两大阴云笼罩2022年美国楼市

今年的美国房地产市场对购房者来说堪称噩梦。今年,美国房地产市场的库存降到了40年来的最低水平。所以即便购房者可以找到预算范围内的房源,他们也很有可能在竞价大战中输给别人。这种说法一点也不夸张,今年春天,美国一度有74%的房源都存在多个买家竞购的现象。

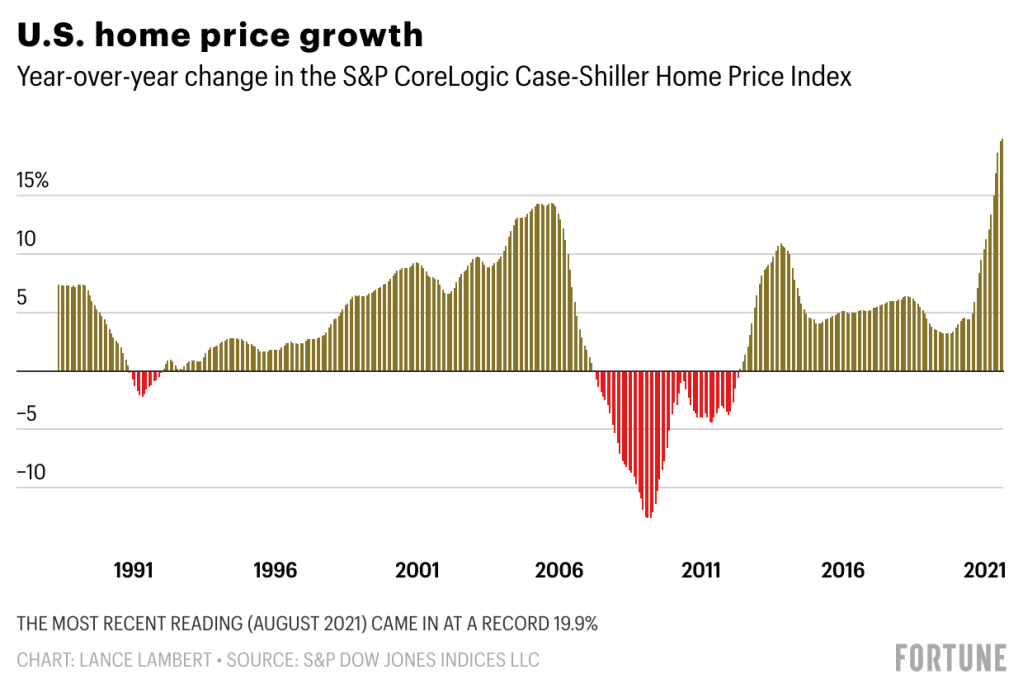

不过好消息是,2022年,美国住房市场或许不会重现今年的疯涨势头了。从去年8月到今年8月,美国房价的涨幅达到了创纪录的19.9%。不过《财富》杂志看到的所有预测模型都表明,明年美国的房价增幅将有所放缓(也就是不会增长得这么快)。现在我们已经看到美国房市有了降温迹象。首先是竞购。到今年9月,有多个买家竞购的房源数已经下降到59%,也就是比4月下降了15个百分点。

不过有业内人士表示,虽然美国房市已经告别了飞速增长时期,但是就下一阶段的房价将往何处去,业界尚未形成共识,对2022年房地产市场的展望也是众说纷纭。有些机构对房市表示看好,比如Zillow公司预测,未来12个月,美国房价还将上涨13.6%;高盛集团(Goldman Sachs)认为美国房价到2022年年底前还将上涨16%。房利美(Fannie Mae)则不那么乐观,认为2022年的房价只会上涨7.9%。也有些机构并不看好明年的美国房市,例如CoreLogic公司认为,未来12个月,美国的房价增幅将只有1.9%。如果Zillow和高盛集团预测准确的话,那么明年就将是有史以来美国房市最火热的一年。如果CoreLogic的预测成为现实,那明年就将是自2012年以来美国房价增长最缓慢的一年。

这些预测相差如此之大,不禁令人发问:为什么2022年的美国房市有这么多的不确定性?

