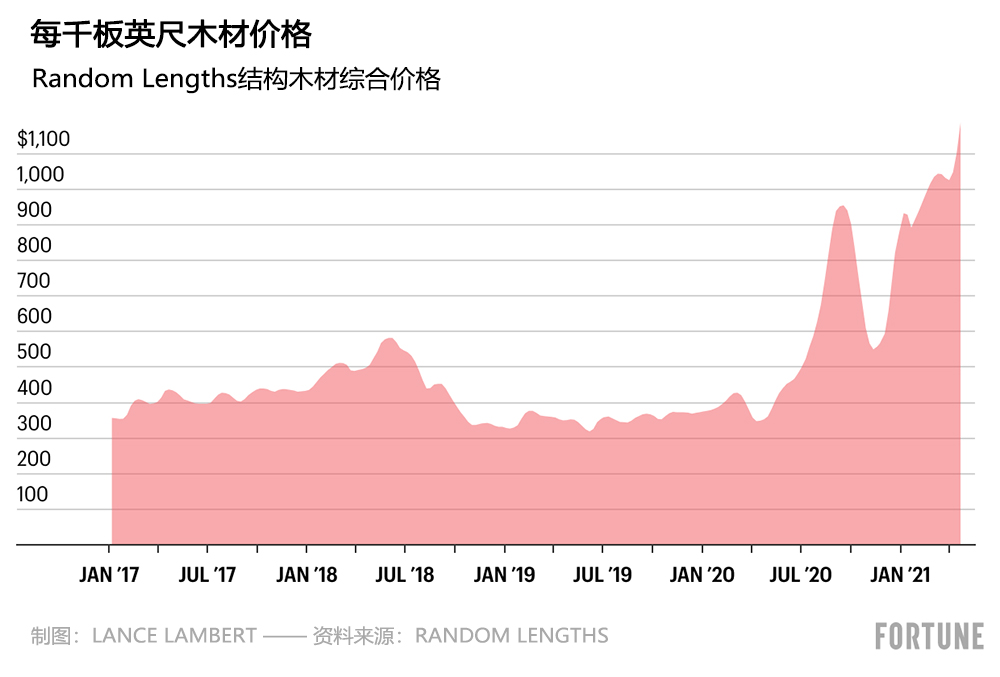

木材价格上涨232%,市场可能“在未来几个月失控”

据Random Lengths统计,上周,每千板英尺木材的价格涨至史上最高点1,188美元。自新冠疫情爆发以来,木材价格的涨幅高达232%。

虽然房屋建筑商和DIY房屋改造用户可能不想听到这个消息,但木材价格甚至还可能继续大幅上涨。4月26日,每千板英尺2乘4英寸规格的木材5月期货合约价格上涨48美元,达到1,420美元。期货合约价格上涨再次使市场熔断,导致当天木材交易暂停。为什么木材场和建筑商会支付比市场价格更高的费用?因为木材严重短缺令买方感到不安。他们之所以购买高价合约,是为了确保他们已经签署合同的项目能够获得需要的木材。

Fastmarkets RISI的高级经济学家达斯廷·贾尔伯特告诉《财富》杂志:“市场陷入困境。未来几个月市场可能会失控。”问题的根源是什么?随着住宅建筑和改造旺季来临,已经极其紧张的木材供应无法满足持续增长的需求。

造成供需不平衡的主要原因是疫情。各州强制执行封锁措施使木材加工场被迫停工,与此同时,在隔离期间无聊的美国人纷纷到家得宝(Home Depot)和劳氏公司(Lowe’s)购买原材料开展手工项目。这导致木材存量急剧减少。之后的情况变得更加糟糕:经济衰退导致的创纪录的低利率带动了房地产行业繁荣。今年3月,新建住房数量达到2006年以来的最高水平。当然,新建住房需要大量木材,导致供应紧张的情况进一步恶化。

在供应端,木材产量终于开始反弹,创下13年新高。但这已经到了极限。木材加工场产能有限和劳动力不足,意味着供应无法满足强劲的需求。

Deacon Lumber公司的首席执行官斯廷森·迪恩在4月26日告诉《财富》杂志,木材期货合约价格暴涨,甚至包括11月的合约,这意味着木材价格在一段时间内还会持续上涨。

