2022年最惨的零售企业,能否走出泥潭?

感谢信。

Bed Bath & Beyond的临时首席执行官苏·戈夫正在试图将该家居用品零售商从重重危机中拯救出来。戈夫表示这些感谢信给了她力量。这家公司多年来一直面临销售下滑、资金快速减少和高管人手不足等问题。(今年9月初,据称对公司状况非常焦虑的古斯塔沃·阿纳尔自杀,让更多的人关注到该公司面临的经营危机。)

今年6月,Bed Bath & Beyond突然将首席执行官马克·特里顿赶下台,之后戈夫接任首席执行官。她坚持认为,供应商依旧信任她,其中包括美国生产床单、家居用品等其他主要产品的国内大品牌,它们是该零售商赖以生存的基础。

8月末,一名华尔街分析师质疑戈夫,为什么她会如此确信供应商愿意与Bed Bath & Beyond合作。毕竟,两年前,公司将业务中心转向打造自己的品牌,曾经让供应商非常恼火。这家零售商在第无数次转型尝试中,试图与国内品牌恢复合作;但它们是否愿意在即将来临的节日季以及以后的时间,继续为该公司供货?

戈夫回答说:“对我而言,最能够证明供应商对公司认可的一点是,它们会向我们重复我们的策略。它们采取的形式是发来感谢信。”她还表示,Bed Bath & Beyond的“旧既是新”策略受到广泛的热烈欢迎。Bed Bath & Beyond未同意戈夫接受本文的采访。该公司称,其首席执行官会在9月29日公司公布季度业绩时,公开发布最新信息。

关于那些感谢信?可能供应商只是要对一家正在日渐衰弱但依旧规模庞大的客户保持礼貌而已。虽然没有供应商公开表示会部分或彻底停止与Bed Bath & Beyond合作,但该公司在8月承认已经有多家供应商收紧了融资条款。这迫使戈夫和她的团队在今年夏天花了大量时间控制损失。

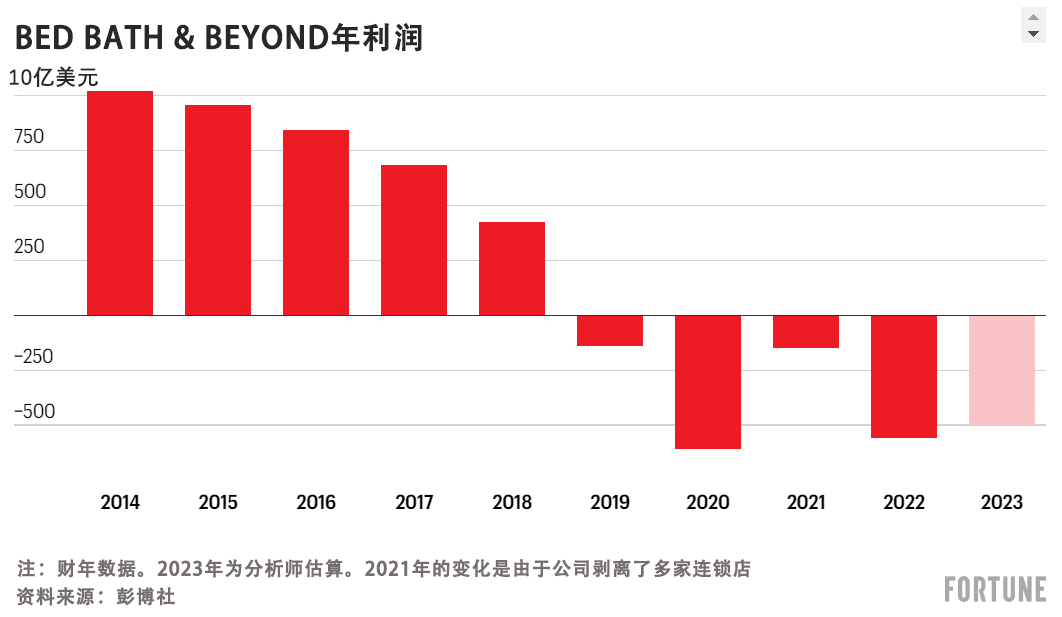

戈夫要拯救曾经美国规模最大的家居用品专业零售商,避免被人们遗忘,她所需要的不只是一些言辞温暖人心的信件。公司最近一个季度净销售额下滑25%,长期大幅下滑的趋势仍然在延续,尽管家居用品市场每年在以4%的速度增长。有分析师预测,Bed Bath & Beyond公司在截至2023年2月的本财年销售额为60亿美元,只有四年前的一半左右。该公司旗下包括较为成功的Buy Buy Baby连锁品牌。更令人担心的是,华尔街预测Bed Bath & Beyond今年将亏损5亿美元,使2018年至2022年的亏损总计达到14亿美元,并且将加快其烧钱的速度。仅上个季度,该公司的运营支出就达到3.835亿美元。

或许最糟糕的是,Bed Bath & Beyond试图在高管职位空缺严重的时候,进行全面整顿,主要措施是推翻特里顿的大多数做法。首席执行官和财务总监的人选目前都只是临时安排;公司几个月前新任命了一位首席商务官;最近公司的运营总监和店铺负责人离职,也让公司在至关重要的节日季来临前又经历了巨变。(公司合并了部分高管岗位。)公司发言人在一份声明中对《财富》杂志表示:“公司董事会非常确信Bed Bath & Beyond公司的领导团队可以执行我们的节日计划。”

更重要的是,Bed Bath & Beyond需要弄清楚它为什么需要消费者的关注。哥伦比亚大学商学院(Columbia Business School)的零售研究主任、加拿大西尔斯百货(Sears Canada)的前任首席执行官马克·科恩问道:“它们认为自己现在是一种什么状态?它们没有高层领导力,没有战略,而且它们试图让公司恢复原来的样子,但它们最初的处境就非常糟糕。”

