预测通胀的“菲利普斯曲线”不起作用了

|

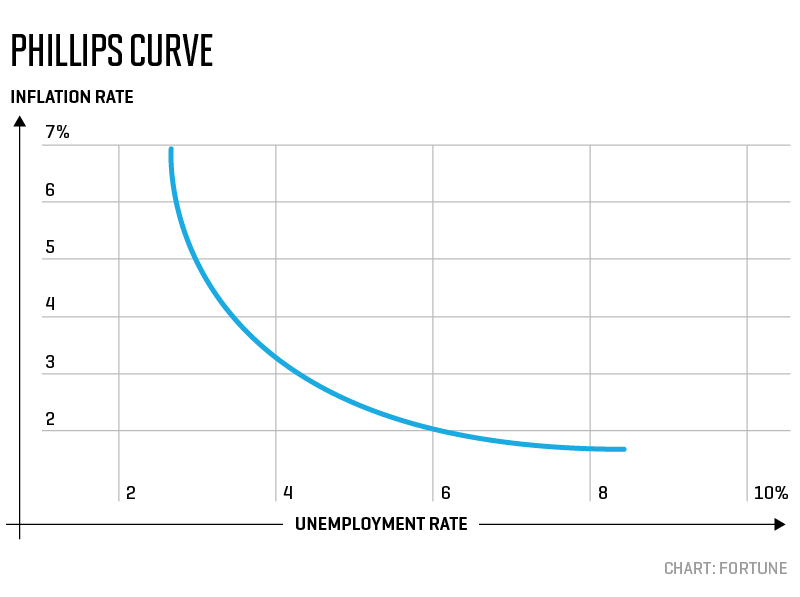

曲奇和牛奶,凯斯·厄本和妮可·基德曼,Jay-Z和碧昂斯,他们都有某种持续的关系。在经济学领域里,失业和通胀的关系也是这样。1958年,经济学家威廉·菲利普斯观察到一种有趣的现象——失业率下降时,通胀率好像就会上升。这种反向关系后来被称为菲利普斯曲线。但最近,许多经济分析师和股票市场观察人士都在问,美国失业率已经跌破4%,那为什么通胀率还是如此之低(不到2%)呢? 首先,菲利普斯实际上并没有说失业率下降时通胀率就会上升。在研究了1861-1957年的数据后,他的结论是失业率下降时,工资往往会上升。由于通胀率经常随之上行,其他经济学家开始把失业率和通胀率之间的相反关系作为经济前景的便捷预测指标,并据此推断央行什么时候会为了抑制通胀而提高利率。出于这样的原因,现在金融行业已经出现了一些关于菲利普斯曲线为何“不起作用”的讨论。 |

Cookies and milk. Keith and Nicole. Jay-Z and Beyoncé. There are certain relationships that just seem to last. In the world of economics, it’s unemployment and inflation. Way back in 1958, economist William Phillips made an interesting observation. It seemed as though when unemployment went down, inflation went up. The inverse relationship became known as the Phillips Curve, and recently a lot of economic analysts and stock market watchers have been asking, with unemployment below 4%, why is inflation still so low (under 2%)? First of all, Phillips didn’t actually say when unemployment fell, inflation would go up. After studying data between 1861 and 1957, he made the observation that when unemployment went down, wages tended to rise. Since inflation often goes up after that, other economists started using the inverse relationship between unemployment and inflation as a short hand predictor of what might happen in the economy—and as a clue as to when central banks might raise interest rates in an effort to keep inflation at bay. This has led to some current discussions in the financial industry as to why the Phillips Curve “isn’t working.” |

|

房利美的首席经济学家道格·邓肯认为,它没有“起作用”的原因首先是二者并非因果关系,“菲利普斯曲线描述的是就业和通胀之间的关联性。二者的关联程度因时而异,但不会发展成因果关系。”所以,虽然通胀上升有时可能出现在失业率下降的阶段,但它们并非一个是因一个是果。 实际上二者之间已经出现过很多次例外情况,它们的反向关系也经常受到质疑。举例来说,在20世纪70年代,曾经出现过滞涨阶段,即失业率和通胀率同时上升。经济学家米尔顿·弗里德曼甚至说过,失业率和通胀率的反向关系只在短时期内有效。就像布拉德·皮特和安吉丽娜·朱莉的婚姻只维持了两年。 弗里德曼认为,通胀上升时,工资较低的劳动者可能会突然意识到自己的工资偏低,进而开始要求加薪,或者通过跳槽来提高收入。这就是整体工资水平上升的原因。但这是个短期现象;从长期来看,其他许多因素也会决定通胀是否上升。 嘉信理财的首席投资策略分析师丽兹·安·索德斯指出,目前的决定因素之一就是经济,其增速一直不足以给工资和通胀带来压力,“直到去年中期,名义GDP增长率仍然低于失业率。在历史上,出现这种情况时,就不会发生菲利普斯曲线所描述的那种关联。”但她说,去年年中菲利普斯曲线再次开始发挥作用,“我们终于看到平均时薪增速略有提高,只是尚未达到以往周期后半段4%左右的水平。” |