从纸面上看,特别是从供需关系上看,2022年美国房地产市场的基本面还是相当强劲的。不过有业内人士对《财富》杂志表示,由于两大不确定因素的存在,我们很难准确评估明年这种供需关系不平衡的程度。

1. 明年的按揭利率会涨多少?

去年岁末年初之际,美联储(Federal Reserve)曾经预测道,今年的通胀将会相对温和,最高不会超过1.8%。然而事实是如此“打脸”。根据10月的最新数据,美国的消费价格指数已经达到6.2%——也就是自1990年以来最高的通胀。20世纪70年代是有名的“通胀失控的十年”,平均通胀水平大约是7.1%,而今年美国的通胀水平已经与20世纪70年代相差无几了。

自从新冠疫情爆发以来,美联储基本上保持了净零利率以刺激经济。但是鉴于出现了通胀高于预期的情况,美联储很有可能通过加息进行调控。只要美联储一加息,30年期的固定按揭贷款利率(目前大约为2.98%)也会水涨船高。高按揭利率意味着高月供,很多购房者很可能因此而打消买房的念头。

约翰·伯恩斯房地产咨询公司(John Burns Real Estate Consulting)的研究副总裁德温·巴赫曼对《财富》杂志说:“如果按揭利率出现变化,它对各方面就都会产生影响……按揭利率是一个不确定因素,它与住房市场方方面面的行为都有直接关系。”

但是,目前房地产业仍然不确定按揭贷款利率会上涨多少。

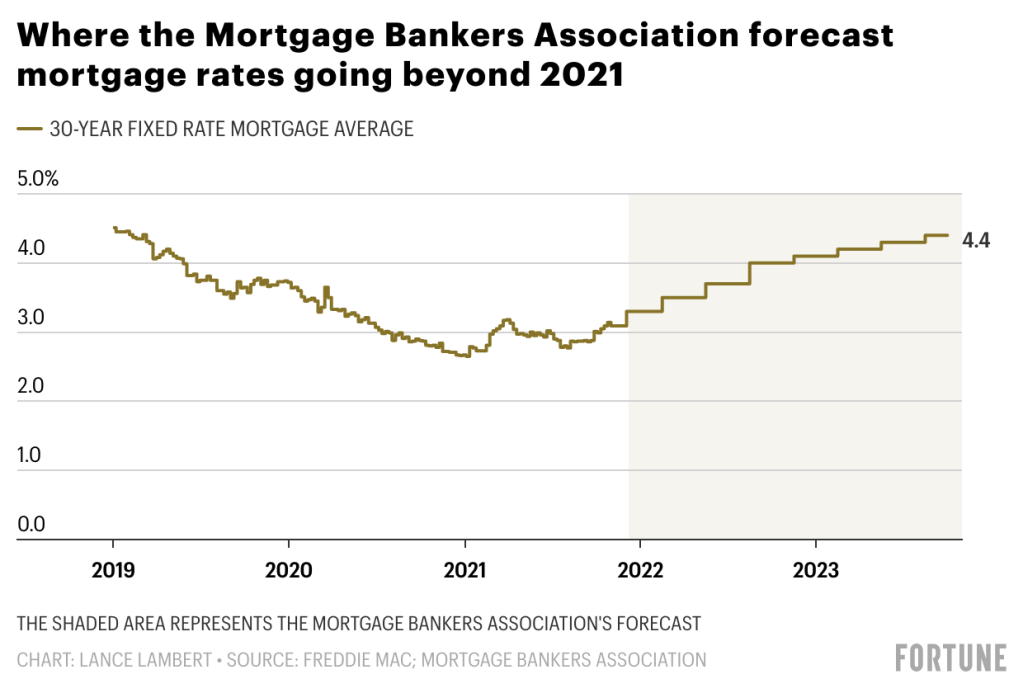

据房利美推测,到明年年底,美国的30年期按揭贷款的平均利率有可能会上涨到3.4%。而美国抵押贷款银行家协会(Mortgage Bankers Association)则认为会涨到4%,而且到2023年年底,还会进一步上涨至4.4%。

有人可能认为,这点加息幅度并不算大,实际并非如此。举个例子,一位购房者首付20%,买了一套总价50万美元的房子。如果他按照当前的按揭利率还款(2.98%),他每月的月供(不含税和保险)就是1682美元。但如果按揭利率上涨到3.4%,他的月供就会达到1774美元。如果涨到4%,他的月供就会上涨到1910美元,折算成30年,就是要为这套房子多掏82000美元。

2. 供应链问题是否影响开工?

