忘记“V型反转”吧,美经济会呈现这种走势

还记得分析师和经济学家都曾说过,我们将看到经济呈现出V形的恢复形态。

有早期迹象表明,随着各州的重启,经济恢复迅速获得动力,但有可能会因为全美新增病例的继续攀升而失去后劲。

新冠病毒新增病例数在最近几周一直在飙升,像得州、佛罗里达州和加州这样的大州再次摆出了严阵以待的架势,它们强制要求对酒吧、餐厅、海滩等场所实施限令。然而,美国很多州如今都出现了新增病例上升的情况。

穆迪的马克•赞迪最近向《财富》透露,如今经济出现V形反转的概率为“零”。

反而,另一个形状可能已经开始显现。

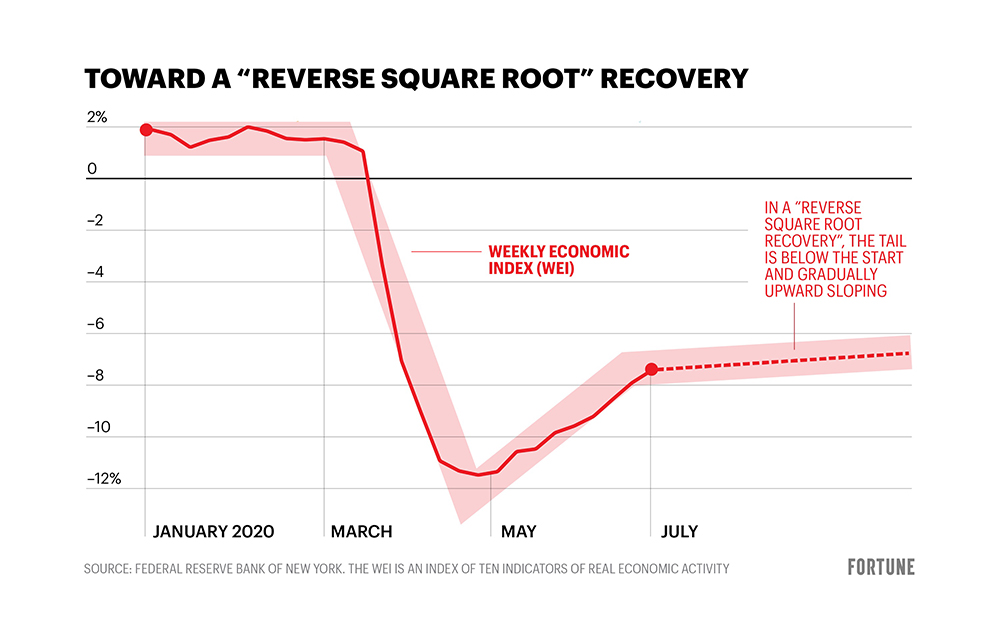

德意志银行高级美国经济师布雷特•莱恩在数月前提出了“倒开方符号”形状的经济恢复趋势,而且他并非是唯一提出这个理论的人。

莱恩对《财富》杂志说:“这一点涉及我们长期以来强调的一件事情,也就是它不会是一个直线式、一成不变的恢复过程,而且不会一直处于上扬状态。”确实,莱恩在6月初就对《财富》杂志说,他认为经济恢复有可能会呈现出“逆向开方符号”的形状。他描述说,“这个形状也就是其尾部会低于起点,并逐渐上扬。”

确实,数据越来越喜人。失业率从4月份和5月份令人头痛的14.7%和13.3%降至6月的11.1%。消费支出5月出现了明显改善,跃增至8.2%(而前两月则是大幅下跌)。莱恩指出,销售额因一次性刺激补助金而“临时得到提振”。

