作用已经在打击像考尔斯夫妇这样刚退休或者即将退休的人。安妮塔称:“是的,这只是账面上的损失,但如果你一直从账上提款,那么你就要花更长的时间才能够回本。”

最近的市场低迷和不断上升的通货膨胀让许多美国老年人踌躇不前。根据Janus Henderson Investors近期发布的《Janus 2022退休信心报告》(Janus 2022 Retirement Confidence Report),在50岁及以上的人群中,近一半(49%)的人表示,由于这些因素,他们已经减少了支出,或者计划这样做。

然而,许多人还是很乐观,他们认为,通胀和市场低迷是短期挑战。Janus的数据显示,大多数的美国老年人(60%)认为,一年后标准普尔500指数(S&P 500)将走高。考虑到婴儿潮一代普遍都可以在过去的经济冲击中重振旗鼓——特别是与其他几代人相比。根据美联储(Federal Reserve)的数据,虽然婴儿潮一代经历了20世纪90年代末的互联网泡沫和2008年的股市和楼市崩盘,但这一代的财富约为730亿美元,约占美国全部财富的51%,大约是千禧一代财富的9倍。

安妮塔指出:“我知道在未来一两年里,我能够进行规划中的某些旅行,因为会回本的。”但仍然有不确定性的阴影在逼近。因此,为了尽快挽回损失,考尔斯夫妇一直在讨论让拉塞尔回到一家较小的航空公司当飞行员。就在上周,他还在面试一个职位。“他正在考虑回去工作,因为如果这种情况继续下去的话,怎么办呢?”安妮塔表示。

她说:“我们最失望的是这一切发生的时机。”她补充道,当需要考虑长期健康问题时,需要做的更大的决定是推迟旅行和拉塞尔可能不退休。她还表示:“我们仍然过得很舒适。”但她指出,所有的“额外花销”,比如旅行和特殊体验,这对夫妇想要在经济宽裕的情况下进行体验,但现在他们无法体验了。

如何在不退休的情况下度过难关

虽然重返工作岗位的决定(即便是兼职)并不是一种坏的冲动,但还有其他方法可以抵御高通胀和市场低迷的双重打击,这是正在退休的婴儿潮一代和已经退休的婴儿潮一代正在经历的。

T. Rowe Price公司的研究发现,即便是在市场和经济形势严峻时期开始的退休储蓄也能够长期维持下去。例如,在1973年投资50万美元的60/40股票和债券投资组合——这一年石油危机引发了熊市——以4%的提款率计算,30年后的结余仍然超过100万美元。

但这类研究并不意味着最近退休的婴儿潮一代(或者仍然在考虑退休的人)应该自满,伊利诺斯州的Bentron金融集团(Bentron Financial Group)的注册理财规划师格雷戈里·库里尼克表示。

“是时候退一步,做你应该做的事情了。”库里尼克说。当务之急是什么?重新评估你每月和每年的实际支出。然后想一想,在当前严峻的市场环境下,这些收入将从哪里来。

即便是这样简单的练习,也需要权衡很多要素。位于纽约的Siena Private Wealth的注册理财规划师和个人理财顾问玛丽莎·罗斯坦说:“通常的原则是,当投资组合下跌时,你不应该回撤。”

这一原则的自然延伸是,退休前和退休人员应该依靠其他收入来源度过难关,直到市场复苏——最常见的收入来源是社会保障金。但如果这意味着提前领取社会保障金(大多数婴儿潮一代的法定退休年龄是66岁或67岁),罗斯坦称,这就可能是一个糟糕的赌注。如果提前领取社会保障金,他们就很可能失去每推迟一年退休,社会保障金的预期增长。股市可能会反弹,但它会以每年8%的速度反弹吗?我们无法预测。但我们可以肯定的是,你在达到法定退休年龄后,每推迟一年退休,你的社会保障金就会以8%的速度增长,你的社会保障金将持续增长直到你年满70岁。”