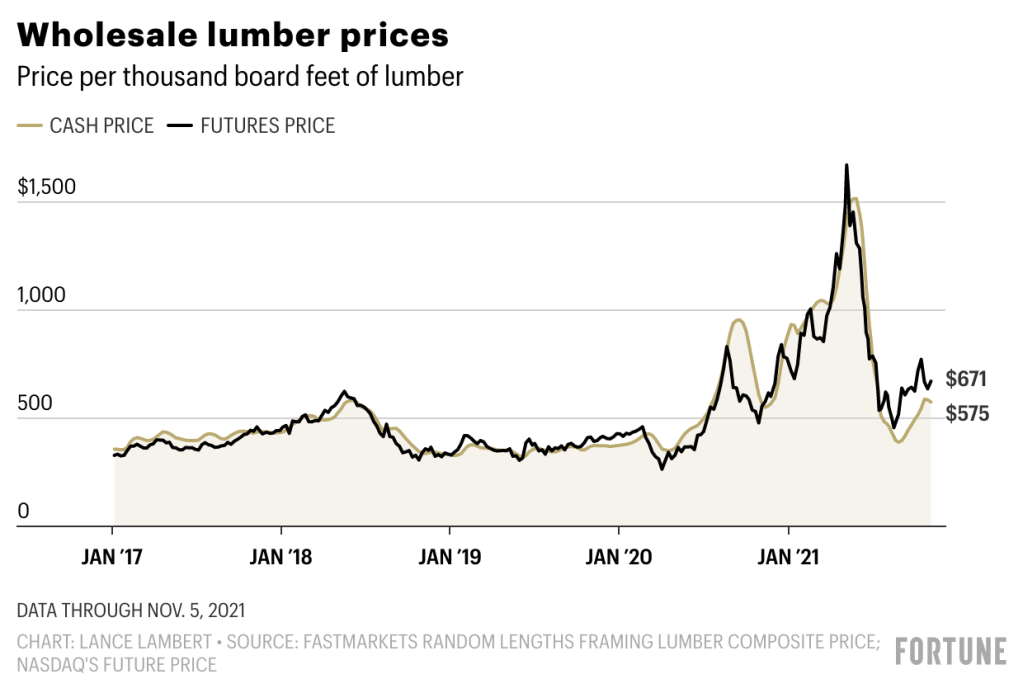

美国的房子会大量用到木材。而今年春天,美国的木材价格一度上涨到新冠疫情前的300%。木材的价格波动只是一个缩影,它背后是美国经济各行各业都面临的材料短缺和供应链压力。最终,随着DIY爱好者在高价格面前放弃了自己打家具,美国的木材价格有所回落。你可能会想,既然木材降价了,新房价格肯定也会跟着降价吧?事实远非如此。光是在过去的四个月里,美国的新房价格就又上涨了5%。

为什么会这样?答案是,虽然木材短缺的问题有所缓解,但是从水泥、窗户到油漆等其他所有原材料的价格都在飙升。

巴赫曼说:“木材的价格已经下来了,我们有了更多的木材,但这并不意味着我们有了更多的家具和橱柜。”更不用说建筑业的离职潮给新房建设带来的冲击了。“劳动力问题又开始抬头了。越来越多的建筑公司都在抱怨招工难的问题。因为招工难,很多工地无法按时交工,原因就是没有足够的劳动力。”

木材价格的下调也很难说是什么好的征兆。今年春天,美国木材价格一度达到每千板英尺1515美元,随着DIY爱好者们开始“躺平”,木材价格也在8月中旬回落到389美元。但现在DIY爱好者又活跃起来了,美国的木材价格也再次攀升至575美元。当然和1515美元相比,现在的木材价格还算便宜,但显然还是远远高于2020年年初的375美元。