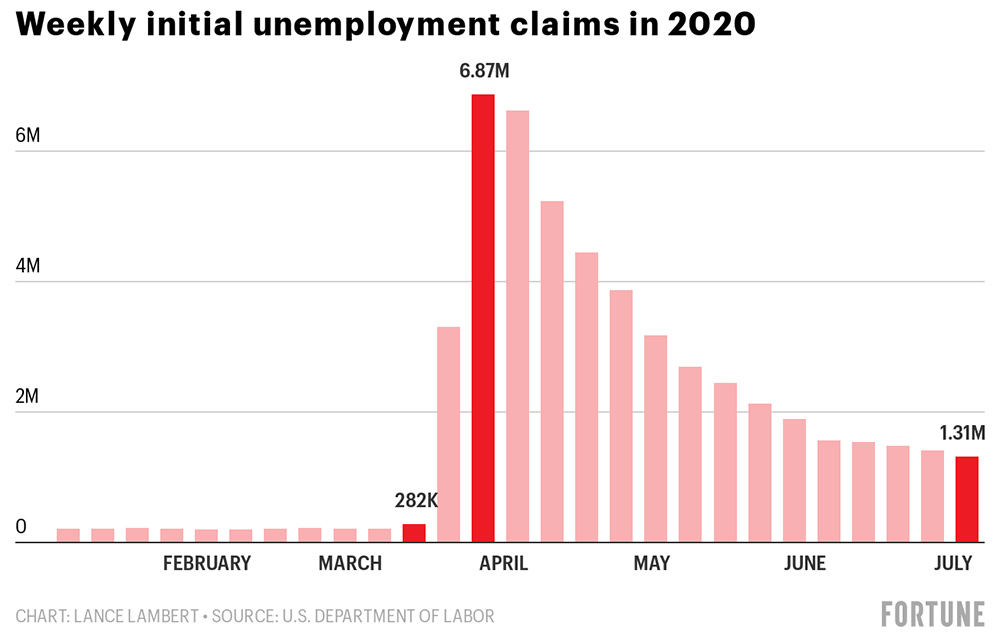

与此同时,每周的失业救助金申领已连续14周下滑,但在过去16周依然顽固地处于100万人以上的水平。

如今,正是这种慢节奏的经济恢复(这一点在每周失业救助金申领数据中体现的很明显)让一些分析师感到担忧。金融网站Bankrate.com高级经济分析师马克•汉姆里克在周四写道:“新冠疫情最近在一些州有所抬头,有关经济能够以可持续的方式成功加速重启的希望成为了泡影。这一现象也引发了人们对经济反弹的担忧。”

在审视这些报告时,德意志银行的莱恩却在思考“为什么[失业率和5月的消费支出]会有所好转,而且结论依然是,毫无疑问,这里仍存在风险,而且现在看来这些风险似乎已经结束。”

什么可能阻碍增长

经济的恢复上方笼罩着一朵黑云:美国一些大州如今因新增病例的抬头而重新开始实施限令,但这些州都是美国的GDP贡献大户。美国经济分析局称,德州、佛罗里达州和加州贡献了全美约三分之一的GDP。

此外,美国银行最近撰写的一篇报道称,尽管最初的经济恢复看起来像是那个充满希望的“V形”,但该银行的经济师在文中称:“当新增病例数达到顶峰时,我们认为约半个美国都将受到影响。由于半个国家在缓慢地重启,而半个国家在缓慢地关闭,经济的整体走势可能会趋平。”

然而在莱恩看来,这并不意味着一些州的经济活动受到了冲击就会把整个经济拖入负增长和负产出的深渊,一些州新增病例的攀升并不一定会成为整个国家经济恢复的丧钟。

这是因为,就像高盛经济师周四在纪要中写的那样:“尽管风险有所增加,但我们有不少理由认为,美国可能没有必要再度大规模地实施封锁令。”这些原因包括,有初期数据显示,阳光带的多个州(例如亚利桑那州和德州)将提升口罩的使用量,而且“实施大规模封锁的门槛似乎比3月份要高得多”。不过,高盛还指出,“风险明显依然存在,也不能排除进一步封锁的可能性。”

即便在未来几周酒吧和餐厅依然对外营业,像莱恩这样的人会看到,“哪怕州政府没有强制实施相关规定,但消费者基本上会自行规范自身的行为。”他说,这一直是人们担心的主要问题:即便各州不会放任消费者肆意消费,但出于对病毒的恐惧,这类活动在各州正式下达关停令之前也可能会因消费者自身的意愿而有所减少。