一家早期成功的零售商误入歧途

该公司早在新冠疫情爆发之前就已经陷入了困境,并且持续了很长时间。虽然公司的销售额在2018年才开始下滑,但它的问题由来已久。

因此,当Bed Bath & Beyond在2019年10月宣布特里顿上台时,投资者才会欢欣鼓舞。特里顿曾经是塔吉特(Target)优秀的首席商务官,他主持创建了该零售商多个非常成功的店铺品牌,在不到三年时间里策划推出了30个自有品牌,帮助公司实现了惊人逆转。特里顿非常大胆地放弃了塔吉特旗下一些不景气的大品牌,并以Cat & Jack和Opalhouse等家喻户晓的品牌取而代之,结果迅速取得成功。

Bed Bath & Beyond的供应商和员工看到了一位救星,华尔街同样如此,认为该公司或许能够改造成另外一家引人注目的“塔吉特”。然而事实很快证明,即使像特里顿这样优秀的人担任首席执行官,也不可以想当然地以为在一家公司的策略,直接搬到另外一家公司同样能够取得成功。特里顿拒绝就本文发表评论。

在特里顿上任时,Bed Bath & Beyond已经落后了太多。它曾经是备受消费者喜爱的零售商,不仅可以迎合大众市场,又能够抓住流行趋势,向消费者推出空气炸锅或单杯咖啡机等;它还可以通过无处不在的八折优惠权,刺激冲动消费。但到2018年,激动人心的时刻结束:公司关闭店铺,布局混乱,购物者很难找到商品;公司提供了同一种产品的太多版本;而且它变得过于依赖优惠券来促进销售,而不是靠宣传和有吸引力的广告。公司还犯了其他战略性错误:例如,Bed Bath & Beyond增加了大量家居清洁用品,这些商品要占据大量货架空间,但购物者在网店或沃尔玛(Walmart)很容易就能够买到。此举并没有给公司带来新客户,而且即使有新客户通常也只会购买一件商品。

公司迫于一位激进投资者的压力才聘请了特里顿。他在2019年11月上任后不久立即开始工作,他全身心投入的状态向华尔街证明这位新任首席执行官说到做到。就像他的前任老板布莱恩·康奈尔在塔吉特所做的那样,特里顿上任后确实首先对Bed Bath & Beyond旗下的许多混乱不堪的店铺进行了整顿。但他上任后的第一把火是什么?在圣诞节前一周,在节日季最高峰的时候,对公司管理层进行大清洗。特里顿辞退了五位高管,包括产品促销、电子商务和市场营销主管。他在2020年对《财富》杂志表示:“他们的薪酬过高,但工作效率低下。”

随后新冠疫情爆发。虽然新冠疫情导致特里顿非常详细的重整计划被推迟执行,但疫情也刺激家居用品消费激增,而这反过来临时掩盖了Bed Bath & Beyond存在的深层次问题。新冠疫情迫使公司改进了电子商务,并提供路边自提等服务,这对公司反而有战略性的促进意义。得益于公司自身采取的措施以及家居用品消费增长的大环境, Bed Bath & Beyond有两个季度艰难实现了增长,让人们临时相信特里顿的重整策略是成功的。

到2020年11月,特里顿准备公布他的全面计划。首先是一些容易完成的任务:当时公司共有约800家门店,他决定关闭200家(公司目前又关闭了150家门店,并裁员20%)。他会减少令购物者不知所措的产品选择(当时Bed Bath & Beyond carried提供了太多土豆削皮器,这令他大为光火)。他开始出售公司旗下的小规模连锁店,比如圣诞树商店(Christmas Tree Shops),融资20亿美元,并改善公司的资产负债表。

特里顿还将利用他在塔吉特、诺德斯特龙(Nordstrom)和耐克(Nike)培养出来的品牌建设能力,推出10个新品牌。他提出了一个大胆的目标:店铺品牌的销售占比从当时的10%提高到30%。他相信,Bed Bath & Beyond未能赢得年轻顾客的青睐,是因为没有足够多的最低价位商品。该零售商曾经占主导地位的婚礼礼品登记业务出现下滑,这是年轻购物者流失的另外一个表现。

特里顿还面临另外一个结构性问题:由于库存管理系统陈旧和供应链不足导致的补货问题。特里顿发誓要解决这个问题。他还有一个更重要的举措:Bed Bath & Beyond取消了大量优惠券。该公司会每周向顾客发放折扣,无论顾客是否需要。

到2021年年中,Bed Bath & Beyond发展轨迹的任何改善转瞬即逝,销售额开始下跌。

SW Retail Advisors公司的总裁斯泰西·维德里茨指出,特里顿推出的一些新品牌,尤其是床单或沙发套等纺织品,与购物者从亚马逊倍思(Amazon Basics)买到的类似商品相比,并没有做到物有所值。她说:“特里顿在塔吉特的做法,无法照搬到Bed Bath & Beyond,当顾客走进店铺的时候会感觉,它们提供的自有品牌产品既没有独特性,价格也不优惠。”维德里茨还表示,长期缺货问题导致购物者很难将商品进行配对,了解哪些商品可以相互搭配。

而且,虽然Bed Bath & Beyond一直在滥用优惠券,但分析师估计(哥伦比亚大学商学院的科恩表示,公司的优惠券政策“混乱不堪”),现实以残忍的方式提醒公司,购物者是多么喜欢优惠券,而且就像药物成瘾者一样,要让购物者摆脱对优惠券的依赖有巨大的难度。取消大多数优惠券,给Bed Bath & Beyond带来了灾难性的后果,就像彭尼百货(J.C. Penney)2012年在前苹果公司(Apple)天才罗恩·约翰逊领导下的遭遇一样。当时,连锁超市彭尼百货也执行了重整计划,主要策略就是取消折扣,结果在第一年就损失了40亿美元。