比起原材料短缺和供应链问题,更令人不安的是,《财富》杂志采访的所有业内人士都不知道通胀和劳动力短缺问题何时能够得到解决。

不过,按揭利率上涨得太快的话,一般会导致房价下行。而新房建设的开工率不足的话,一般只会导致房价涨得更高。目前,美国大约有400万套新房在建,而“千禧一代”中的大多数人已经到了首次买房的年纪。如果开工率进一步下降(今年9月只开工了155万套,已经显著低于3月的173万套),这就意味着本就紧张的房源将变得更加紧张,购房者之间的竞争也将更加激烈。

行业媒体Fastmarkets Random Lengths的肖恩·丘奇告诉《财富》杂志:“现在有很多人担心,在通胀的压力下,加上宏观经济面临的各种威胁,美国的新房建设速度还能否保持2021年的水平。”(财富中文网)

译者:朴成奎

今年的美国房地产市场对购房者来说堪称噩梦。今年,美国房地产市场的库存降到了40年来的最低水平。所以即便购房者可以找到预算范围内的房源,他们也很有可能在竞价大战中输给别人。这种说法一点也不夸张,今年春天,美国一度有74%的房源都存在多个买家竞购的现象。

不过好消息是,2022年,美国住房市场或许不会重现今年的疯涨势头了。从去年8月到今年8月,美国房价的涨幅达到了创纪录的19.9%。不过《财富》杂志看到的所有预测模型都表明,明年美国的房价增幅将有所放缓(也就是不会增长得这么快)。现在我们已经看到美国房市有了降温迹象。首先是竞购。到今年9月,有多个买家竞购的房源数已经下降到59%,也就是比4月下降了15个百分点。

不过有业内人士表示,虽然美国房市已经告别了飞速增长时期,但是就下一阶段的房价将往何处去,业界尚未形成共识,对2022年房地产市场的展望也是众说纷纭。有些机构对房市表示看好,比如Zillow公司预测,未来12个月,美国房价还将上涨13.6%;高盛集团(Goldman Sachs)认为美国房价到2022年年底前还将上涨16%。房利美(Fannie Mae)则不那么乐观,认为2022年的房价只会上涨7.9%。也有些机构并不看好明年的美国房市,例如CoreLogic公司认为,未来12个月,美国的房价增幅将只有1.9%。如果Zillow和高盛集团预测准确的话,那么明年就将是有史以来美国房市最火热的一年。如果CoreLogic的预测成为现实,那明年就将是自2012年以来美国房价增长最缓慢的一年。

这些预测相差如此之大,不禁令人发问:为什么2022年的美国房市有这么多的不确定性?

从纸面上看,特别是从供需关系上看,2022年美国房地产市场的基本面还是相当强劲的。不过有业内人士对《财富》杂志表示,由于两大不确定因素的存在,我们很难准确评估明年这种供需关系不平衡的程度。

1. 明年的按揭利率会涨多少?

去年岁末年初之际,美联储(Federal Reserve)曾经预测道,今年的通胀将会相对温和,最高不会超过1.8%。然而事实是如此“打脸”。根据10月的最新数据,美国的消费价格指数已经达到6.2%——也就是自1990年以来最高的通胀。20世纪70年代是有名的“通胀失控的十年”,平均通胀水平大约是7.1%,而今年美国的通胀水平已经与20世纪70年代相差无几了。

自从新冠疫情爆发以来,美联储基本上保持了净零利率以刺激经济。但是鉴于出现了通胀高于预期的情况,美联储很有可能通过加息进行调控。只要美联储一加息,30年期的固定按揭贷款利率(目前大约为2.98%)也会水涨船高。高按揭利率意味着高月供,很多购房者很可能因此而打消买房的念头。

约翰·伯恩斯房地产咨询公司(John Burns Real Estate Consulting)的研究副总裁德温·巴赫曼对《财富》杂志说:“如果按揭利率出现变化,它对各方面就都会产生影响……按揭利率是一个不确定因素,它与住房市场方方面面的行为都有直接关系。”

但是,目前房地产业仍然不确定按揭贷款利率会上涨多少。

据房利美推测,到明年年底,美国的30年期按揭贷款的平均利率有可能会上涨到3.4%。而美国抵押贷款银行家协会(Mortgage Bankers Association)则认为会涨到4%,而且到2023年年底,还会进一步上涨至4.4%。

有人可能认为,这点加息幅度并不算大,实际并非如此。举个例子,一位购房者首付20%,买了一套总价50万美元的房子。如果他按照当前的按揭利率还款(2.98%),他每月的月供(不含税和保险)就是1682美元。但如果按揭利率上涨到3.4%,他的月供就会达到1774美元。如果涨到4%,他的月供就会上涨到1910美元,折算成30年,就是要为这套房子多掏82000美元。

2. 供应链问题是否影响开工?