比如,库里尼克建议他的客户利用一两年的储蓄建立一个进入退休的匝道,而不是依赖社会保障金或者投资提款。储蓄账户余额不会给投资者带来高额回报,但现在使用这些资金而不是动用退休账户,意味着那些投资将更有机会回本,你能够推迟领取社会保障金。账面损失转化为现实损失的机会就更少。

“如果你的计划已经就位,那么你就应该可以抵御像这样的风暴。”库里尼克说。“你猜怎么着,这不是我们要经历的最后一场风暴。”

对退休的成本要现实一点

带着合乎实际的期望进入退休生活也是关键。关于退休最大的误解之一是,退休后需要的钱比工作时要少。库里尼克说,这种认识是错误的。

像考尔斯夫妇一样,许多美国人想去旅行或做所有因为工作而无法做的事情。库里尼克表示,他接触过的最近退休的人员通常比停止全职工作前多支出105%到110%,而且这种情况可能会持续到退休后的五年或十年。

同样,另一个巨大的障碍是,退休人员将自动处于较低的税率等级。库里尼克再次指出,这通常不会立即发生。他说:“如果我们花更多的钱,就意味着我们提取更多的钱,这意味着我们可能会处于同等的,甚至是更高一点的税率等级。”更不用说目前美国的税率可能是许多美国人所见过的最低税率。

库里尼克表示,尽管他从不建议客户不做某件事情,例如在投资组合缩水23%的时候就不去远行,但他确实强调了潜在的后果,以及可能需要优先考虑的重要事情。妥协。灵活处理。他补充道,这些原则将很好地帮助那些退休后进入这种环境的人。“一切都在变化。计划是不断变化的——事情一直在变化。”

然而,不管怎么说,库里尼克强调了制定计划的重要性。他说:“这并不意味着每个人都需要与理财规划师合作,但你需要制定某种计划,并确保该计划是可靠的。”

每个人对退休的定义都是不同的,但所有这些都意味着不同额度的消费,这有助于你很好地理解你可以通过做哪些事情来实现既定的目标。(财富中文网)

译者:中慧言-王芳

安妮塔·考尔斯计划于明年乘坐游轮畅游欧洲,领略距离她的家乡美国阿拉巴马州数千英里之外的风光,那里的各大城市充满活力、宫殿鳞次栉比,还能够参观中世纪的堡垒。

然后,她和丈夫拉塞尔计划开着他们的新房车进行为期三个月的公路旅行。这只是拉塞尔在今年2月年满65岁从美国航空公司(American Airlines)退休后,这对夫妇计划的众多旅行中的两次旅行。

但这一切都被搁置了,部分原因是汽油价格高企、消费品价格上涨,以及市场低迷吞噬了这对夫妇约四分之一的退休储蓄。63岁的安妮塔对《财富》杂志表示,自今年2月以来,这对夫妇的投资损失了约50万美元。

“那是我们退休储蓄的一大笔钱。”安妮塔说。“这非常可怕。我们原以为今年会去旅游,但这一切都戛然而止。你希望你的钱可以长久保值。”

考尔斯夫妇并不是唯一面临重大损失的人,他们的退休金余额连续第三个季度下降。富达投资(Fidelity Investments)最近的研究显示,在第三季度,富达投资的401(k)(企业年金计划)退休金余额较上年同期平均下降23%。富达投资管理着约3,500万个退休账户。个人退休账户(IRA)余额同比下降了近25%,403(b)账户所持股份(通常由非营利组织提供的退休计划)减少了21%。

尽管在投资者提款之前,这些下跌只是账面损失,但心理作用已经在打击像考尔斯夫妇这样刚退休或者即将退休的人。安妮塔称:“是的,这只是账面上的损失,但如果你一直从账上提款,那么你就要花更长的时间才能够回本。”

最近的市场低迷和不断上升的通货膨胀让许多美国老年人踌躇不前。根据Janus Henderson Investors近期发布的《Janus 2022退休信心报告》(Janus 2022 Retirement Confidence Report),在50岁及以上的人群中,近一半(49%)的人表示,由于这些因素,他们已经减少了支出,或者计划这样做。