到2021年年底,事实已经证明,特里顿不可能解决公司的缺货问题。在截至2月的财年第三季度,在全球供应链危机的冲击下,Bed Bath & Beyond sales销售额同比下降28%,仅有18.8亿美元,这个下降幅度已经超过了面临同样危机的同行们能够承受的程度。特里顿批评供应商没有按照足够的数量或提前履行订单。但许多问题的根源在公司内部:在塔吉特的时候,公司所面临的缺货问题也是在经过多年之后才得到解决,但至少当时生产和运输一切正常。即使早在新冠疫情之前,Bed Bath & Beyond的供应链效率就已经被认为低于平均水平;在新冠疫情时期,由于难以预测的消费者需求,供应链方面的弱点带来了灾难性的后果。

去年,更麻烦的是,特里顿还要应对Chewy.com的创始人之一、激进投资者瑞安·科恩。科恩一直要求Bed Bath & Beyond进行改革,例如出售Buy Buy Baby、执行更严格的成本纪律和整顿董事会等。他在今年8月不再在公司担任职务。

特里顿确实在某种程度上安抚了投资者:在他领导期间,公司共投入了10亿美元回购股票,以安抚华尔街的情绪。但现在看来,此举纯属误入歧途,因为这笔资金本可以用于修缮店铺和增强Bed Bath & Beyond的配送系统,而且公司的股价依旧在下跌。

即将到来的节日季的挑战

随着节日季来临,现在尚无法确定供应商今年是否能够为这家陷入困境的零售商改善缺货问题,还是说供应商根本不会尝试提供帮助。一方面,它们这样做将面临财务上的阻碍。8月又出现很多新情况。通过购买应收账款向零售供应商提供短期融资的公司,不再覆盖Bed Bath & Beyond,导致供应商向其供货要面临更大风险。

不要去管那些送给戈夫的感谢信。Bed Bath & Beyond要想修复与全国品牌商的关系依旧任重道远,毕竟品牌商在亚马逊、梅西百货(Macy’s)、科尔士百货(Kohl’s)和沃尔玛等许多大型零售商也可以得到这样的零售条款。戈夫于8月在指责特里顿时宣布,该零售商将继续以这些品牌商为重点,并关闭特里顿推出的三分之二的品牌。

这样做可能是合理的。维德里茨表示,尤其是在家居用品行业,购物者通常更偏好全国性品牌而不是店铺自有品牌,这与服装不同,因为人们在购买服装时更喜欢冒险。但这引发了一个问题:在特里顿时期已经被Bed Bath & Beyond疏远的品牌商,在发现了财务上更稳定的零售商之后,是否还会愿意恢复与该公司的合作?

即使它们开始供货,它们的商品可能被送到一片混乱的门店。最近,在Bed Bath & Beyond门店经理的Reddit页面上,有人哀叹门店的Wamsutta床单库存不可靠。Wamsutta是一个备受欢迎的中端品牌。还有人对基层员工的士气低落心急如焚。另外,公司颁布了在门店禁止使用个人手机的新规定,引起了员工的不满。有员工称:“门店/公司有更大的问题需要担心,不要只关注我有没有用自己的手机。”

与Bed Bath & Beyond合作的供应商不太可能为其配送最好的商品,或者提供能够吸引顾客的独家售卖商品。GlobalData的总经理尼尔·桑德斯说:“如果你是一个全国性品牌,考虑到Bed Bath & Beyond目前的状况,你为什么会决定在这家公司推出独家售卖商品?”(Bed Bath & Beyond的品牌总裁马拉·斯尔哈尔在8月对分析师表示,公司已经为节日季准备了多款独家售卖商品。)

此外,最近几年,彭尼百货、Pier 1 Imports、西尔斯百货和Linens ’n Things陆续申请破产保护,已经给供应商造成了影响,他们更有可能希望将最好的商品供应给真正在增长的零售商。哥伦比亚大学商学院的科恩称:“供应商经常受到打击,却从来没有得到任何合理的赔偿。”

但恢复发放优惠券和提供更多全国性品牌,并不可以保证购物者就能够重新回到Bed Bath & Beyond的门店。以彭尼百货为例。该公司两年前申请破产保护,但其并没有从取消优惠券之后的客户流失的影响中真正恢复过来,如今公司的规模只有十年前的一半。

戈夫面临着众多挑战,据路透社(Reuters)报道,她将担任临时首席执行官至少一年时间。虽然她取消了一些高层岗位,但Bed Bath & Beyond必须补足领导团队。而公司面临如此可怕的困境,而高层人才流失又给人们留下了糟糕的刻板印象,这样一家公司要吸引人才将面临巨大的挑战。

Bed Bath & Beyond决定基本推翻之前的策略,并重新恢复三年前并不成功的模式,这与彭尼百货在九年前采取的止损措施如出一辙。表面上看,除了为消费者提供另一个购买KitchenAid蛋糕机的地方以外,公司的目标是稳定局面,并找到使其继续存在的理由。

GlobalData的桑德斯指出:“市场竞争激烈,它们很难立足。它们需要成为一家极具创新力的零售商,一个给人们带来惊喜的地方。但它们在这些方面的表现早已大不如前。”

经过长达数年的客户流失,要想赢回客户,公司必须提供真正令人惊叹的购物体验。华尔街并不看好公司的前景:高盛集团(Goldman Sachs)对公司股票的定价为2美元,而其目前的价格为6.65美元。行业分析师同样对Bed Bath & Beyond能否顺利重整旗鼓表示质疑。

在8月的投资者报告会上,一位贝雅资本(Baird)的分析师对戈夫说:“请想一想如果公司销售的商品基本与其他零售商重合,如何才能做到差异化经营。”这确实是戈夫需要尽快解决的一个问题。(财富中文网)