像莱恩这样的经济师提到了另外两个因素,它们可能会阻碍最近从数据中看到的这种经济快速反弹现象:莱恩说,第一,“很明显的一点在于,政府提供的大规模财政支持,包括[刺激性]救助金,在5月份为零售行业的销售业绩提供了支撑,但这类支撑在未来几个月将逐渐消失。”莱恩说第二个风险在于:如果每周额外600美元的失业救助金无法获得延期,那么就将在7月底到期。他说:“这确实是个问题。”

再透露一个有趣的小道新闻。莱恩指出,谷歌Trends上对“失业福利”词条的搜索数量再次提升,而且他自己也在密切关注失业救助金申领和失业报告(主要是临时而非是永久性的离职)。最新的失业报告显示,尽管工作岗位在6月有所恢复,但永久性裁员的数量增至290万。

消费支出明显已经走出了危机的低谷(3月和4月分别下降了6.6%和12.6%),5月份出现了激增。但莱恩谨慎地认为,这些在未来可能保持积极走向的数字或许亦无法给那些受影响最严重的地区带来提振作用。

他说:“从环比角度来讲,这些数字真不错。”莱恩称,德意志银行预测第三季度真实消费支出将出现10.5%的年化增长,然而,“别忘了,在这个10.5%的增幅中,医疗的贡献占了最大份额。”他说:“尽管医疗行业的增速会更快,但餐厅和酒店的恢复则需要很长的时间。不幸的是,后者才是劳动力市场的主阵营,也是重灾区。”

然而,疫情前所未有的不确定性意味着任何推测都难以成为定论。但莱恩表示:“对于那些此前曾认为下半年经济增速会更快的人来说,如今他们可能想的是,‘好吧,可能还是比我之前想的要慢一些。’”(财富中文网)

译者:Feb

还记得分析师和经济学家都曾说过,我们将看到经济呈现出V形的恢复形态。

有早期迹象表明,随着各州的重启,经济恢复迅速获得动力,但有可能会因为全美新增病例的继续攀升而失去后劲。

新冠病毒新增病例数在最近几周一直在飙升,像得州、佛罗里达州和加州这样的大州再次摆出了严阵以待的架势,它们强制要求对酒吧、餐厅、海滩等场所实施限令。然而,美国很多州如今都出现了新增病例上升的情况。

穆迪的马克•赞迪最近向《财富》透露,如今经济出现V形反转的概率为“零”。

反而,另一个形状可能已经开始显现。

德意志银行高级美国经济师布雷特•莱恩在数月前提出了“倒开方符号”形状的经济恢复趋势,而且他并非是唯一提出这个理论的人。

莱恩对《财富》杂志说:“这一点涉及我们长期以来强调的一件事情,也就是它不会是一个直线式、一成不变的恢复过程,而且不会一直处于上扬状态。”确实,莱恩在6月初就对《财富》杂志说,他认为经济恢复有可能会呈现出“逆向开方符号”的形状。他描述说,“这个形状也就是其尾部会低于起点,并逐渐上扬。”

确实,数据越来越喜人。失业率从4月份和5月份令人头痛的14.7%和13.3%降至6月的11.1%。消费支出5月出现了明显改善,跃增至8.2%(而前两月则是大幅下跌)。莱恩指出,销售额因一次性刺激补助金而“临时得到提振”。

与此同时,每周的失业救助金申领已连续14周下滑,但在过去16周依然顽固地处于100万人以上的水平。

如今,正是这种慢节奏的经济恢复(这一点在每周失业救助金申领数据中体现的很明显)让一些分析师感到担忧。金融网站Bankrate.com高级经济分析师马克•汉姆里克在周四写道:“新冠疫情最近在一些州有所抬头,有关经济能够以可持续的方式成功加速重启的希望成为了泡影。这一现象也引发了人们对经济反弹的担忧。”

在审视这些报告时,德意志银行的莱恩却在思考“为什么[失业率和5月的消费支出]会有所好转,而且结论依然是,毫无疑问,这里仍存在风险,而且现在看来这些风险似乎已经结束。”

什么可能阻碍增长

经济的恢复上方笼罩着一朵黑云:美国一些大州如今因新增病例的抬头而重新开始实施限令,但这些州都是美国的GDP贡献大户。美国经济分析局称,德州、佛罗里达州和加州贡献了全美约三分之一的GDP。