然而,许多人还是很乐观,他们认为,通胀和市场低迷是短期挑战。Janus的数据显示,大多数的美国老年人(60%)认为,一年后标准普尔500指数(S&P 500)将走高。考虑到婴儿潮一代普遍都可以在过去的经济冲击中重振旗鼓——特别是与其他几代人相比。根据美联储(Federal Reserve)的数据,虽然婴儿潮一代经历了20世纪90年代末的互联网泡沫和2008年的股市和楼市崩盘,但这一代的财富约为730亿美元,约占美国全部财富的51%,大约是千禧一代财富的9倍。

安妮塔指出:“我知道在未来一两年里,我能够进行规划中的某些旅行,因为会回本的。”但仍然有不确定性的阴影在逼近。因此,为了尽快挽回损失,考尔斯夫妇一直在讨论让拉塞尔回到一家较小的航空公司当飞行员。就在上周,他还在面试一个职位。“他正在考虑回去工作,因为如果这种情况继续下去的话,怎么办呢?”安妮塔表示。

她说:“我们最失望的是这一切发生的时机。”她补充道,当需要考虑长期健康问题时,需要做的更大的决定是推迟旅行和拉塞尔可能不退休。她还表示:“我们仍然过得很舒适。”但她指出,所有的“额外花销”,比如旅行和特殊体验,这对夫妇想要在经济宽裕的情况下进行体验,但现在他们无法体验了。

如何在不退休的情况下度过难关

虽然重返工作岗位的决定(即便是兼职)并不是一种坏的冲动,但还有其他方法可以抵御高通胀和市场低迷的双重打击,这是正在退休的婴儿潮一代和已经退休的婴儿潮一代正在经历的。

T. Rowe Price公司的研究发现,即便是在市场和经济形势严峻时期开始的退休储蓄也能够长期维持下去。例如,在1973年投资50万美元的60/40股票和债券投资组合——这一年石油危机引发了熊市——以4%的提款率计算,30年后的结余仍然超过100万美元。

但这类研究并不意味着最近退休的婴儿潮一代(或者仍然在考虑退休的人)应该自满,伊利诺斯州的Bentron金融集团(Bentron Financial Group)的注册理财规划师格雷戈里·库里尼克表示。

“是时候退一步,做你应该做的事情了。”库里尼克说。当务之急是什么?重新评估你每月和每年的实际支出。然后想一想,在当前严峻的市场环境下,这些收入将从哪里来。

即便是这样简单的练习,也需要权衡很多要素。位于纽约的Siena Private Wealth的注册理财规划师和个人理财顾问玛丽莎·罗斯坦说:“通常的原则是,当投资组合下跌时,你不应该回撤。”

这一原则的自然延伸是,退休前和退休人员应该依靠其他收入来源度过难关,直到市场复苏——最常见的收入来源是社会保障金。但如果这意味着提前领取社会保障金(大多数婴儿潮一代的法定退休年龄是66岁或67岁),罗斯坦称,这就可能是一个糟糕的赌注。如果提前领取社会保障金,他们就很可能失去每推迟一年退休,社会保障金的预期增长。股市可能会反弹,但它会以每年8%的速度反弹吗?我们无法预测。但我们可以肯定的是,你在达到法定退休年龄后,每推迟一年退休,你的社会保障金就会以8%的速度增长,你的社会保障金将持续增长直到你年满70岁。”

比如,库里尼克建议他的客户利用一两年的储蓄建立一个进入退休的匝道,而不是依赖社会保障金或者投资提款。储蓄账户余额不会给投资者带来高额回报,但现在使用这些资金而不是动用退休账户,意味着那些投资将更有机会回本,你能够推迟领取社会保障金。账面损失转化为现实损失的机会就更少。

“如果你的计划已经就位,那么你就应该可以抵御像这样的风暴。”库里尼克说。“你猜怎么着,这不是我们要经历的最后一场风暴。”