翻译:刘进龙

审校:汪皓

感谢信。

Bed Bath & Beyond的临时首席执行官苏·戈夫正在试图将该家居用品零售商从重重危机中拯救出来。戈夫表示这些感谢信给了她力量。这家公司多年来一直面临销售下滑、资金快速减少和高管人手不足等问题。(今年9月初,据称对公司状况非常焦虑的古斯塔沃·阿纳尔自杀,让更多的人关注到该公司面临的经营危机。)

今年6月,Bed Bath & Beyond突然将首席执行官马克·特里顿赶下台,之后戈夫接任首席执行官。她坚持认为,供应商依旧信任她,其中包括美国生产床单、家居用品等其他主要产品的国内大品牌,它们是该零售商赖以生存的基础。

8月末,一名华尔街分析师质疑戈夫,为什么她会如此确信供应商愿意与Bed Bath & Beyond合作。毕竟,两年前,公司将业务中心转向打造自己的品牌,曾经让供应商非常恼火。这家零售商在第无数次转型尝试中,试图与国内品牌恢复合作;但它们是否愿意在即将来临的节日季以及以后的时间,继续为该公司供货?

戈夫回答说:“对我而言,最能够证明供应商对公司认可的一点是,它们会向我们重复我们的策略。它们采取的形式是发来感谢信。”她还表示,Bed Bath & Beyond的“旧既是新”策略受到广泛的热烈欢迎。Bed Bath & Beyond未同意戈夫接受本文的采访。该公司称,其首席执行官会在9月29日公司公布季度业绩时,公开发布最新信息。

关于那些感谢信?可能供应商只是要对一家正在日渐衰弱但依旧规模庞大的客户保持礼貌而已。虽然没有供应商公开表示会部分或彻底停止与Bed Bath & Beyond合作,但该公司在8月承认已经有多家供应商收紧了融资条款。这迫使戈夫和她的团队在今年夏天花了大量时间控制损失。

戈夫要拯救曾经美国规模最大的家居用品专业零售商,避免被人们遗忘,她所需要的不只是一些言辞温暖人心的信件。公司最近一个季度净销售额下滑25%,长期大幅下滑的趋势仍然在延续,尽管家居用品市场每年在以4%的速度增长。有分析师预测,Bed Bath & Beyond公司在截至2023年2月的本财年销售额为60亿美元,只有四年前的一半左右。该公司旗下包括较为成功的Buy Buy Baby连锁品牌。更令人担心的是,华尔街预测Bed Bath & Beyond今年将亏损5亿美元,使2018年至2022年的亏损总计达到14亿美元,并且将加快其烧钱的速度。仅上个季度,该公司的运营支出就达到3.835亿美元。

或许最糟糕的是,Bed Bath & Beyond试图在高管职位空缺严重的时候,进行全面整顿,主要措施是推翻特里顿的大多数做法。首席执行官和财务总监的人选目前都只是临时安排;公司几个月前新任命了一位首席商务官;最近公司的运营总监和店铺负责人离职,也让公司在至关重要的节日季来临前又经历了巨变。(公司合并了部分高管岗位。)公司发言人在一份声明中对《财富》杂志表示:“公司董事会非常确信Bed Bath & Beyond公司的领导团队可以执行我们的节日计划。”

更重要的是,Bed Bath & Beyond需要弄清楚它为什么需要消费者的关注。哥伦比亚大学商学院(Columbia Business School)的零售研究主任、加拿大西尔斯百货(Sears Canada)的前任首席执行官马克·科恩问道:“它们认为自己现在是一种什么状态?它们没有高层领导力,没有战略,而且它们试图让公司恢复原来的样子,但它们最初的处境就非常糟糕。”

一家早期成功的零售商误入歧途

该公司早在新冠疫情爆发之前就已经陷入了困境,并且持续了很长时间。虽然公司的销售额在2018年才开始下滑,但它的问题由来已久。

因此,当Bed Bath & Beyond在2019年10月宣布特里顿上台时,投资者才会欢欣鼓舞。特里顿曾经是塔吉特(Target)优秀的首席商务官,他主持创建了该零售商多个非常成功的店铺品牌,在不到三年时间里策划推出了30个自有品牌,帮助公司实现了惊人逆转。特里顿非常大胆地放弃了塔吉特旗下一些不景气的大品牌,并以Cat & Jack和Opalhouse等家喻户晓的品牌取而代之,结果迅速取得成功。

Bed Bath & Beyond的供应商和员工看到了一位救星,华尔街同样如此,认为该公司或许能够改造成另外一家引人注目的“塔吉特”。然而事实很快证明,即使像特里顿这样优秀的人担任首席执行官,也不可以想当然地以为在一家公司的策略,直接搬到另外一家公司同样能够取得成功。特里顿拒绝就本文发表评论。

在特里顿上任时,Bed Bath & Beyond已经落后了太多。它曾经是备受消费者喜爱的零售商,不仅可以迎合大众市场,又能够抓住流行趋势,向消费者推出空气炸锅或单杯咖啡机等;它还可以通过无处不在的八折优惠权,刺激冲动消费。但到2018年,激动人心的时刻结束:公司关闭店铺,布局混乱,购物者很难找到商品;公司提供了同一种产品的太多版本;而且它变得过于依赖优惠券来促进销售,而不是靠宣传和有吸引力的广告。公司还犯了其他战略性错误:例如,Bed Bath & Beyond增加了大量家居清洁用品,这些商品要占据大量货架空间,但购物者在网店或沃尔玛(Walmart)很容易就能够买到。此举并没有给公司带来新客户,而且即使有新客户通常也只会购买一件商品。

