美国孩子上大学,父母要掏多少钱?

在新冠疫情爆发的第二年,美国大学生及其家人继续为大学支付的费用减少了。

根据Sallie Mae和Ipsos的最新报告,在2021-22学年,美国家庭支付的大学平均费用连续第二年下降。这份年度报告是基于益普索(Ipsos)最近对952名本科生和953名大学生家长的调查得出的。

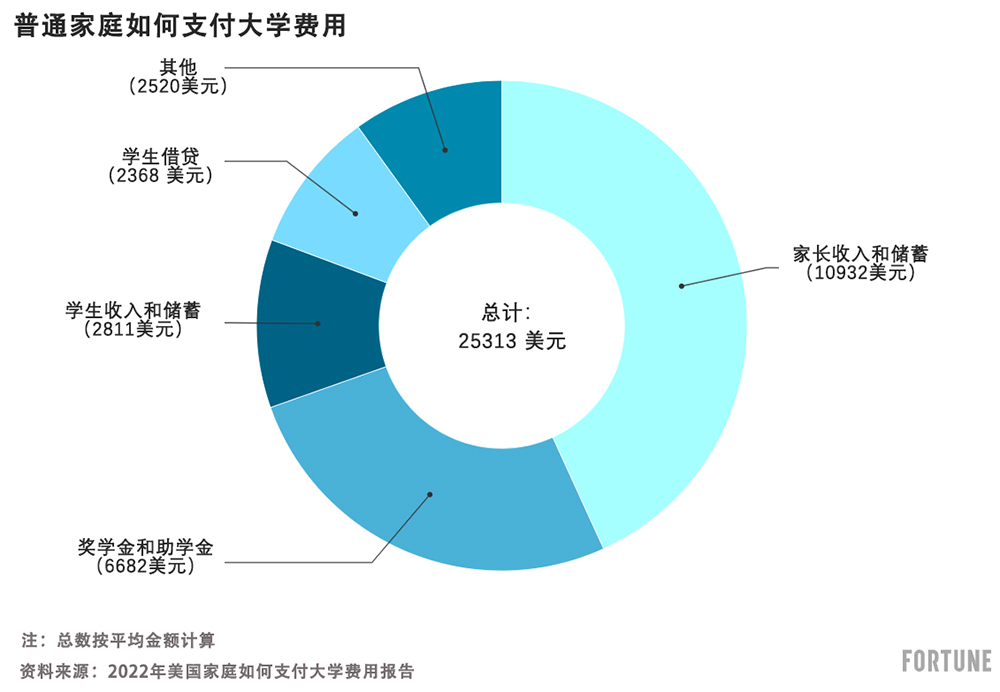

去年,家长和大学生平均支付大学费用25,313美元,包括学费、杂费、食宿费、交通费和技术费用。该报告称,这比2020-21学年家庭支付的费用下降了约4%,与2017年的平均支出相比下降了4%。

然而,尽管在过去的两年中,美国家庭支付的大学费用略有下降,但平均而言,上一学年美国家庭支付的大学费用比十年前增加了20%。

总体而言,大多数学院和大学的学费持续上涨——今年秋天还将继续上涨。根据美国大学理事会(College Board)的数据,在2021-22学年,四年制公立大学的州内住校学生平均总费用为每年27,330美元,州外学生为44,150美元。四年制私立大学平均总费用为每年55,800美元。但有几所学校已经提高了2022-23学年的学费,这让许多家庭感到担忧。

尽管近年来的联邦学生资助免费申请(Free Application for Federal Student Aid)流程发生了变化,但家庭继续通过自掏腰包(储蓄和收入)的方式来支付大部分大学费用。事实上,只有68%的家庭在上一学年提交了联邦学生资助免费申请表格。