It doesn’t “work” because it’s not a cause-and-effect relationship to begin with, according to Doug Duncan, Chief Economist at Fannie Mae. “The Phillips Curve is the observation that there is correlation of employment and inflation. The degree of correlation varies over time. But that does not extend to causation.” So while rising inflation may sometimes occur during times of falling unemployment, one doesn’t cause the other. In fact, there have been so many exceptions to the inverse relationship, its usefulness is often called into question. For instance, there was the period of stagflation in the 70s when unemployment and inflation both went up. And economist Milton Friedman went so far as to state that the inverse relationship between unemployment and inflation only worked in the short term. Kind of like Brad and Angelina. (Sorry.) Friedman said that when inflation kicked in, workers who were getting paid lower wages would suddenly realize they were being underpaid and start to ask for raises or change jobs to make more money. That’s why overall wages would go up. But this was a short term phenomenon; over the long term, many other factors would affect whether inflation rose. Liz Ann Sonders, Chief Investment Strategist at Charles Schwab & Co., points to one determining factor right now as the economy, which hasn’t been growing fast enough to put pressure on wages and inflation. “Up until mid-last year, nominal GDP growth was below the unemployment rate. Historically when that occurs, there has been no Phillips Curve correlation.” But in the middle of last year, she says, the Phillips Curve kicked back in. “We finally saw average hourly earnings kick into a slightly higher gear, albeit not to the 4% or so that historically accompanied the latter part of cycles.” |

|

但这次的工资上涨并未带动通胀大幅上升。刚刚出炉的CPI报告显示,今年5月,美国通胀率为0.1%,这让过去12个月美国CPI降至1.8%的低水平。 邓肯认为:“劳动者的生产率上升了,因此拿到了更高的工资。这不是通胀。生产率上升的动力来自于企业投资,而且当前环境下往往是对技术工具的投资。” 鉴于菲利普斯曲线描述的关联具有不确定性而且作用范围较小,央行无法将其作为可靠的预测工具。就连美联储主席杰罗姆·鲍威尔也在6月初讲话时提到了菲利普斯曲线,他描述了一个“和目前情况差不多”的低通胀(1.4%)、低失业率(4.1%)阶段。鲍威尔说,当时的“宏观经济学家对菲利普斯曲线呈平直状态感到困惑。”他指的是1999年。在那之后的几年里,互联网泡沫破裂,大衰退也即将到来。导致大衰退的原因众多,包括家庭债务、按揭危机以及银行倒闭。美联储政策所要应付的经济局势要比通胀和工资之间的简单关系复杂得多。 在当前经济中,鲍威尔关注的绝不仅仅是菲利普斯曲线。“用货币政策给就业市场施加足够大的推力从而提高通胀存在让金融等市场出现不稳定过剩的风险。”换句话说,下调利率来刺激经济在理论上会带动工资和通胀上升,但也可能产生反作用。经济体系中资金过多可能使经济过热,而且首先,它形成的局面可能非常类似于引发2008年金融危机的情况。 因此,虽然不能忽视体现失业率和通胀率关系的菲利普斯曲线,但如今的情况要比曲奇和牛奶的简单关联更复杂一些。(财富中文网) 译者:Charlie 审校:夏林 |

But this time while wages have risen, significant inflation has not followed. The just-released CPI report showed a modest .1% rise in May, pushing inflation at the consumer level down to a rate of just 1.8% over the past 12 months. “Workers are becoming more productive so businesses are paying them more,” according to Duncan. “This is not inflation. The source of the productivity gain is investment by businesses, often in the current environment in technology tools.” Given the uncertainty and narrow scope of the Phillips Curve correlations, central banks can’t use the curve as a reliable predictive tool. No less than Fed Chairman Jerome Powell referred to the Phillips Curve in a speech at the beginning of June, describing a period of low inflation (1.4%) and low unemployment (4.1%) that was “not so different from today.” It was a time, he said, that “macroeconomists were puzzling over the flatness of the Phillips Curve.” The year was 1999. In the subsequent years, we saw the collapse of the dot.com boom and the onset of the Great Recession, driven by a myriad of causes, including household debt, the mortgage crisis, and bank failures. Fed policy had to react to economic dynamics infinitely more complicated than the simple relationship between inflation and wages. In the current economy, Powell has his eye on much more than just the Phillips Curve. “Using monetary policy to push sufficiently hard on labor markets to lift inflation could pose risks of destabilizing excesses in financial markets or elsewhere.” In other words, lowering interest rates in order to stimulate the economy, which theoretically would lead to a growth in wages and inflation, could backfire. Too much money in the system could lead to an overheated economy and a scenario much like the one that led to the 2008 financial crisis in the first place. So while the Phillips Curve relationship between unemployment and inflation can’t be ignored, today’s equation is a little more complicated than just cookies and milk. |