美国的房子会大量用到木材。而今年春天,美国的木材价格一度上涨到新冠疫情前的300%。木材的价格波动只是一个缩影,它背后是美国经济各行各业都面临的材料短缺和供应链压力。最终,随着DIY爱好者在高价格面前放弃了自己打家具,美国的木材价格有所回落。你可能会想,既然木材降价了,新房价格肯定也会跟着降价吧?事实远非如此。光是在过去的四个月里,美国的新房价格就又上涨了5%。

为什么会这样?答案是,虽然木材短缺的问题有所缓解,但是从水泥、窗户到油漆等其他所有原材料的价格都在飙升。

巴赫曼说:“木材的价格已经下来了,我们有了更多的木材,但这并不意味着我们有了更多的家具和橱柜。”更不用说建筑业的离职潮给新房建设带来的冲击了。“劳动力问题又开始抬头了。越来越多的建筑公司都在抱怨招工难的问题。因为招工难,很多工地无法按时交工,原因就是没有足够的劳动力。”

木材价格的下调也很难说是什么好的征兆。今年春天,美国木材价格一度达到每千板英尺1515美元,随着DIY爱好者们开始“躺平”,木材价格也在8月中旬回落到389美元。但现在DIY爱好者又活跃起来了,美国的木材价格也再次攀升至575美元。当然和1515美元相比,现在的木材价格还算便宜,但显然还是远远高于2020年年初的375美元。

比起原材料短缺和供应链问题,更令人不安的是,《财富》杂志采访的所有业内人士都不知道通胀和劳动力短缺问题何时能够得到解决。

不过,按揭利率上涨得太快的话,一般会导致房价下行。而新房建设的开工率不足的话,一般只会导致房价涨得更高。目前,美国大约有400万套新房在建,而“千禧一代”中的大多数人已经到了首次买房的年纪。如果开工率进一步下降(今年9月只开工了155万套,已经显著低于3月的173万套),这就意味着本就紧张的房源将变得更加紧张,购房者之间的竞争也将更加激烈。

行业媒体Fastmarkets Random Lengths的肖恩·丘奇告诉《财富》杂志:“现在有很多人担心,在通胀的压力下,加上宏观经济面临的各种威胁,美国的新房建设速度还能否保持2021年的水平。”(财富中文网)

译者:朴成奎

This year was an absolute nightmare for would-be homebuyers. Even if they could find a home within their budget—no easy task as inventory hit a 40-year low this year—there’s a good chance they lost it in a frenzied bidding war. That’s not an exaggeration: At one point this spring, a staggering 74% of U.S. home listings were getting multiple offers.

But there might be a tiny bit of good news for house hunters: The industry consensus is that the 2022 housing market will see less crazy price hikes. Every forecast model Fortune has reviewed shows price growth—which soared a record 19.9% between August 2020 and August 2021—decelerating (a.k.a. not going up as fast) next year. Already, we’re starting to see some of that cooling. Look no further than bidding wars. As of September, 59% of homes are getting multiple offers, or a 15 percentage point drop from April.

However, while industry insiders say we’re transitioning into a period where price growth isn’t as astronomical, there’s no consensus on what that new rate of price growth will look like. Indeed, when it comes to the 2022 housing market, the outlooks are all over the place. On the high end, there is Zillow, which is forecasting 13.6% price growth in the coming 12 months, and Goldman Sachs, which predicts a 16% bump by the end of 2022. Fannie Mae is less bullish, saying prices will climb 7.9% in 2022. Meanwhile, CoreLogic is pretty bearish in forecasting just a 1.9% price jump over the coming 12 months. If Zillow or Goldman Sachs are right, that would mean 2022 would still be among the hottest years on record. If CoreLogic’s forecast turns into reality, then we would be headed for the slowest period for price growth since 2012.