公司迫于一位激进投资者的压力才聘请了特里顿。他在2019年11月上任后不久立即开始工作,他全身心投入的状态向华尔街证明这位新任首席执行官说到做到。就像他的前任老板布莱恩·康奈尔在塔吉特所做的那样,特里顿上任后确实首先对Bed Bath & Beyond旗下的许多混乱不堪的店铺进行了整顿。但他上任后的第一把火是什么?在圣诞节前一周,在节日季最高峰的时候,对公司管理层进行大清洗。特里顿辞退了五位高管,包括产品促销、电子商务和市场营销主管。他在2020年对《财富》杂志表示:“他们的薪酬过高,但工作效率低下。”

随后新冠疫情爆发。虽然新冠疫情导致特里顿非常详细的重整计划被推迟执行,但疫情也刺激家居用品消费激增,而这反过来临时掩盖了Bed Bath & Beyond存在的深层次问题。新冠疫情迫使公司改进了电子商务,并提供路边自提等服务,这对公司反而有战略性的促进意义。得益于公司自身采取的措施以及家居用品消费增长的大环境, Bed Bath & Beyond有两个季度艰难实现了增长,让人们临时相信特里顿的重整策略是成功的。

到2020年11月,特里顿准备公布他的全面计划。首先是一些容易完成的任务:当时公司共有约800家门店,他决定关闭200家(公司目前又关闭了150家门店,并裁员20%)。他会减少令购物者不知所措的产品选择(当时Bed Bath & Beyond carried提供了太多土豆削皮器,这令他大为光火)。他开始出售公司旗下的小规模连锁店,比如圣诞树商店(Christmas Tree Shops),融资20亿美元,并改善公司的资产负债表。

特里顿还将利用他在塔吉特、诺德斯特龙(Nordstrom)和耐克(Nike)培养出来的品牌建设能力,推出10个新品牌。他提出了一个大胆的目标:店铺品牌的销售占比从当时的10%提高到30%。他相信,Bed Bath & Beyond未能赢得年轻顾客的青睐,是因为没有足够多的最低价位商品。该零售商曾经占主导地位的婚礼礼品登记业务出现下滑,这是年轻购物者流失的另外一个表现。

特里顿还面临另外一个结构性问题:由于库存管理系统陈旧和供应链不足导致的补货问题。特里顿发誓要解决这个问题。他还有一个更重要的举措:Bed Bath & Beyond取消了大量优惠券。该公司会每周向顾客发放折扣,无论顾客是否需要。

到2021年年中,Bed Bath & Beyond发展轨迹的任何改善转瞬即逝,销售额开始下跌。

SW Retail Advisors公司的总裁斯泰西·维德里茨指出,特里顿推出的一些新品牌,尤其是床单或沙发套等纺织品,与购物者从亚马逊倍思(Amazon Basics)买到的类似商品相比,并没有做到物有所值。她说:“特里顿在塔吉特的做法,无法照搬到Bed Bath & Beyond,当顾客走进店铺的时候会感觉,它们提供的自有品牌产品既没有独特性,价格也不优惠。”维德里茨还表示,长期缺货问题导致购物者很难将商品进行配对,了解哪些商品可以相互搭配。

而且,虽然Bed Bath & Beyond一直在滥用优惠券,但分析师估计(哥伦比亚大学商学院的科恩表示,公司的优惠券政策“混乱不堪”),现实以残忍的方式提醒公司,购物者是多么喜欢优惠券,而且就像药物成瘾者一样,要让购物者摆脱对优惠券的依赖有巨大的难度。取消大多数优惠券,给Bed Bath & Beyond带来了灾难性的后果,就像彭尼百货(J.C. Penney)2012年在前苹果公司(Apple)天才罗恩·约翰逊领导下的遭遇一样。当时,连锁超市彭尼百货也执行了重整计划,主要策略就是取消折扣,结果在第一年就损失了40亿美元。

到2021年年底,事实已经证明,特里顿不可能解决公司的缺货问题。在截至2月的财年第三季度,在全球供应链危机的冲击下,Bed Bath & Beyond sales销售额同比下降28%,仅有18.8亿美元,这个下降幅度已经超过了面临同样危机的同行们能够承受的程度。特里顿批评供应商没有按照足够的数量或提前履行订单。但许多问题的根源在公司内部:在塔吉特的时候,公司所面临的缺货问题也是在经过多年之后才得到解决,但至少当时生产和运输一切正常。即使早在新冠疫情之前,Bed Bath & Beyond的供应链效率就已经被认为低于平均水平;在新冠疫情时期,由于难以预测的消费者需求,供应链方面的弱点带来了灾难性的后果。

去年,更麻烦的是,特里顿还要应对Chewy.com的创始人之一、激进投资者瑞安·科恩。科恩一直要求Bed Bath & Beyond进行改革,例如出售Buy Buy Baby、执行更严格的成本纪律和整顿董事会等。他在今年8月不再在公司担任职务。

特里顿确实在某种程度上安抚了投资者:在他领导期间,公司共投入了10亿美元回购股票,以安抚华尔街的情绪。但现在看来,此举纯属误入歧途,因为这笔资金本可以用于修缮店铺和增强Bed Bath & Beyond的配送系统,而且公司的股价依旧在下跌。

即将到来的节日季的挑战

随着节日季来临,现在尚无法确定供应商今年是否能够为这家陷入困境的零售商改善缺货问题,还是说供应商根本不会尝试提供帮助。一方面,它们这样做将面临财务上的阻碍。8月又出现很多新情况。通过购买应收账款向零售供应商提供短期融资的公司,不再覆盖Bed Bath & Beyond,导致供应商向其供货要面临更大风险。

不要去管那些送给戈夫的感谢信。Bed Bath & Beyond要想修复与全国品牌商的关系依旧任重道远,毕竟品牌商在亚马逊、梅西百货(Macy’s)、科尔士百货(Kohl’s)和沃尔玛等许多大型零售商也可以得到这样的零售条款。戈夫于8月在指责特里顿时宣布,该零售商将继续以这些品牌商为重点,并关闭特里顿推出的三分之二的品牌。

这样做可能是合理的。维德里茨表示,尤其是在家居用品行业,购物者通常更偏好全国性品牌而不是店铺自有品牌,这与服装不同,因为人们在购买服装时更喜欢冒险。但这引发了一个问题:在特里顿时期已经被Bed Bath & Beyond疏远的品牌商,在发现了财务上更稳定的零售商之后,是否还会愿意恢复与该公司的合作?