对退休的成本要现实一点

带着合乎实际的期望进入退休生活也是关键。关于退休最大的误解之一是,退休后需要的钱比工作时要少。库里尼克说,这种认识是错误的。

像考尔斯夫妇一样,许多美国人想去旅行或做所有因为工作而无法做的事情。库里尼克表示,他接触过的最近退休的人员通常比停止全职工作前多支出105%到110%,而且这种情况可能会持续到退休后的五年或十年。

同样,另一个巨大的障碍是,退休人员将自动处于较低的税率等级。库里尼克再次指出,这通常不会立即发生。他说:“如果我们花更多的钱,就意味着我们提取更多的钱,这意味着我们可能会处于同等的,甚至是更高一点的税率等级。”更不用说目前美国的税率可能是许多美国人所见过的最低税率。

库里尼克表示,尽管他从不建议客户不做某件事情,例如在投资组合缩水23%的时候就不去远行,但他确实强调了潜在的后果,以及可能需要优先考虑的重要事情。妥协。灵活处理。他补充道,这些原则将很好地帮助那些退休后进入这种环境的人。“一切都在变化。计划是不断变化的——事情一直在变化。”

然而,不管怎么说,库里尼克强调了制定计划的重要性。他说:“这并不意味着每个人都需要与理财规划师合作,但你需要制定某种计划,并确保该计划是可靠的。”

每个人对退休的定义都是不同的,但所有这些都意味着不同额度的消费,这有助于你很好地理解你可以通过做哪些事情来实现既定的目标。(财富中文网)

译者:中慧言-王芳

Anita Cowles planned to be on a river cruise in Europe next year, taking in the sights and sounds of vibrant cities, sprawling palaces, and medieval fortresses thousands of miles away from her Alabama hometown.

She and her husband, Russell, then planned to undertake a three-month roadtrip in their new RV. Those are just two of the many trips the couple were planning after Russell retired as a pilot from American Airlines in February when he turned 65.

But all of that has been put on hold in part because of high gas prices, higher consumer goods prices, and a market downturn that’s wiped out about a quarter of the couple’s retirement savings. Since February, the couple’s investments have lost about $500,000 in value, Anita, 63, tells Fortune.

“That’s a big chunk of our retirement,” Anita says. “It’s extremely scary. We thought that we would be doing some traveling this year, but that’s come to an abrupt halt. You want your money to last.”

The Cowles aren’t alone in facing major losses—retirement balances dipped for the third consecutive quarter this year. During the third quarter, the average 401(k) balance at Fidelity dropped an average of 23% from a year ago, according to recent Fidelity Investments research, which handles about 35 million retirement accounts. IRA balances dropped nearly 25% year-over-year and 403(b) account holdings—retirement plans typically used by nonprofits—were down 21%.

While these dips are merely paper losses until investors make withdrawals, the psychological effects are already hitting recent and pre-retirees like the Cowles. “Yes, it is just on paper, but if you keep drawing from that, then it’s going to take even longer to make your money back,” Anita says.

The recent market downturn and rising inflation have given many older Americans pause. Nearly half (49%) of those ages 50 and older report they have already reduced their spending, or plan to do so, as a result of these factors, according to Janus Henderson Investors’ recent Janus 2022 Retirement Confidence Report.

Yet, many are optimistic that inflation and down markets are short-term challenges. A majority of older Americans (60%) believe the S&P 500 Index will be higher one year from now, according to Janus. And that tracks, given that baby boomers are a generation that has generally recovered nicely from economic shocks in the past—especially compared to other generations. While baby boomers experienced the Dot Com bubble in the late 1990s and the stock market and housing crash of 2008, the generation holds about $73 billion, or about 51% of all the U.S. wealth, according to the Federal Reserve. That’s about nine times more than millennials.

“I know that ahead a year or two, I’ll be able to take some of those trips because the money will be back,” Anita says. But there’s still a shadow of uncertainty looming. So in an effort to recoup some of their losses faster, the Cowles have been discussing Russell returning to work as pilot for a smaller airline. Just last week he was interviewing for a role. “He’s considering going back to work because what if it continues?” Anita says.