此外,美国银行最近撰写的一篇报道称,尽管最初的经济恢复看起来像是那个充满希望的“V形”,但该银行的经济师在文中称:“当新增病例数达到顶峰时,我们认为约半个美国都将受到影响。由于半个国家在缓慢地重启,而半个国家在缓慢地关闭,经济的整体走势可能会趋平。”

然而在莱恩看来,这并不意味着一些州的经济活动受到了冲击就会把整个经济拖入负增长和负产出的深渊,一些州新增病例的攀升并不一定会成为整个国家经济恢复的丧钟。

这是因为,就像高盛经济师周四在纪要中写的那样:“尽管风险有所增加,但我们有不少理由认为,美国可能没有必要再度大规模地实施封锁令。”这些原因包括,有初期数据显示,阳光带的多个州(例如亚利桑那州和德州)将提升口罩的使用量,而且“实施大规模封锁的门槛似乎比3月份要高得多”。不过,高盛还指出,“风险明显依然存在,也不能排除进一步封锁的可能性。”

即便在未来几周酒吧和餐厅依然对外营业,像莱恩这样的人会看到,“哪怕州政府没有强制实施相关规定,但消费者基本上会自行规范自身的行为。”他说,这一直是人们担心的主要问题:即便各州不会放任消费者肆意消费,但出于对病毒的恐惧,这类活动在各州正式下达关停令之前也可能会因消费者自身的意愿而有所减少。

像莱恩这样的经济师提到了另外两个因素,它们可能会阻碍最近从数据中看到的这种经济快速反弹现象:莱恩说,第一,“很明显的一点在于,政府提供的大规模财政支持,包括[刺激性]救助金,在5月份为零售行业的销售业绩提供了支撑,但这类支撑在未来几个月将逐渐消失。”莱恩说第二个风险在于:如果每周额外600美元的失业救助金无法获得延期,那么就将在7月底到期。他说:“这确实是个问题。”

再透露一个有趣的小道新闻。莱恩指出,谷歌Trends上对“失业福利”词条的搜索数量再次提升,而且他自己也在密切关注失业救助金申领和失业报告(主要是临时而非是永久性的离职)。最新的失业报告显示,尽管工作岗位在6月有所恢复,但永久性裁员的数量增至290万。

消费支出明显已经走出了危机的低谷(3月和4月分别下降了6.6%和12.6%),5月份出现了激增。但莱恩谨慎地认为,这些在未来可能保持积极走向的数字或许亦无法给那些受影响最严重的地区带来提振作用。

他说:“从环比角度来讲,这些数字真不错。”莱恩称,德意志银行预测第三季度真实消费支出将出现10.5%的年化增长,然而,“别忘了,在这个10.5%的增幅中,医疗的贡献占了最大份额。”他说:“尽管医疗行业的增速会更快,但餐厅和酒店的恢复则需要很长的时间。不幸的是,后者才是劳动力市场的主阵营,也是重灾区。”

然而,疫情前所未有的不确定性意味着任何推测都难以成为定论。但莱恩表示:“对于那些此前曾认为下半年经济增速会更快的人来说,如今他们可能想的是,‘好吧,可能还是比我之前想的要慢一些。’”(财富中文网)

译者:Feb

Remember when analysts and economists were saying we'd see a V-shaped recovery? They may be rethinking that thesis now.

There are early indicators that the recovery, which quickly gained traction as states started reopening, may be losing steam as cases continue spike across the country.

New cases of the coronavirus have skyrocketed in recent weeks, hitting a record of roughly 60,000 new cases on July 9. Big states like Texas, Florida, and California, are now battening down the hatches once more, by reimposing restrictions for bars, restaurants, beaches, and more. But cases of the virus are now on the rise in many states.

Moody's Mark Zandi recently told Fortune there's a "zero chance" of a V-shaped recovery now.

Instead, another shape may be, well, taking shape.

Deutsche Bank senior U.S. economist Brett Ryan was among those who predicted a "reverse square root symbol" shaped recovery months ago.

"This speaks to what we’ve been saying for a long time, which is that this is not going to be a straight line, lock-step recovery, up and up and up. It’s going to have some bumps along the road," Ryan tells Fortune. Indeed, Ryan told Fortune in the beginning of June that he thought a reverse square root symbol recovery was likely, "whereby the tail is below the start and gradually upward sloping," as he described it.