即使它们开始供货,它们的商品可能被送到一片混乱的门店。最近,在Bed Bath & Beyond门店经理的Reddit页面上,有人哀叹门店的Wamsutta床单库存不可靠。Wamsutta是一个备受欢迎的中端品牌。还有人对基层员工的士气低落心急如焚。另外,公司颁布了在门店禁止使用个人手机的新规定,引起了员工的不满。有员工称:“门店/公司有更大的问题需要担心,不要只关注我有没有用自己的手机。”

与Bed Bath & Beyond合作的供应商不太可能为其配送最好的商品,或者提供能够吸引顾客的独家售卖商品。GlobalData的总经理尼尔·桑德斯说:“如果你是一个全国性品牌,考虑到Bed Bath & Beyond目前的状况,你为什么会决定在这家公司推出独家售卖商品?”(Bed Bath & Beyond的品牌总裁马拉·斯尔哈尔在8月对分析师表示,公司已经为节日季准备了多款独家售卖商品。)

此外,最近几年,彭尼百货、Pier 1 Imports、西尔斯百货和Linens ’n Things陆续申请破产保护,已经给供应商造成了影响,他们更有可能希望将最好的商品供应给真正在增长的零售商。哥伦比亚大学商学院的科恩称:“供应商经常受到打击,却从来没有得到任何合理的赔偿。”

但恢复发放优惠券和提供更多全国性品牌,并不可以保证购物者就能够重新回到Bed Bath & Beyond的门店。以彭尼百货为例。该公司两年前申请破产保护,但其并没有从取消优惠券之后的客户流失的影响中真正恢复过来,如今公司的规模只有十年前的一半。

戈夫面临着众多挑战,据路透社(Reuters)报道,她将担任临时首席执行官至少一年时间。虽然她取消了一些高层岗位,但Bed Bath & Beyond必须补足领导团队。而公司面临如此可怕的困境,而高层人才流失又给人们留下了糟糕的刻板印象,这样一家公司要吸引人才将面临巨大的挑战。

Bed Bath & Beyond决定基本推翻之前的策略,并重新恢复三年前并不成功的模式,这与彭尼百货在九年前采取的止损措施如出一辙。表面上看,除了为消费者提供另一个购买KitchenAid蛋糕机的地方以外,公司的目标是稳定局面,并找到使其继续存在的理由。

GlobalData的桑德斯指出:“市场竞争激烈,它们很难立足。它们需要成为一家极具创新力的零售商,一个给人们带来惊喜的地方。但它们在这些方面的表现早已大不如前。”

经过长达数年的客户流失,要想赢回客户,公司必须提供真正令人惊叹的购物体验。华尔街并不看好公司的前景:高盛集团(Goldman Sachs)对公司股票的定价为2美元,而其目前的价格为6.65美元。行业分析师同样对Bed Bath & Beyond能否顺利重整旗鼓表示质疑。

在8月的投资者报告会上,一位贝雅资本(Baird)的分析师对戈夫说:“请想一想如果公司销售的商品基本与其他零售商重合,如何才能做到差异化经营。”这确实是戈夫需要尽快解决的一个问题。(财富中文网)

翻译:刘进龙

审校:汪皓

Thank-you notes.

Those are what Bed Bath & Beyond’s interim CEO, Sue Gove, has said give her succor as she tries to dig the deeply troubled home goods retailer out of a massive crisis. The company has been plagued for years by plunging sales, lightning-fast cash burn, and a depleted C-suite. (Its business crisis was thrust into an even wider spotlight, in early September, by the suicide of Gustavo Arnal, who was reportedly deeply anxious over the condition of the company.)

But Gove, a board member who took the reins in June after Bed Bath & Beyond abruptly ousted CEO Mark Tritton, insists that she still has the trust of vendors—the big national brands that make the sheets, home goods, and other staples on whom the retailer’s survival depends.

In late August, Gove was asked by a Wall Street analyst how she could be so sure that those vendors would be willing to work with Bed Bath & Beyond. After all, they’d been burned by the company two years ago, when it shifted its focus to building its own brands. The retailer was now pivoting back to national brands in its umpteenth turnaround attempt; would they be willing to keep its shelves stocked in the upcoming holiday season and beyond?

“One of the most telling pieces to me, in terms of their receptivity, is how they are parroting back to us our strategy,” Gove replied. “That’s come in the form of thank-you notes.” She went on to say there has been a “wide, open-armed embrace” of Bed Bath & Beyond’s old-is-new strategy. Bed Bath & Beyond declined to make Gove available for further comment for this piece, saying the CEO would provide an update publicly on September 29 when the company reports quarterly earnings.

As for those notes? Well, it’s possible that the vendors were just being polite with a declining but still sizable customer. While no vendors have said publicly that they would pull back either partly or altogether from Bed Bath & Beyond, the company acknowledged in August a number of them have tightened their financing terms. That led Gove and her team to spend a lot of time on damage control this summer.