贾尔伯特认为,只有需求降温,价格才有可能回落。但除非房屋建筑和改造旺季结束,否则需求会持续旺盛。简而言之,未来几个月,木材价格将依旧高居不下。(财富中文网)

翻译:刘进龙

审校:汪皓

据Random Lengths统计,上周,每千板英尺木材的价格涨至史上最高点1,188美元。自新冠疫情爆发以来,木材价格的涨幅高达232%。

虽然房屋建筑商和DIY房屋改造用户可能不想听到这个消息,但木材价格甚至还可能继续大幅上涨。4月26日,每千板英尺2乘4英寸规格的木材5月期货合约价格上涨48美元,达到1,420美元。期货合约价格上涨再次使市场熔断,导致当天木材交易暂停。为什么木材场和建筑商会支付比市场价格更高的费用?因为木材严重短缺令买方感到不安。他们之所以购买高价合约,是为了确保他们已经签署合同的项目能够获得需要的木材。

Fastmarkets RISI的高级经济学家达斯廷·贾尔伯特告诉《财富》杂志:“市场陷入困境。未来几个月市场可能会失控。”问题的根源是什么?随着住宅建筑和改造旺季来临,已经极其紧张的木材供应无法满足持续增长的需求。

造成供需不平衡的主要原因是疫情。各州强制执行封锁措施使木材加工场被迫停工,与此同时,在隔离期间无聊的美国人纷纷到家得宝(Home Depot)和劳氏公司(Lowe’s)购买原材料开展手工项目。这导致木材存量急剧减少。之后的情况变得更加糟糕:经济衰退导致的创纪录的低利率带动了房地产行业繁荣。今年3月,新建住房数量达到2006年以来的最高水平。当然,新建住房需要大量木材,导致供应紧张的情况进一步恶化。

在供应端,木材产量终于开始反弹,创下13年新高。但这已经到了极限。木材加工场产能有限和劳动力不足,意味着供应无法满足强劲的需求。

Deacon Lumber公司的首席执行官斯廷森·迪恩在4月26日告诉《财富》杂志,木材期货合约价格暴涨,甚至包括11月的合约,这意味着木材价格在一段时间内还会持续上涨。

贾尔伯特认为,只有需求降温,价格才有可能回落。但除非房屋建筑和改造旺季结束,否则需求会持续旺盛。简而言之,未来几个月,木材价格将依旧高居不下。(财富中文网)

翻译:刘进龙

审校:汪皓

Last week the price per thousand board feet of lumber soared to an all-time high of $1,188, according to Random Lengths. Since the onset of the pandemic, lumber has shot up a whopping 232%.

Home builders and DIYers don't want to hear this, but the ceiling could be higher—maybe even a lot higher. On April 26, the May futures contract price per thousand board feet of two-by-fours jumped $48 to $1,420. That squeeze once again triggered the circuit breakers and caused lumber trading to halt for the day. Why would lumber yards and builders pay above market rates? Severe lumber scarcity has buyers on edge. They're buying the sky-high contracts in order to ensure they'll actually get the lumber they need for projects already under contract.

"The market is in trouble. It could spiral out of control in the next few months," Dustin Jalbert, senior economist at Fastmarkets RISI, told Fortune. The issue? Supply, which is already backlogged, simply can't catch up as demand continues to grow with the start of the home building and home renovation seasons.

This supply and demand mismatch is largely a result of the pandemic. At the same time that state-mandated lockdowns caused mills to halt production, bored quarantining Americans were rushing to Home Depot and Lowe’s to buy up materials for do-it-yourself projects. That caused lumber inventory to plummet. It only got worse from there: Recession-induced record-low interest rates caused a housing boom. In March, new housing starts hit their highest levels since 2006. Of course, new homes require a lot of lumber, thus exacerbating the shortage.

On the supply side, lumber production is finally rebounding: Wood production hit a 13-year high. But that can only do so much. Limited mill capacity combined with labor shortages, mean supply can't catch up to robust demand.

Stinson Dean, CEO of Deacon Lumber, told Fortune on April 26 that soaring lumber futures contracts, including for months as far away as November, signal that lumber prices will be elevated for quite some time.

For prices to correct, Jalbert says, demand will need to cool down—something that is unlikely to occur until the home building and renovation seasons are over. Simply put, exuberant lumber prices aren't going anywhere in the next few months.