True, the data has been improving. Unemployment fell from a heady 14.7% in April and 13.3% in May to 11.1% in June. Consumer spending came in much-improved in May, jumping to 8.2% (off of two months of massive drops). Ryan points out the sales were "boosted temporarily" by one-time stimulus checks.

Weekly jobless claims, meanwhile, have fallen for the past 14 consecutive weeks, but have remained stubbornly above a whopping 1 million per week for the last 16 consecutive weeks.

Now it's the slowing pace of recovery (notable in data like weekly unemployment claims) that is worrisome to some analysts. "As the COVID-19 outbreak has recently intensified in some states, hopes for an accelerated, sustained, and successful reopening of the economy have hit roadblocks," Bankrate.com senior economic analyst Mark Hamrick wrote Thursday. "This raises concern about the economy’s rebound."

And when examining those reports, Deutsche's Ryan instead looked into "exactly why perhaps [unemployment and May consumer spending] were better, and the conclusion remains that there are definitely still risks and it seems like those risks are now playing out," he said.

What might hamper growth

One dark cloud hanging over the overall recovery: Some of the big states now reimposing restrictions amid rising case counts are among the top GDP contributors in the country: Texas, Florida, and California make up roughly one third of the nation's GDP, according to the U.S. Bureau of Economic Analysis.

What's more, Bank of America recently wrote in a report that while the initial bounce looked like that hopeful V, "By the time the growth in the virus peaks, we assume roughly half of the country will be impacted. With half of the country slowly opening and half slowly closing, the economy could flatten out overall," economists at the bank wrote.

That doesn't mean a hit to activity in some of these states will veer the economy back into negative growth and output, Ryan believes, and spiking cases in some states isn't necessarily a death-knell for the nation's recovery at large.

That's because, as economists at Goldman Sachs wrote in a note Thursday, "While the risks have increased, we see several reasons why renewed broad lockdowns may not be needed," including that early data suggests states in the Sun Belt (like Arizona and Texas) are increasing mask usage, and that "the bar for broad lockdowns appears significantly higher" than it was in March. But the firm also points out that "risks clearly remain, and further lockdowns cannot be ruled out."

Even if the bars remained open and the restaurants welcomed guests in the coming weeks, those like Ryan note "you're seeing consumers kind of self-regulating their behavior even absent state regulations." That has been a key concern: That even if states do give consumers the green light to go forth and spend, activity may be diminished "on their own volition because of the fears of the virus even before states officially issue shutdown orders," he says.

Economists like Ryan cite two other factors that might inhibit the fast rebound we've seen in data recently: One, "it’s becoming pretty clear that the massive fiscal support that was provided including the [stimulus] checks supported retail sales in May—that’s going to peter out over the next few months," Ryan says. The second risk, Ryan says, is if the $600 per week enhanced unemployment, set to expire at the end of July, doesn't get an extension. "That's going to be a problem," he says.

Another interesting tidbit? Ryan points out that searches for "unemployment benefits" are on the rise again on Google Trends, and he's watching jobless claims and unemployment reports closely (specifically for temporary versus permanent layoffs). The latest unemployment report shows that while jobs were recovered in June, the number of permanent layoffs increased to 2.9 million.

Consumer spending has clearly rebounded off of its depths in the crisis (down -6.6% in March and -12.6% April) as it surged in May. But Ryan cautions that the likely positive numbers moving forward may not be boosting some of the worst-hit areas.

"On a sequential basis, it will look really good," he says. Deutsche Bank is projecting a 10.5% annualized increase in real consumer spending in the 3rd quarter, Ryan notes, but "What you have to remember, though, is of that 10.5%, the health care contribution is going to be the biggest," he says. "While health care is going to bounce quicker, it’s going to take a long time for restaurants and hotels to come back, and unfortunately that’s a significant part of the labor market and where a lot of damage was done."

Still, the unprecedented uncertainty of the virus means anyone's guess is, well, anyone's guess. But Ryan remarks: "If you had thought that you would have faster growth in the back half of the year, you're probably thinking, 'Okay, it’s probably a little slower than I thought.'"