These wide-ranging forecasts prompt the question: Why is there so much uncertainty when it comes to the 2022 housing market?

On paper, the fundamentals underpinning the market—demand outpacing supply—remain strong heading into 2022. However, industry insiders tell Fortune two big unknowns make it hard to pinpoint just how big that demand and supply mismatch will be next year.

1. How high will mortgage rates climb in 2022

Heading into 2021, the Federal Reserve predicted that inflation would remain relatively tame and that it would top out at 1.8% this year. Boy, were they wrong. At its latest reading for the month of October, the consumer price index came in at 6.2%—the highest rate of inflation since 1990. That’s barely below the 7.1% average inflation rate notched during the 1970s, a decade notorious for runaway inflation.

Higher than expected inflation makes it all the more likely that the Federal Reserve would raise the federal funds rate—something it has kept near zero during the pandemic in an effort to encourage more economic activity. But if the Federal Reserve does raise rates, it would also see the average 30-year fixed mortgage rate (currently at 2.98%) rise. Of course, upped mortgage rates directly translate into higher monthly payments—which would lock some buyers out of the market altogether.

“If something changes in the mortgage rate environment, that could throw a massive wrench in everything…Mortgage rates are a bit of an unknown, and they have a direct relation with activity in the housing market,” Devyn Bachman, vice president of research at John Burns Real Estate Consulting, told Fortune.

But the industry isn’t quite sure how high rates will rise.

Fannie Mae foresees the average 30-year rate climbing to 3.4% by the end of next year. Meanwhile, the Mortgage Bankers Association is forecasting that the mortgage rate will climb to 4% by the end of 2022, and to 4.4% by the end of 2023.

Those forecasted rate increases are bigger than they might look. For instance, say a buyer put down 20% on a $500,000 home. If she locked in the current average 30-year rate (2.98%), she would have a monthly payment (excluding taxes and insurance) of $1,682. But if the mortgage rate is 3.4%, it pushes the monthly payment to $1,774. At the 4% rate level forecasted by the Mortgage Bankers Association, that payment spikes all the way to $1,910, or an additional $82,000 over the course of 30 years.

2. Will supply chain shortages hold back homebuilders in 2022?

Lumber, which was up 300% this spring above its pre-pandemic price, was arguably the canary in the coal mine for the material shortages and supply chain issues that are plaguing the economy. Ultimately, framing lumber prices started to crash back in May as do-it-yourselfers simply balked at the exorbitant prices. That price correction obviously brought down the price of new homes, right? Not even close. Over the past four months alone new-home prices are up another 5%.

What’s going on? While the wood shortage has eased, the price of almost every other building component has shot up. Concrete. Windows. Paint. You name it, the price is up.

“Lumber has come down; we have more lumber. But that does not mean we have more appliances or cabinets,” Bachman noted. Not to mention, the Great Resignation has hit the construction industry fairly hard. “Labor is starting to rear its ugly head again, and we’re hearing a lot more conversations about ‘I can’t find workers. I can’t get [the work done] on time. There’s not enough labor,’” Bachman said.

Even the correction in the lumber market is hardly a silver lining. After peaking at $1,515 per thousand board feet this spring, lumber prices crashed to $389 by mid-August as DIY buyers sat on the sideline. But now those buyers are rushing back in, helping to send the price back to $575. That might seem cheap compared with the top of the lumber bubble. However, it’s still well above the $375 price builders were paying heading into 2020.

What’s more troubling than the lack of material or supply chain relief is the fact that industry insiders interviewed by this publication don’t have any idea of when—or how—inflationary spikes and labor shortages will get resolved.

Unlike with mortgage rates, which threaten to decelerate prices if they’re upped too fast, homebuilding cutbacks threaten to send prices higher. It boils down to the fact the U.S. is under-built by 4 million homes as the largest chunk of millennials are hitting their peak first-time homebuying years. If builders are forced to scale back further (the 1.55 million housing starts in September are already below the 1.73 million starts in March), it could mean even fewer homes for sale in an already historically tight—and competitive—housing market.

“There is some concern about whether homebuilding can sustain its 2021 pace amid inflationary pressures and various threats to the economy,” Shawn Church, editor at Fastmarkets Random Lengths, told Fortune.