Gove will need more than some warmly worded correspondence to save what was once the largest specialized home goods retailer in the country from retail oblivion. In the company’s most recent quarter, net sales fell 25%, continuing a long streak of dramatic declines—even at a time when the home-furnishings market has been growing 4% annually. And analysts expect Bed Bath & Beyond Inc., the broader company that includes the more successful Buy Buy Baby chain, to post sales of $6 billion in its current fiscal year ending in February 2023—about half their level just four years ago. More worrisome, Wall Street projects Bed Bath & Beyond will lose $500 million this year, adding to losses of $1.4 billion between 2018 and 2022, and accelerating its intense cash burn. Last quarter alone, the company’s operations burned through $383.5 million.

Perhaps most daunting of all, Bed Bath & Beyond now has to try to effect a turnaround, largely based on reversing most of Tritton’s work, at a time when there are major vacancies in the C-suite. The CEO and finance chief roles are both occupied by interim officers; it named a new chief merchant only a few months ago; and the recent departures of the company’s operations chief and its stores chief are also big changes at the start of the key holiday season. (Some roles in the C-suite have been combined.) A company spokesperson told Fortune in a statement that “the board is very confident that Bed Bath & Beyond Inc. has the leadership team to execute our plans for holiday.”

More fundamentally, Bed Bath & Beyond has to figure out why it needs to exist in consumers’ eyes. “Where do they find themselves now?” asked Mark Cohen, director of retail studies at Columbia Business School and a former CEO of Sears Canada. “They’ve got no senior leadership, they’ve got no strategy, and they’re trying to swing the pendulum back to where it was, and that was a pretty crappy place.”

A retail wunderkind misfires

That crappy place predates the pandemic by a substantial span. While the company’s sales only started to decline in 2018, its problems had been brewing for years.

That’s why, when Bed Bath & Beyond announced in October 2019 that Tritton was taking the reins, investors were elated. Tritton was the whiz chief merchant at Target who oversaw the creation of many of that retailer’s highly successful store brands, engineering 30 label launches in less than three years that helped fuel its stunning turnaround. Tritton was bold enough to scrap some big but stagnant Target brands and replace them with instantly successful house names like Cat & Jack and Opalhouse.

Bed Bath & Beyond vendors and workers saw a potential savior, and so did Wall Street—maybe the company could reinvent itself as a buzzy “Tarzhay.” But as would soon become clear, as talented as Tritton was, a new CEO can’t just assume his playbook from one company will automatically work at another. Tritton declined to comment for this article.

Bed Bath & Beyond had fallen a long way by the time he arrived. It was once a beloved retailer that managed to be both mass-market and slightly trendy, introducing consumers to new products like air fryers or single serve coffee makers; it also had a reputation for prompting impulse buys with its ubiquitous 20%-off coupons. But by 2018, the thrill was gone: Stores were cluttered, confusing, and hard for shoppers to navigate; the company offered too many versions of the same products; and it had become almost too reliant on coupons—rather than on buzz or attractive presentation—to drum up sales. There were other strategic misfires: For example, Bed Bath & Beyond had added a huge assortment of household cleaning products, items that consumed considerable shelf space but that shoppers could easily find online or at Walmart. It was not winning new customers, and those that did come often left with only one item.

Tritton, who had been brought in after pressure on the company from an activist investor, got to work right away in November 2019, guns blazing to show Wall Street the rookie CEO meant business. Just as his former boss Brian Cornell had done at Target, Tritton did start to spiffy up many of Bed Bath & Beyond’s clutter-ridden stores. But his first major move? Purging Bed Bath & Beyond’s C-suite—just one week before Christmas, at the peak of the holiday season. Tritton sent five top executives packing, including its merchandising, e-commerce, and marketing chiefs. “They were expensive, and they were ineffective,” he told Fortune in 2020.

Then COVID-19 struck. While the pandemic delayed the unveiling of Tritton’s fully fleshed out turnaround plan, it also led to a surge in home goods spending—and that, in turn, temporarily hid Bed Bath & Beyond’s deep problems. The pandemic even gave the company a strategic boost by forcing it to improve its e-commerce and offer services like curbside pickup. Bed Bath & Beyond was able to squeeze a couple of quarters of growth out, buoyed by its own moves and the overall spike in home goods spending, temporarily giving people faith the Tritton turnaround was working.

By November 2020, Tritton was ready to announce his master plan. First, he addressed some low-hanging fruit: He would close 200 stores out of some 800 locations at the time (the company is closing another 150 now and cutting 20% of jobs). He would reduce a product selection that could overwhelm shoppers (at the time he was particularly incensed by how many potato-peelers Bed Bath & Beyond carried.) And he had begun selling off smaller store chains in the company’s portfolio like Christmas Tree Shops, raising $2 billion and improving the balance sheet.

Tritton would also apply his brand-building prowess—honed at Target, Nordstrom, and Nike before that—to launch 10 new brands. His bold goal: having store brands generate 30% of sales, up from 10% at the time. He believed that Bed Bath & Beyond had failed to win young customers by not having enough “opening price point” items, retail parlance for cheaper goods. The retailer’s once-dominant wedding registry business had slipped, another sign that young shoppers were looking elsewhere.

Tritton had another structural problem to tame: Bed Bath & Beyond had trouble stocking shelves, owing to an antiquated inventory management system and inadequate supply chain. Tritton vowed to fix that. He also made another, more fateful move: Bed Bath & Beyond ditched much of the chain’s coupons system, which issued weekly discount offers to customers whether they asked for them or not.

By mid-2021, it was becoming clear that any improvements in Bed Bath & Beyond’s trajectory had been fleeting, and sales began to plunge.

Stacey Widlitz, president of SW Retail Advisors, points out that some of Tritton’s new brands, notably in textiles like sheets or throws, were of too low a quality in relation to their price, certainly in comparison with the deals that shoppers could get for similar items at Amazon Basics. “The playbook from Target did not transfer to Bed Bath & Beyond, and the customer walked in and felt they weren’t providing private label products that were distinctive and at a better price,” she says. Widlitz also said that chronic out-of-stock problems made it hard for shoppers to match items and see what worked together.