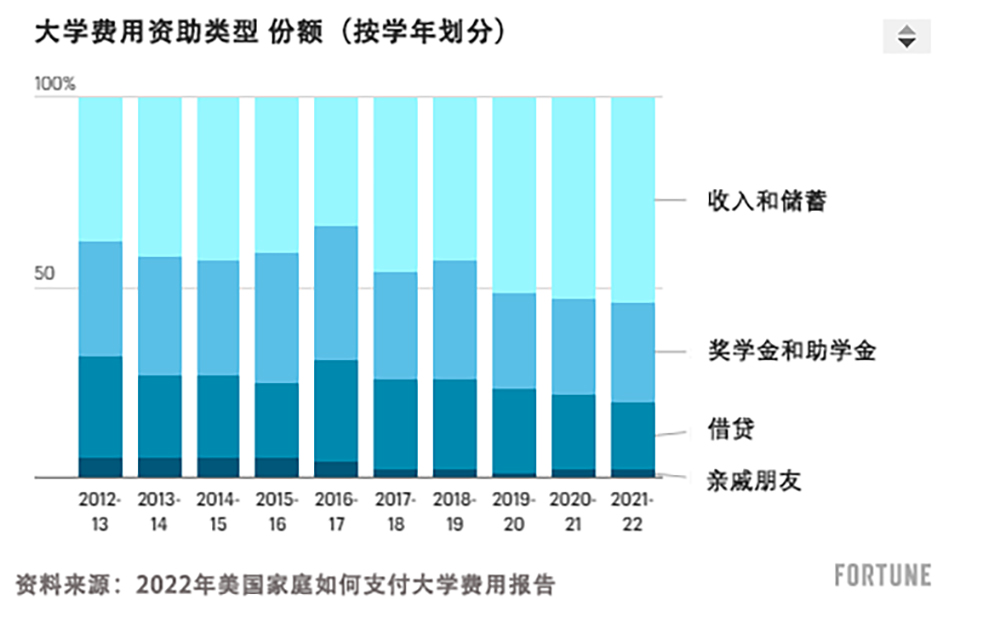

在过去的十年里,越来越多的家庭承担了更多的大学费用,对奖学金和贷款的依赖越来越少。在2012-13学年,大约38%的大学费用来自家庭储蓄,30%来自奖学金和助学金,27%来自贷款,5%来自亲戚和朋友。

但在去年,家庭储蓄和收入占典型大学总资金的一半以上(54%),而只有26%来自助学金和奖学金形式的“免费资金”。大约18%来自贷款,平均而言,亲戚和朋友的资金占总资金的2%。

在许多情况下,家庭和学生都在采取措施降低大学费用。在Sallie Mae调查的家庭中,约有60%的家庭说他们有奖学金资助,这些奖学金通常来自学生就读的大学。但许多人没有最大化利用助学金。

虽然大多数家庭和学生提交了联邦学生资助免费申请表格,但许多人没有提交表格。最常见的原因是什么?他们认为他们的收入太高了。但专家表示,除非父母年收入超过35万美元,并且只有一名学生就读于州内公立大学,否则他们应该提交联邦学生资助免费申请表格。

此外,许多家庭仍然没有尽早提交联邦学生资助免费申请表格。据报道,当被问及这个问题时,75%的家庭表示不知道从10月1日开始就可以提交联邦学生资助免费申请表格。但提早申请,获得资助的机会就更大。如果你等待了一段时间,能够申请的助学金资金可能就会减少。

然而,报告称,绝大多数接受调查的家庭(88%)仍然认为,获得大学学位可以创造机会,是“对学生未来的投资”。此外,约有六成(61%)家庭表示,他们会送孩子去大学仅仅是为了社交和智力体验——持这种观点的人数达到了十年来的最高水平。(财富中文网)

译者:中慧言-王芳

在新冠疫情爆发的第二年,美国大学生及其家人继续为大学支付的费用减少了。

根据Sallie Mae和Ipsos的最新报告,在2021-22学年,美国家庭支付的大学平均费用连续第二年下降。这份年度报告是基于益普索(Ipsos)最近对952名本科生和953名大学生家长的调查得出的。

去年,家长和大学生平均支付大学费用25,313美元,包括学费、杂费、食宿费、交通费和技术费用。该报告称,这比2020-21学年家庭支付的费用下降了约4%,与2017年的平均支出相比下降了4%。

然而,尽管在过去的两年中,美国家庭支付的大学费用略有下降,但平均而言,上一学年美国家庭支付的大学费用比十年前增加了20%。

总体而言,大多数学院和大学的学费持续上涨——今年秋天还将继续上涨。根据美国大学理事会(College Board)的数据,在2021-22学年,四年制公立大学的州内住校学生平均总费用为每年27,330美元,州外学生为44,150美元。四年制私立大学平均总费用为每年55,800美元。但有几所学校已经提高了2022-23学年的学费,这让许多家庭感到担忧。

尽管近年来的联邦学生资助免费申请(Free Application for Federal Student Aid)流程发生了变化,但家庭继续通过自掏腰包(储蓄和收入)的方式来支付大部分大学费用。事实上,只有68%的家庭在上一学年提交了联邦学生资助免费申请表格。