“Our biggest disappointment really is just the timing of all this,” she says, adding that delaying trips and Russell potentially unretiring are bigger decisions when there are long-term health concerns to weigh. “We are still comfortable,” she adds but says that all of the “extras” like travel and special experiences the couple wanted to be able to do while feeling okay financially about it—now they can’t.

How to weather the storm without coming out of retirement

While the decision to head back to work, even on a part-time basis, isn’t a bad impulse, there are other ways to weather the double whammy of high inflation and a down market that retiring and retired baby boomers are experiencing.

Research from T. Rowe Price finds that retirement savings do hold up over the long haul, even when starting in challenging market and economic periods. A $500,0000 retirement savings in a 60/40 portfolio of stocks and bonds, for example, invested in 1973—a year marked by an oil crisis that kicked off a bear market—still ended up with a balance of more than $1 million at the end of 30 years using a 4% withdrawal rate.

But that kind of research doesn’t mean recently retired baby boomers (or those still eying retirement) should be complacent, says Gregory Kurinec, a certified financial planner (CFP) with Illinois-based Bentron Financial Group.

“It’s time to take a step back and do the things that you’re supposed to do,” Kurinec says. The top priority? Reevaluate how much you’re actually spending on a monthly and annual basis. Then figure out where that income is going to come from given the current tough market climate.

Even with that simple exercise, there are a lot of tradeoffs to consider. “The common wisdom is that you should never pull out of your portfolio when it is down,” says Marisa Rothstein, a CFP and personal financial advisor at New York-based Siena Private Wealth.

The natural extension of this wisdom is that pre-retirees and retirees should rely on other sources of income to get them through until the market recovers—the most common go-to source being Social Security. But if that means claiming Social Security early (full retirement age is 66 or 67 for most baby boomers), Rothstein says it could be a bad bet. “By claiming Social Security early, they are likely forfeiting the promised growth built into Social Security from each year of delay. The stock market might rebound, but will it rebound at a rate of 8% per year? We just can’t predict that. But we can be sure that your Social Security benefit will grow at that rate for every year you postpone beyond your full retirement age. And will continue to grow until age 70.”

Kurinec, for instance, recommends his clients build an on-ramp into retirement using a year or two of savings, rather than relying on Social Security or withdrawals from investments. A savings account balance isn’t going to net investors a ton of return, but using these funds now instead of dipping into retirement accounts means that those investments will have a better chance of recovering and you can hold off on claiming Social Security. Less chance of paper losses turning into realized losses.

“If you have a plan in place, then you should be able to weather storms like this,” Kurinec says. “And guess what, this isn't the last one we're gonna go through.”

Be realistic about the cost of being a retiree

Going into retirement with realistic expectations is also key. One of the biggest misconceptions about retirement is that Americans need less money in retirement than while they’re working. Wrong, Kurinec says.

Like the Cowles, many Americans want to travel or do all the things they weren’t able to do because they were working. Kurinec says recent retirees he works with typically end up spending 105% to 110% more than what they were spending before they stopped working full-time—and that can last for five or 10 years after retirement.

In that same vein, another huge stumbling block is the idea that retirees are going to automatically be in a lower tax bracket. Again, Kurinec says that generally doesn’t happen right away. “If we're spending more money, that means we're taking in more money, which means we're probably gonna be in an equal, if not a little bit of a higher tax bracket,” he says. Not to mention that the current U.S. tax rates are probably the lowest many Americans are ever going to see.

Kurinec says that while he never tells his clients not to do something, like take a big trip when their portfolio is down 23%, he does stress the potential consequences and the need to perhaps prioritize what’s important. Compromise. Be flexible. Those tenets will serve folks who are retiring into this environment well, he adds. “Everything is fluid. Planning is fluid—things change all the time,” he says.

At the end of the day however, Kurinec stresses the importance of having a plan. “That doesn't mean every single person needs to work with a financial planner, but you need to have some sort of plan in place and make sure that plan is solid,” he says.

Everybody's definition of retirement is going to be different, but that's all going to cost different amounts of money, and it helps to have a good grasp on what you want to do to make that a reality.