What’s more, while Bed Bath & Beyond had been overdoing it on coupons, in the estimation of analysts (Columbia’s Cohen says it was doling them out “promiscuously”), it was brutally reminded how much shoppers love them, and how hard it is to wean them off the drug. The elimination of most coupons yielded the same disastrous results at Bed Bath & Beyond as they had at J.C. Penney under former Apple whiz kid Ron Johnson years earlier in 2012, when that department store chain lost $4 billion in the first year of a turnaround attempt anchored in large part on ditching discounting.

By the end of 2021, it was also becoming clear that Tritton was not coming even close to licking the company’s out-of-stock problem. In the third quarter of the fiscal year ended in February, Bed Bath & Beyond sales dropped 28% year over year, to $1.88 billion, because of the global supply-chain crisis—a drop far deeper than those endured by its peers facing the same crisis. Tritton blamed vendors for not filling orders in sufficient numbers or early enough. But many of the problems were internal: At Target, which had also had out-of-stock problems for years before taming it, Tritton could at least rely on a well-oiled machine for making and shipping. Bed Bath & Beyond’s supply-chain muscle was considered subpar even before the pandemic; in the COVID era, with its hard-to-predict consumer demand, that vulnerability has proved catastrophic.

Adding to the drama of the past year, Tritton had to deal with activist investor Ryan Cohen, one of the founders of Chewy.com. Cohen in August exited his position in Bed Bath & Beyond after months of pushing for changes, like selling off Buy Buy Baby, more cost discipline, and changing up the board.

Tritton did appease investors in one way: Under his leadership, the company spent $1 billion on share buybacks to mollify Wall Street. But that’s a move now seen as misguided, given that the money could have been better used on store improvements and beefing up Bed Bath & Beyond’s distribution system—and that shares plunged anyway.

Tough holidays ahead

As Bed Bath & Beyond heads into the holiday season, it’s not clear vendors will do any better this year at keeping the struggling retailer’s shelves stocked, or that they’ll even try. For one thing, they’ll face a financial disincentive. In August, several “factors”—companies that provide short-term financing to retail vendors by buying their accounts receivable—revoked coverage of the company, making it riskier for vendors to ship to Bed Bath & Beyond.

Thank-you notes to Gove aside, Bed Bath & Beyond has a lot of repair work to do in its relations with national brands, the retail term for brands widely available at many other major retailers such as Amazon, Macy’s, Kohl’s, and Walmart. In a rebuke to Tritton, Gove in August announced that the retailer would renew its focus on those brands, and close two-thirds of the brands that Tritton launched.

That is likely sensible. Widlitz says in home goods in particular, shoppers generally prefer national brands over store brands, unlike apparel where they are more adventurous. But that prompts the question: Will the brands that Bed Bath & Beyond alienated under Tritton step up again, when many have found other more financially stable retailers to ship to?

Even if they do ship, their goods will be arriving at stores that are in disarray. Recently on a Reddit page for Bed Bath & Beyond store managers, some were lamenting how unreliably stocked their stores were with Wamsutta sheets—a popular and widely available mid-price brand. Others fretted over how low morale was on the front lines. Elsewhere, other workers were chafing under a new, no-personal-phones rule on store floors, with one posting, “The store/company has bigger issues to worry about other than me being on my phone.”

Vendors who do play ball with Bed Bath & Beyond are unlikely to send their best merchandise or offer much in the way of exclusives that would give anyone a compelling reason to visit. “If you’re a national brand, why on earth would you decide to launch exclusive things with Bed Bath & Beyond given the state that they’re in?” asked Neil Saunders, a managing director at GlobalData. (Bed Bath & Beyond’s brand president, Mara Sirhal, told analysts in August that the company had lined up some exclusive lines for the holidays.)

What’s more, vendors have been burned in recent years by the Chapter 11 bankruptcy filings of rivals like J.C. Penney, Pier 1 Imports, Sears, and Linens ’n Things, and they are more likely to want to supply their best merchandise to retailers that are actually growing. “Vendors always get slammed, and they never get any kind of reasonable recovery,” says Columbia’s Cohen.

But bringing back coupons and offering more national brands won’t guarantee shoppers will go running back into Bed Bath & Beyond’s stores. Just ask J.C. Penney, which filed for Chapter 11 bankruptcy protection two years ago and never really recovered from customer defection after it ditched coupons, and now is half the size it was a decade ago.

There is no shortage of challenges for Gove, who according to a Reuters report, will stay in the interim CEO post for a least a year,. While she has eliminated some C-suite jobs, Bed Bath & Beyond must fill its leadership gap. And talent attraction is a tough order for a company in such dire straits, and with compromised institutional memory after all the turnover at the top.

Bed Bath & Beyond’s decision to essentially reverse strategy and go back to a model that was not working at all just three years ago has echoes of what Penney did to stanch the hemorrhage nine years ago. Ostensibly the goal is for the retailer to steady itself while it figures out what gives Bed Bath & Beyond a raison d’être, outside of being yet another place to buy a KitchenAid cake maker.

“The market is very crowded, and it’s hard to see where they fit in,” says GlobalData’s Saunders. “They need to be a very innovative retailer, a place of discovery. But they really aren’t that good at those things anymore.”

After years of shopper exodus, it will take a truly spectacular shopping experience to win them back. Wall Street has its doubts: Goldman Sachs has a price target on BBBY of $2, compared with its current price of $6.65. Industry analysts are similarly skeptical Bed Bath & Beyond can pull it off.

During the August investor presentation, a Baird analyst said to Gove: “Just trying to understand how you really differentiate the business by selling product that is widely available at other retailers.” That is exactly what Gove has to figure out, and fast.