在过去的十年里,越来越多的家庭承担了更多的大学费用,对奖学金和贷款的依赖越来越少。在2012-13学年,大约38%的大学费用来自家庭储蓄,30%来自奖学金和助学金,27%来自贷款,5%来自亲戚和朋友。

但在去年,家庭储蓄和收入占典型大学总资金的一半以上(54%),而只有26%来自助学金和奖学金形式的“免费资金”。大约18%来自贷款,平均而言,亲戚和朋友的资金占总资金的2%。

在许多情况下,家庭和学生都在采取措施降低大学费用。在Sallie Mae调查的家庭中,约有60%的家庭说他们有奖学金资助,这些奖学金通常来自学生就读的大学。但许多人没有最大化利用助学金。

虽然大多数家庭和学生提交了联邦学生资助免费申请表格,但许多人没有提交表格。最常见的原因是什么?他们认为他们的收入太高了。但专家表示,除非父母年收入超过35万美元,并且只有一名学生就读于州内公立大学,否则他们应该提交联邦学生资助免费申请表格。

此外,许多家庭仍然没有尽早提交联邦学生资助免费申请表格。据报道,当被问及这个问题时,75%的家庭表示不知道从10月1日开始就可以提交联邦学生资助免费申请表格。但提早申请,获得资助的机会就更大。如果你等待了一段时间,能够申请的助学金资金可能就会减少。

然而,报告称,绝大多数接受调查的家庭(88%)仍然认为,获得大学学位可以创造机会,是“对学生未来的投资”。此外,约有六成(61%)家庭表示,他们会送孩子去大学仅仅是为了社交和智力体验——持这种观点的人数达到了十年来的最高水平。(财富中文网)

译者:中慧言-王芳

During the second year of the pandemic, American college students and their families continued to pay less for the college experience.

The average cost families paid for college fell for the second year in a row during the 2021–22 academic school year, according to the latest How America Pays for College report from Sallie Mae and Ipsos. The annual report is based on a recent survey of 952 undergraduate students and 953 parents of college students conducted by Ipsos.

Last year, parents and college students paid an average of $25,313 toward college costs, including tuition, fees, and room and board, as well as transportation costs and technology expenses. That’s down by about 4% from what families paid during the 2020–21 school year, and a 4% drop compared with the average spent in 2017, according to the report.

Yet despite the slight drop in college spending over the past two years, on average, families spent 20% more on college during the past school year than families did 10 years ago.

Overall, tuition costs have continued to tick up for most colleges and universities—and that’s set to continue this fall as well. The average total cost during the 2021–22 school year for a public four-year university for in-state students staying on campus was $27,330 a year and $44,150 for out-of-state students, according to the College Board. A year at a four-year private college cost an average of $55,800 for all expenses. But several schools have already increased prices for the 2022–23 school year, causing many families to worry.

Despite changes to the Free Application for Federal Student Aid (FAFSA) process in recent years, families continue to cover the bulk of college costs through out-of-pocket savings and income. In fact, only 68% of college families reported submitting a FAFSA form in the past school year.

Over the past decade, families have increasingly shouldered more college costs, depending less on scholarships and loans. During the 2012–13 school year, about 38% of funds came from savings, while 30% came from scholarships and grants, 27% from loans, and 5% from relatives and friends.

But last year, families’ savings and income accounted for over half (54%) of typical total college funding, while only 26% came from “free money” in the form of grants and scholarships. About 18% came from loans, and money from relatives and friends made up an average of 2% of funds.

In many cases, families and students are taking steps to reduce the cost of college. About 60% of families surveyed by Sallie Mae say they used scholarships, most commonly from the college the student attended. But many are leaving money on the table in the form of financial aid.

Although the majority of families and students submitted a FAFSA form, many did not. The most common reason? They believed their income was too high. But experts say that unless parents earn more than $350,000 a year and only have one student enrolled in an in-state public college, they should file a FAFSA form.

Additionally, many families are still not submitting their FAFSA form as early as possible. When asked, 75% of families are unaware the FAFSA is available beginning on Oct. 1, according to the report. But filing earlier gives families a better chance at getting aid. If you wait, there may be less financial aid money available.

Yet the vast majority of families surveyed (88%) still believe that earning a college degree creates opportunities and is an “investment in the student’s future,” according to the report. Further, roughly six in 10 families (61%) report they would send their student to college for the social and intellectual experiences alone—and that sentiment is at a 10-year high.